In recent years, the financial landscape has undergone a massive transformation. One of the most significant developments has been the rise of online gambling cryptocurrency, which has reshaped how people store, transfer, and invest money. From individual investors to large institutions, digital currencies are now becoming an integral part of the global financial system.

What Is Online Cryptocurrency?

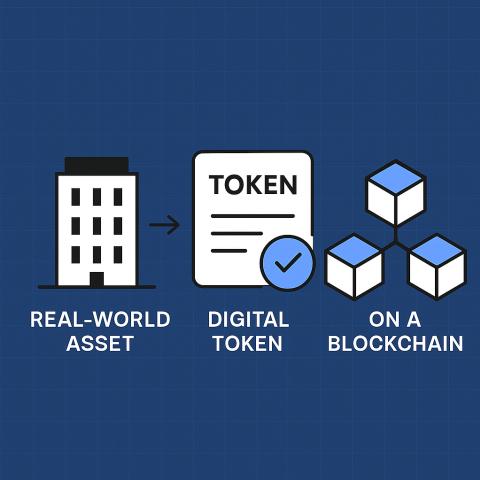

Online cryptocurrency refers to digital or virtual currencies that operate through decentralized networks based on blockchain technology. Unlike traditional currencies issued by governments, cryptocurrencies are typically not controlled by any central authority. Transactions are verified through cryptographic processes and recorded on distributed ledgers, ensuring transparency and security.

The most well-known example is Bitcoin, but today there are thousands of cryptocurrencies available, each offering unique features and use cases. These digital assets can be used for payments, investments, trading, and even decentralized applications.

How It Works

Cryptocurrencies rely on blockchain technology, which is essentially a digital ledger shared across a network of computers. When a transaction is made, it is verified by network participants (often called miners or validators) and added to a block. Once confirmed, the transaction becomes a permanent part of the blockchain.

Users typically access online cryptocurrency through digital wallets. These wallets store private keys that allow users to send and receive funds securely. Transactions are fast, borderless, and often come with lower fees compared to traditional banking systems.

Benefits of Online Cryptocurrency

1. Decentralization

One of the main advantages is decentralization. Since no single authority controls the network, users have more autonomy over their funds.

2. Global Accessibility

Anyone with an internet connection can participate. This makes cryptocurrencies particularly valuable in regions with limited access to traditional banking services.

3. Enhanced Security

Blockchain technology uses advanced cryptography, making transactions secure and difficult to alter.

4. Transparency

All transactions are recorded on a public ledger, allowing users to verify activity and reduce fraud risks.

5. Investment Opportunities

Many people see online cryptocurrency as an investment asset. The volatility of the market presents both risks and opportunities for traders and long-term investors.

Risks and Challenges

While the benefits are appealing, there are also risks involved. Cryptocurrency markets can be highly volatile, with prices fluctuating rapidly. Regulatory uncertainty in different countries can also impact adoption and trading conditions. Additionally, users must take responsibility for securing their private keys, as losing them can result in permanent loss of funds.

Cybersecurity threats, scams, and fraudulent projects are also concerns in the crypto space. Therefore, conducting thorough research and using reputable platforms is essential before investing.

The Future of Digital Finance

The future of online cryptocurrency looks promising as blockchain technology continues to evolve. Governments and financial institutions are exploring digital currencies and blockchain-based solutions to improve efficiency and transparency. Decentralized finance (DeFi), non-fungible tokens (NFTs), and smart contracts are expanding the use cases beyond simple transactions.

As adoption increases, we may see cryptocurrencies integrated more seamlessly into everyday financial activities, including online shopping, remittances, and cross-border business transactions.

Conclusion

The rise of online cryptocurrency marks a new era in digital finance. With its decentralized structure, global accessibility, and innovative technology, it offers significant potential for individuals and businesses alike. However, understanding the risks and staying informed are crucial steps for anyone looking to participate in this rapidly evolving market.