In a fast-paced world where two-wheelers are an essential part of daily commute, ensuring their safety is no longer a luxury—it's a necessity. With increasing road risks and unpredictable mishaps, having reliable bike insurance gives you peace of mind and financial protection. One name that stands out in the insurance landscape is ICICI Lombard. Known for its robust insurance solutions, ICICI Lombard offers a range of bike insurance policies tailored to meet the diverse needs of Indian riders.

Why

Choose ICICI Lombard Bike Insurance?

ICICI

Lombard Bike Insurance is designed to offer complete protection against a

wide array of risks including accidents, theft, natural calamities, and

third-party liabilities. With a reputation built on trust, transparency, and

customer-centric services, the company makes sure your ride is always

covered—both on paper and on the road.

Whether you’re a seasoned rider or a

new bike owner, ICICI Lombard ensures your experience is smooth from policy

purchase to claim settlement.

Features

and Benefits of ICICI Lombard Bike Insurance

- Wide Coverage:

From accidental damage to natural disasters like floods and earthquakes,

ICICI Lombard provides extensive coverage.

- 24x7 Customer Support:

With ICICI Lombard Car Insurance Customer Care available round the

clock, assistance is just a call away.

- Cashless Garage Network: Over 8,800+ garages across India for hassle-free

cashless claim service.

- Quick Claim Settlement: The ICICI Lombard Car Insurance Claim process

is swift and transparent, with many claims settled in record time.

- Zero Paperwork:

With digital services like the ICICI Lombard Car Insurance Policy

Document available online, everything you need is at your fingertips.

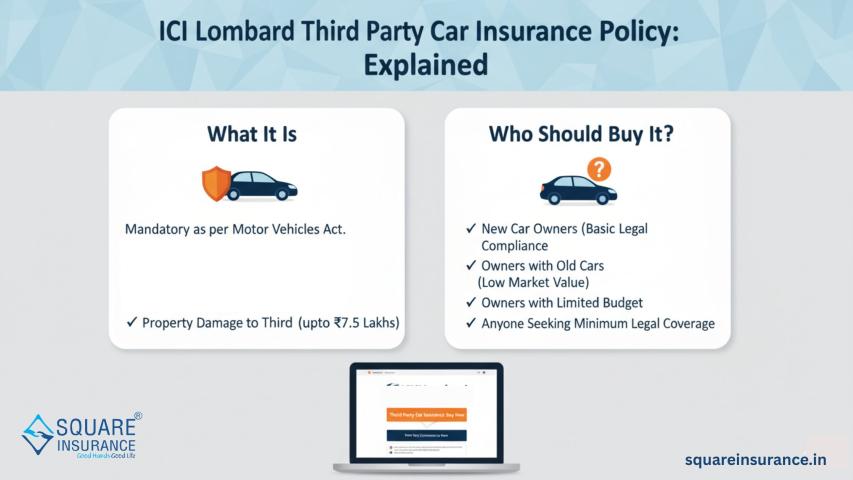

Types

of Bike Insurance Plans Offered by ICICI Lombard

1.

Third-Party Bike Insurance

This is a basic and mandatory cover

that protects you against legal liabilities arising from damage or injury

caused to a third party. It's similar in concept to the ICICI Lombard Third

Party Car Insurance Policy and is ideal for those looking for minimal

compliance-based coverage.

2.

Comprehensive Bike Insurance

For those seeking wider protection,

the ICICI Lombard Comprehensive Car Insurance model applies equally well

to bike insurance. It includes both third-party liability and own-damage cover.

Whether your bike gets damaged in an accident or by fire or flood, this plan

has you covered.

3.

Standalone Own Damage Bike Insurance

Mirroring the ICICI Lombard

Standalone Own Damage Car Insurance, this plan is meant for those who

already have third-party insurance but need additional protection for their

vehicle. It covers damage from accidents, theft, and natural disasters.

