Starting a business is already a big challenge. Many entrepreneurs also want to grow their personal money on the side, but they don’t always know where to begin. That’s where investment platforms come in. These are websites or apps that allow you to buy and sell things like stocks, funds, or even cryptocurrencies — all from your phone or computer.

This guide explains what investment platforms are, why they matter for startup founders, and which ones are the easiest to use if you’re just starting out.

What Is an Investment Platform?

An investment platform is like a digital marketplace for money. Instead of going to a bank or calling a financial advisor, you log into an app, decide what you want to invest in (for example, a stock like Apple or a fund that tracks the S&P 500), and the platform does the transaction for you.

Think of it as Amazon, but for investments.

Why Should Entrepreneurs Care?

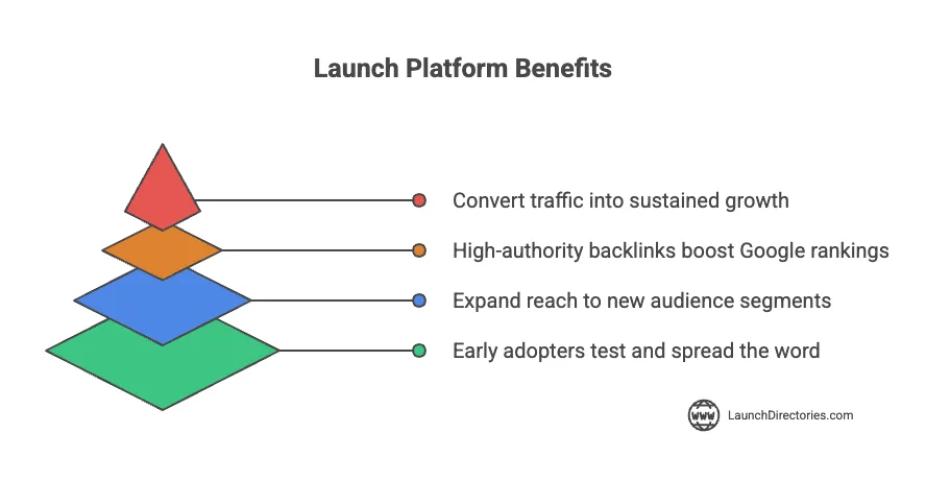

If you’re building a startup, every dollar counts. Investment platforms help you:

Grow your savings while you work on your business.

Diversify your risk so all your money isn’t tied to just your startup.

Access capital markets easily, without paying big fees.

Even if you’re focused 100% on your company, using these platforms can help secure your personal financial future.

The Best Platforms (Simplified Comparison)

1. Robinhood – The Easy App

Super simple to use.

You don’t pay extra fees when you buy or sell.

Great for people who want to start small.

2. Charles Schwab – The All-in-One Solution

Offers almost everything: stocks, bonds, retirement plans.

Lots of tools to research and learn.

A better choice if you plan to invest seriously for years.

3. eToro – The Social Platform

You can see what other investors are doing.

Even copy the strategies of experienced traders.

Feels more like a community than a bank.

4. Fidelity – The Retirement Planner

Focuses on long-term wealth.

Great if you’re thinking ahead about retirement.

Less exciting for short-term trading, but very reliable.

5. Wealthfront – The Robot Investor

Uses algorithms (a kind of smart software) to manage your money automatically.

You don’t have to study markets or make decisions daily.

Perfect if you’re busy running your startup.

How to Choose the Right One

When picking a platform, ask yourself:

How much time do I want to spend learning about investments?

If little: choose Wealthfront.

If more: try Schwab or Fidelity.

Am I investing for short-term or long-term?

Short-term: Robinhood or eToro.

Long-term: Fidelity or Schwab.

Do I want zero fees or more advanced tools?

Zero fees: Robinhood.

Advanced tools: Schwab.

Final Takeaway

Investment platforms are no longer just for Wall Street professionals. They’re easy to use, affordable, and available on your phone. For startup founders and beginners, they are a smart way to make money work for you, while you’re busy making your business grow.