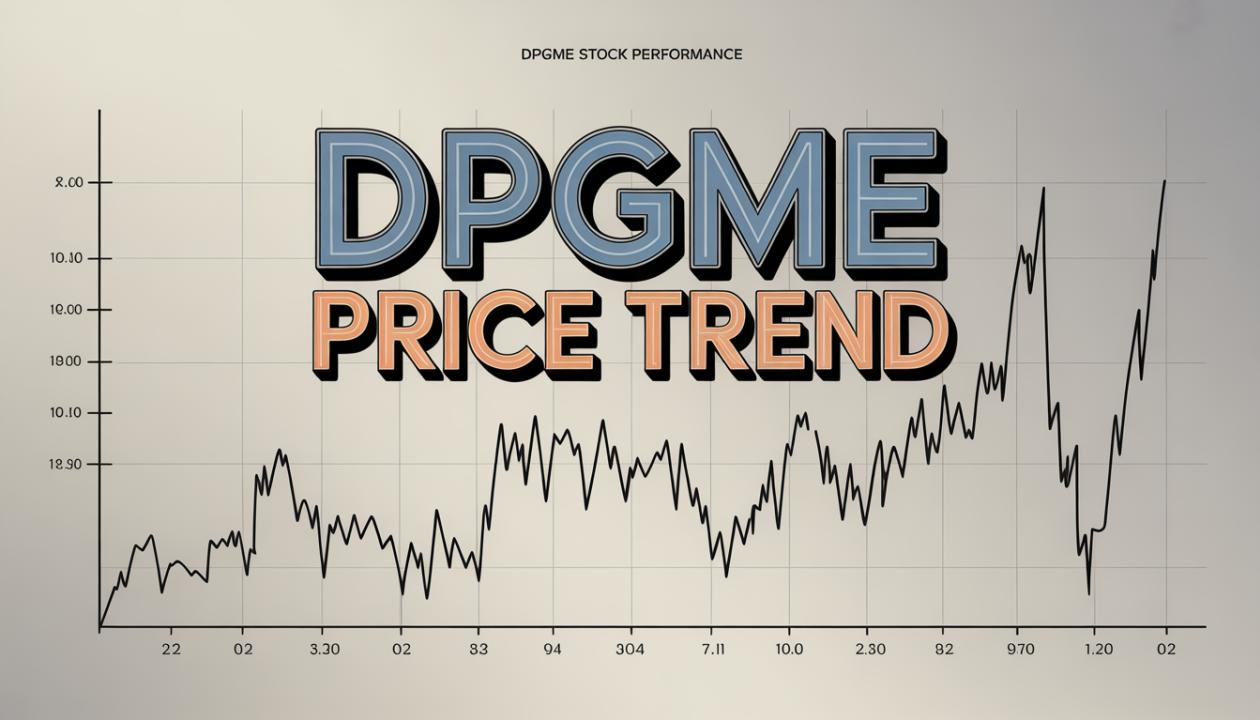

The DPGME Price Trend has become an important topic for many businesses that depend on solvents and specialty chemicals. DPGME, also known as Dipropylene Glycol Monomethyl Ether, is widely used in paints, coatings, cleaning products, inks, and industrial formulations. Because of its broad application, even small changes in its pricing can affect production costs across many industries.

Understanding the Dipropylene Glycol Monomethyl Ether Price Trend does not require complex technical knowledge. It mainly depends on basic factors like supply and demand, raw material costs, energy prices, and global economic conditions. When we look at the trend closely, we see that it reflects not just chemical market dynamics but also overall industrial activity.

What Drives the DPGME Price Trend?

The DPGME Price Trend is closely linked to the cost of its raw materials. Since DPGME is derived from petrochemical feedstocks, fluctuations in crude oil prices often influence its production cost. When crude oil prices increase, manufacturers face higher input costs, and this usually pushes DPGME prices upward. On the other hand, when oil prices fall, there may be some relief in production expenses.

Another important factor affecting the Dipropylene Glycol Monomethyl Ether Price Trend is demand from end-use industries. For example, when the construction and automotive sectors perform well, demand for paints and coatings increases. This directly raises the need for solvents like DPGME. In such situations, prices may strengthen due to higher consumption.

Seasonal demand also plays a role. In many regions, construction activity peaks during warmer months, leading to temporary price increases. In contrast, during slower industrial periods, the DPGME Price Trend may show stability or slight declines.

Global Supply and Market Balance

Supply conditions have a strong impact on the DPGME Price Trend. If production plants operate smoothly and raw materials are easily available, supply remains stable. However, unexpected shutdowns, maintenance activities, or logistical disruptions can tighten supply and cause prices to rise.

International trade also influences the Dipropylene Glycol Monomethyl Ether Price Trend. Since DPGME is traded globally, changes in shipping costs, port congestion, and trade regulations can impact pricing in different regions. For example, if freight rates increase significantly, import-dependent markets may experience higher local prices.

Currency exchange rates further add to price variations. If a country imports large volumes of DPGME and its currency weakens against the dollar, the local price may rise even if global prices remain unchanged.

