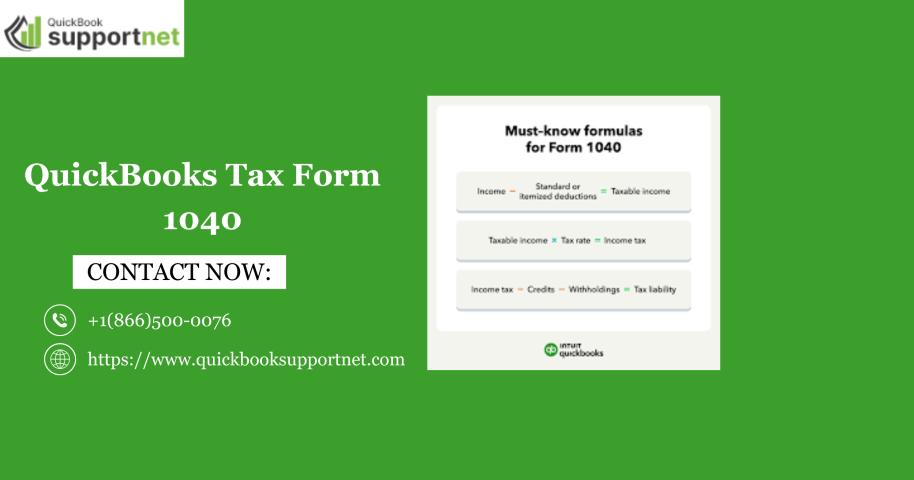

Filing personal taxes doesn’t have to feel overwhelming or confusing. With the right preparation and accounting tools, you can complete your federal return accurately and on time. Many individuals, freelancers,..

Filing personal taxes can feel overwhelming, especially when multiple income sources, deductions, and credits come into play. Thankfully, QuickBooks Tax Form 1040 simplifies the process for individuals, self-employed professionals, and..

As your Shopify store grows, so do your customer management needs. While Shopify’s default customer registration form works for very basic stores, it quickly becomes a limitation for businesses that..

Payroll tax reporting can feel overwhelming, especially when quarterly deadlines approach. For many businesses, mistakes happen not because they want to avoid compliance, but because the process itself is confusing...

Managing payroll taxes is one of the most critical responsibilities for employers, and FUTA compliance is no exception. When businesses use QuickBooks Online Form 940, the process of reporting Federal..

Every employer in the United States who paid wages subject to FUTA tax must file IRS Form 940 annually. If you’re using QuickBooks Desktop, the process becomes smooth, automated, and..

Preparing year-end tax documents can be overwhelming, especially when it comes to generating essential vendor forms like IRS Form 1099 and Form 1096. Whether you use QuickBooks Desktop or QuickBooks..

When tax season rolls around, every business owner knows how important it is to ensure compliance with IRS filing requirements. One of the essential tasks includes preparing and submitting Forms..

As a small business owner, staying compliant with tax obligations is essential to avoid penalties and keep your finances in order. One of the key IRS forms you need to..

Running a successful Shopify store isn’t just about having great products — it’s about creating smooth and professional user experiences. One of the most effective ways to achieve that is..

The 2290 road tax, also known as the Heavy Vehicle Use Tax (HVUT), is an essential annual fee for vehicles weighing 55,000 pounds or more. This tax funds highway maintenance..

The crypto is humming like a virtual gold rush, and you are piling your winnings on a Bitcoin trade or DeFi harvest. However, the shadow of the taxman is always..

Tax deductions are an important tool for businesses in the United States, helping to lower taxable income and reduce overall tax liabilities. For startups, understanding which expenses are deductible can..

In today’s competitive business environment, digital marketing is no longer optional—it is essential for sustainable revenue growth. Companies that strategically leverage digital channels can attract qualified leads, nurture prospects, convert..

Filing personal taxes doesn’t have to feel overwhelming or confusing. With the right preparation and accounting tools, you can complete your federal return accurately and on time. Many individuals, freelancers,..

Filing personal taxes can feel overwhelming, especially when multiple income sources, deductions, and credits come into play. Thankfully, QuickBooks Tax Form 1040 simplifies the process for individuals, self-employed professionals, and..

Ever wondered how your accountant manages your tax so efficiently?

This Tax Agent Portal Guide breaks down how the portal works and why it helps accountants lodge accurately and on..

Keeping payroll accurate and compliant is one of the most critical responsibilities for any business. With changing tax laws and annual updates, payroll software must stay current to avoid calculation..