ICICI

Lombard Zero Depreciation Bike Insurance

One of the standout features is the ICICI

Lombard Zero Depreciation Bike Insurance add-on. This cover ensures you get

the full claim amount without deduction for depreciation on parts. Especially

for bikes under 5 years old, this can be a cost-saving and value-enhancing

option. This add-on is also a popular feature in ICICI Lombard Zero

Depreciation Add-On Cover for cars, making it a trusted option for

two-wheelers as well.

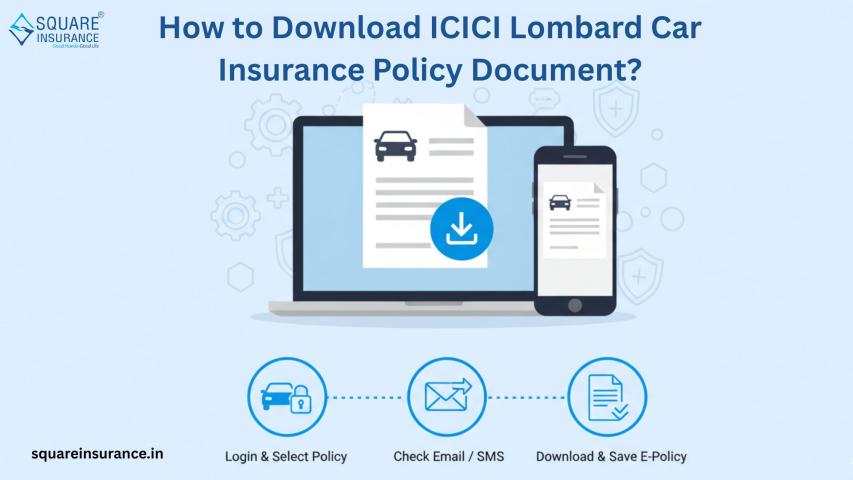

How

to Buy or Renew ICICI Lombard Bike Insurance

Purchasing or renewing your policy

is now easier than ever. The digital-first approach ensures minimal paperwork

and maximum efficiency.

Steps

for ICICI Lombard Car/Bike Insurance Renewal:

- Visit the official ICICI Lombard website.

- Enter your existing policy details or bike registration

number.

- Review your current coverage and select add-ons like

Zero Depreciation.

- Use the ICICI Lombard Car Insurance Premium

Calculator to estimate your renewal premium.

- Make the payment and download your ICICI Lombard Car

Insurance Policy Document instantly.

Renewing your policy on time ensures

continued protection and peace of mind. A lapse in insurance can not only leave

you vulnerable but also attract legal penalties.

Understanding

Premiums with the ICICI Lombard Premium Calculator

Determining the cost of your policy

has never been easier. With the ICICI Lombard Car Insurance Premium

Calculator, you can input basic details like your bike's make, model, age,

and location to get an instant premium estimate. This transparency helps you

make an informed decision and avoid hidden charges.

Claim

Process: Quick, Easy, Transparent

The ICICI Lombard Car Insurance

Claim process for two-wheelers is straightforward and efficient:

- Register your claim online or via the customer care.

- Get your vehicle surveyed.

- Submit required documents.

- Choose from cashless or reimbursement options.

- Sit back as ICICI Lombard takes care of the rest.

With a high claim settlement ratio,

ICICI Lombard ensures you’re not left stranded in your hour of need.

Customer

Support that Cares

In times of uncertainty, timely support

makes all the difference. The ICICI Lombard Car Insurance Customer Care

team is accessible via toll-free numbers, email, and live chat. From policy

queries to claim updates, their experts are trained to assist with

professionalism and empathy.

Final

Thoughts

Choosing the right bike insurance is

as important as choosing the right bike. With ICICI

Lombard Bike Insurance, you get a perfect blend of coverage, affordability,

and service. Whether you’re riding to work or cruising on a weekend trip,

knowing that you're covered by a reliable insurer adds a layer of confidence to

your journey.

So, gear up, ride safe, and let

ICICI Lombard take care of the rest.