Impact of Energy and Production Costs

Energy costs are another major factor behind the DPGME Price Trend. Chemical manufacturing requires substantial energy for processing and refining. When electricity or natural gas prices increase, production becomes more expensive. Manufacturers may adjust their selling prices to maintain margins.

Environmental regulations can also influence the Dipropylene Glycol Monomethyl Ether Price Trend. Stricter environmental policies may require producers to invest in cleaner technologies, which can increase operational costs. Over time, these additional costs can reflect in market prices.

In recent years, sustainability has gained more importance. Some companies are exploring greener alternatives or more efficient production methods. While this is positive for the environment, it may initially affect production expenses and pricing structures.

Regional Differences in the DPGME Price Trend

The DPGME Price Trend does not always move in the same direction across all regions. Asia, particularly countries with strong chemical manufacturing bases, often plays a key role in global supply. If production levels in major exporting countries increase, global supply may improve, stabilizing prices.

In North America and Europe, demand patterns and regulatory environments can create unique pricing situations. For example, if local production decreases while demand remains strong, prices may rise faster than in other regions.

Transportation infrastructure and storage capacity also matter. Markets with efficient supply chains often experience less volatility compared to regions with logistical challenges.

Recent Market Observations

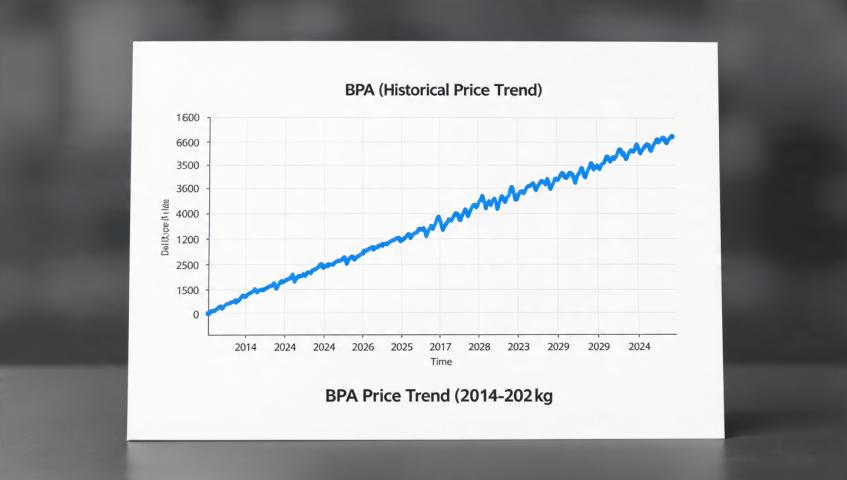

Looking at recent patterns in the Dipropylene Glycol Monomethyl Ether Price Trend, we can observe periods of fluctuation followed by stabilization. During times of global uncertainty, such as economic slowdowns or supply chain disruptions, prices have shown temporary spikes.

However, when supply chains normalize and raw material availability improves, the DPGME Price Trend tends to settle into a more balanced range. In general, the market does not move sharply without clear reasons. Most price shifts are gradual and linked to broader industrial and economic signals.

Buyers and suppliers often monitor inventory levels carefully. When stocks are low, buyers may secure materials quickly, pushing prices higher. When inventories are sufficient, the market feels less pressure.

Future Outlook for Dipropylene Glycol Monomethyl Ether Price Trend

The future of the DPGME Price Trend will likely depend on industrial growth, crude oil movements, and global trade conditions. If construction and manufacturing activities expand steadily, demand for solvents like DPGME may remain firm.

At the same time, improvements in production efficiency and supply chain management could help keep the Dipropylene Glycol Monomethyl Ether Price Trend relatively stable. Market participants are becoming more cautious and strategic, which may reduce extreme price swings.

In simple terms, the DPGME Price Trend reflects a balance between production costs and industrial demand. By keeping an eye on energy prices, raw material availability, and global economic activity, businesses can better understand where the market might move next.

Overall, while short-term fluctuations are normal, the long-term trend often follows broader economic growth patterns. For companies using DPGME, staying informed and planning ahead remains the best way to manage price changes effectively.

👉 👉 👉 Please Submit Your Query for DPGME Price Trend, demand-supply, suppliers, market analysis:https://www.price-watch.ai/book-a-demo/

About Price-Watch™

Price-Watch™ is an India-based, independent price reporting agency (PRA) that provides real-time price forecasts and data-driven insights into global raw material markets. It specializes in tracking prices, analyzing market trends, and delivering timely updates on plant shutdowns, supply disruptions, capacity expansions, and demand–supply dynamics. Price-Watch™ reporting goes beyond prices to include grade-level insights, applications, and country-level demand intelligence you can trust. Powered by AI forecasting and over a decade of historical data, the Price-Watch™ platform empowers manufacturers, traders, and procurement professionals to make faster, smarter decisions and turn market volatility into actionable opportunity.

Futura Tech Park,

C Block, 8th floor 334,

Old Mahabalipuram Road,

Sholinganallur, Chennai, Tamil Nadu, Pincode - 600119.

Linkedin: https://www.linkedin.com/company/price-watch-ai/

Facebook: https://www.facebook.com/people/Price-Watch/61568490385598/

Twitter: https://x.com/pricewatchai

Website: https://www.price-watch.ai/