Income Tax Return (ITR) और GST Registration: Delhi And Ghaziabad

✅ Penalty से बचाव – समय पर ITR filing न करने पर भारी जुर्माना लग सकता है।

🔹 कानूनी मान्यता – GST Registration आपके business को ग्राहकों और सप्लायर्स के बीच trustworthy बनाता है।

✔️ Salaried individuals, freelancers और businesses के लिए ITR filing

✔️ PAN card, Aadhaar card

Written by

taxefiling1212

332 days ago

Related articles:

5 Alternative Revenue Streams for Startups to Boost Cash Flow

Building a startup is a thrilling but challenging journey, and focusing solely on your core product or service may limit your growth potential. By exploring alternative revenue streams, you can..

Employment Income Verification AI Agent: Automating Secure and Accurate Validation

An Employment Income Verification AI Agent is designed to automatically validate a person’s employment status and income details using structured and unstructured data sources. It reduces manual verification time, minimizes..

GST Payment and Registration in India: Complete Guide

The Goods and Services Tax (GST) is one of the most important reforms in India’s taxation system. It replaced a mix of state and central taxes with a single unified..

ITR Filing FY 2024-25: Upload Your Form 16 Easily

The start of a new financial year brings new responsibilities, and one of the most important is filing your Income Tax Return (ITR). For the financial year 2024-25, the process..

Income Tax Return Filing, ITR In India

Whether you're a salaried individual, freelancer, or business owner, income tax return filing and company registration are essential steps toward financial stability and legal compliance. If you're looking to file..

RapidTaxO ITR Filing FY 2024-25 & Online GST Filing India

Filing income tax and GST returns is a legal responsibility for every eligible individual and business in India. But for many, the process can feel complicated or time-consuming. With the..

Section 80-IAC Income Tax Exemption for Startups – Full Guide (2025)

Startups in India are the backbone of innovation and economic growth. Recognizing this, the Indian government introduced Section 80-IAC under the Income Tax Act to give DPIIT-recognized startups a powerful..

What if Every Click Had the Power to Turn Into Your Next Earning?

Clicks don’t pay the bills — conversions do.

But what if you could make every click smarter? More intentional. More valuable.

In this post, we explore how to transform casual..

ITR Filing Last Date FY 2024-25 (AY 2025-26) - Rapid TaxO

Filing your ITR? Here’s why you shouldn’t wait till the last minuteFiling your income tax return is one of those things that’s easy to delay — until it’s suddenly urgent...

File Income Tax Return Online in India Before the Last Date

Introduction:Filing your Income Tax Return (ITR) isn’t just a legal requirement—it’s a smart financial move. Whether you're a salaried individual, freelancer, or business owner, the ability to file income tax..

Are Crypto Gains Taxed? Unraveling 2025’s Crypto Tax Puzzle

The crypto is humming like a virtual gold rush, and you are piling your winnings on a Bitcoin trade or DeFi harvest. However, the shadow of the taxman is always..

Understanding Tax Deductions for Businesses in the U.S.: A Startup’s Guide

Tax deductions are an important tool for businesses in the United States, helping to lower taxable income and reduce overall tax liabilities. For startups, understanding which expenses are deductible can..

Digital Marketing That Increases Revenue

In today’s competitive business environment, digital marketing is no longer optional—it is essential for sustainable revenue growth. Companies that strategically leverage digital channels can attract qualified leads, nurture prospects, convert..

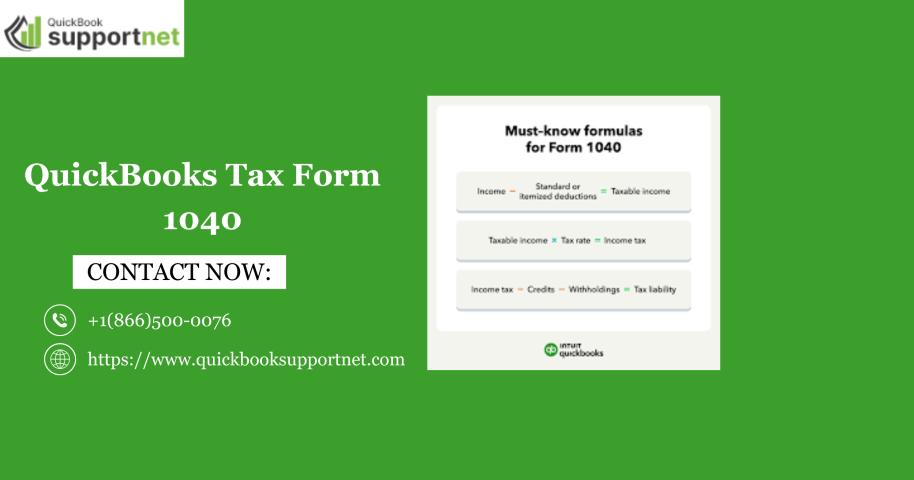

QuickBooks Tax Form 1040 Tutorial: Accurate & Fast Tax Filing

Filing personal taxes doesn’t have to feel overwhelming or confusing. With the right preparation and accounting tools, you can complete your federal return accurately and on time. Many individuals, freelancers,..

QuickBooks Tax Form 1040 for Individuals – Step Guide

Filing personal taxes can feel overwhelming, especially when multiple income sources, deductions, and credits come into play. Thankfully, QuickBooks Tax Form 1040 simplifies the process for individuals, self-employed professionals, and..

Tax Agent Portal Guide – What Your Accountant Does Behind the Scenes

Ever wondered how your accountant manages your tax so efficiently?

This Tax Agent Portal Guide breaks down how the portal works and why it helps accountants lodge accurately and on..

QuickBooks Payroll Tax Table Update Download: Step-by-Step Guide for 2026

Keeping payroll accurate and compliant is one of the most critical responsibilities for any business. With changing tax laws and annual updates, payroll software must stay current to avoid calculation..

What are the Top 10 Challenges of Tax Consultants?

Taxation is one of the trickiest aspects of running a business. It’s not just about calculating numbers — it’s about interpreting laws, staying compliant, and making sure no one pays..