When it comes to securing your financial future, many people

often think about savings, investments, and insurance separately. However, the

Life Insurance Corporation of India (LIC) offers policies that not only provide

life protection but also help you grow your savings systematically. LIC has

been a trusted name in India for decades, providing reliable insurance products

that combine safety, returns, and long-term planning. In this article, we will

explore how LIC of India policies can help you grow your savings and achieve

your financial goals.

1. Dual Benefit: Protection and Savings

One of the key features of LIC policies is that they offer

both protection and savings. When you invest in a life insurance policy, you

are not only securing your family’s future in case of any unfortunate event but

also building a corpus over time. Policies like endowment plans, money-back

plans, and whole life policies come with a maturity benefit, which is a sum of

money you receive after completing the policy term. This dual benefit ensures

that your money is working for you while providing the security you need.

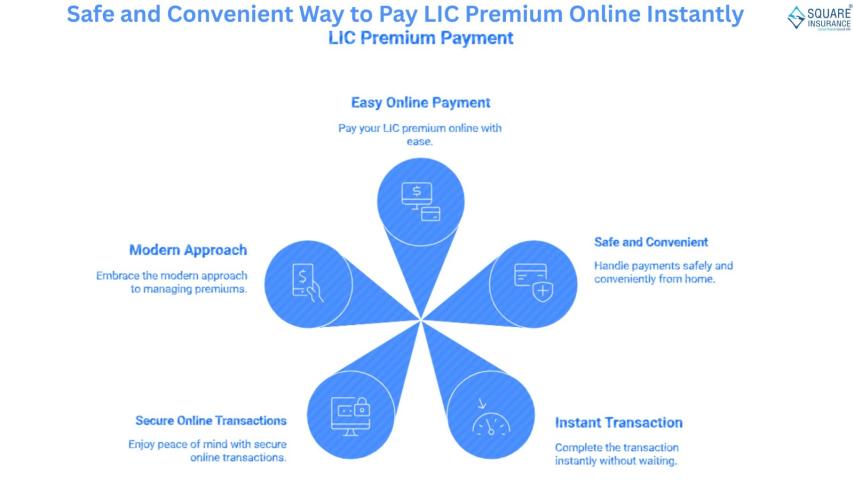

2. Systematic and Disciplined Savings

LIC policies encourage a disciplined savings habit.

Depending on the policy, premiums are typically paid monthly, quarterly,

half-yearly, or annually. By making regular payments, you are automatically

saving money every month, which over time grows into a substantial amount. This

approach helps individuals who may struggle to save consistently on their own,

making LIC policies a reliable tool for long-term financial growth.

3. Guaranteed Returns

Certain LIC policies, such as endowment and money-back

plans, provide guaranteed returns. These plans offer a fixed sum assured at the

end of the policy term, ensuring that your savings grow predictably over time.

Unlike some investment options that depend on market performance, LIC’s

guaranteed returns provide security and peace of mind. For conservative

investors, this is a safe way to grow savings while minimizing risk.

4. Bonuses That Enhance Savings

Many LIC policies, especially traditional ones, offer

bonuses declared annually by the corporation. These bonuses are added to the

sum assured, increasing the total payout at maturity. Simple reversionary

bonuses and terminal bonuses are the two primary categories of bonuses. Over

time, these bonuses can significantly enhance your savings, making LIC policies

a combination of insurance and wealth accumulation.

5. Tax Benefits Boost Savings

Investing in LIC policies comes with significant tax

advantages under Indian tax laws.Up to ₹1.5 lakh annually, premiums paid are

deductible under Section 80C of the Income Tax Act. Furthermore, Section

10(10D) generally exempts the death benefits and maturity proceeds from taxes.

These tax benefits help you save more effectively, as you retain a larger

portion of your money while your savings continue to grow.

6. Long-Term Financial Planning

LIC policies are excellent tools for long-term financial

planning. Whether your goal is to save for your child’s education, buy a house,

or build a retirement corpus, LIC offers policies that align with these

objectives. Money invested in these plans grows steadily over time, allowing

you to achieve financial milestones without relying solely on volatile market

instruments.

7. Money-Back Policies for Periodic Returns

LIC money-back plans are ideal for those who want regular

returns in addition to protection. These policies provide a percentage of the

sum assured at regular intervals during the policy term, in addition to the

maturity benefit. This approach not only helps you meet short-term financial

needs but also ensures that your savings continue to grow steadily over the

long term.

8. Flexibility in Policy Selection

LIC offers a wide variety of policies to suit different

financial goals and budgets. For example:

·

Term Plans: Provide high coverage at low

premiums. Ideal for protection rather than savings.

·

Endowment Plans: Combine insurance with a

savings component, offering guaranteed returns at maturity.

·

Money-Back Plans: Offer periodic payouts along

with maturity benefits for financial liquidity.

·

Pension Plans: Help accumulate a retirement

corpus while offering steady payouts after retirement.

This flexibility allows you to choose a policy that matches

your financial objectives, risk tolerance, and investment horizon.

9. Loan Facility for Emergencies

LIC policies also come with a loan facility, allowing

policyholders to borrow against the surrender value of their policy. This means

that in times of emergency, you can access funds without breaking your savings

habit. The loan interest rates are usually lower than standard bank loans,

making it a convenient and cost-effective way to meet urgent financial needs

while ensuring your savings continue to grow.

10. Encourages a Safety-First Approach

While growth is important, LIC policies ensure that your

savings are protected. Unlike high-risk investments, LIC policies provide

safety and stability, which is especially valuable in uncertain economic times.

Your premiums and accumulated bonuses are safe, giving you a predictable and

secure way to grow your wealth over time.

11. Peace of Mind

An often overlooked but crucial benefit of LIC policies is

the peace of mind they offer. Knowing that your family will be financially

protected in your absence, that your long-term goals are on track, and that

your investments are secure provides immense psychological comfort. This peace

of mind encourages consistent savings, which ultimately leads to wealth

accumulation over the years.

Conclusion

Policies from LIC of India are more than just insurance;

they are effective instruments for increasing your savings and safeguarding

your financial future. With guaranteed returns, bonuses, tax benefits, flexible

options, and long-term planning advantages, LIC policies provide a safe and

systematic way to build wealth. Whether your goal is to save for retirement,

children’s education, or future emergencies, LIC policies can help you achieve

it with discipline and confidence.

For anyone looking to make the most of LIC policies and grow

their savings effectively, Square Insurance can assist in choosing the right

policy that aligns with your financial goals and ensures long-term benefits.