zManaging payroll taxes can be a daunting task for small and medium-sized businesses. One of the most essential IRS filings business owners must stay on top of is Form 941, the Employer’s Quarterly Federal Tax Return. Luckily, QuickBooks Form 941 simplifies this process and helps ensure accuracy and compliance with federal tax laws.

In this detailed guide, we’ll explore what Form 941 is, how it functions within QuickBooks Online and QuickBooks Desktop, and why it’s critical for every employer to understand and file correctly. If you face any issues while generating or e-filing this form, you can also reach expert help at +1(866)500-0076.

Understanding Form 941: A Core IRS Requirement

Form 941 is the quarterly tax return that employers file with the Internal Revenue Service (IRS) to report wages paid to employees, federal income taxes withheld, and both employer and employee shares of Social Security and Medicare taxes.

Every employer who pays wages subject to these taxes must file Form 941 each quarter, even if they only have one employee. The form also includes adjustments for tips, sick pay, and other payroll changes.

Without accurate and timely submission of Form 941, businesses risk IRS penalties, interest on unpaid taxes, and even potential audits. That’s why it’s important to understand not only how to file it but also how to use QuickBooks to simplify and automate the process.

What is QuickBooks Form 941?

QuickBooks Form 941 refers to the built-in IRS tax form feature within QuickBooks Payroll (both Online and Desktop versions) that helps employers generate, review, and e-file the 941 form easily.

When you use QuickBooks for payroll, the software automatically tracks employee wages, deductions, and tax liabilities throughout each quarter. At the end of the quarter, QuickBooks populates Form 941 with all the necessary data, ensuring accuracy and compliance with federal tax reporting standards.

This automation eliminates the risk of manual entry errors, speeds up the filing process, and helps business owners avoid missed deadlines.

How QuickBooks Populates Form 941 Automatically

One of the best features of QuickBooks Form 941 is automation. Instead of manually entering details into IRS forms, QuickBooks populates Form 941 using real-time payroll data. Here’s how it works:

- Payroll Data Collection – Each payroll run in QuickBooks records employee wages, deductions, and employer contributions.

- Tax Calculation – QuickBooks calculates Social Security, Medicare, and federal income tax amounts automatically.

- Form Generation – At the end of the quarter, QuickBooks compiles this information and generates Form 941 with pre-filled values.

- Review and Adjust – Users can review and edit any entries before final submission.

- E-File Option – QuickBooks allows direct e-filing to the IRS for quick submission and acknowledgment.

This intelligent automation saves time, minimizes human error, and ensures accurate filings every quarter.

Form 941 in QuickBooks Online

Form 941 QuickBooks Online is designed for businesses using the cloud-based version of QuickBooks. QuickBooks Online Payroll automatically prepares the quarterly return as you process payrolls throughout the quarter.

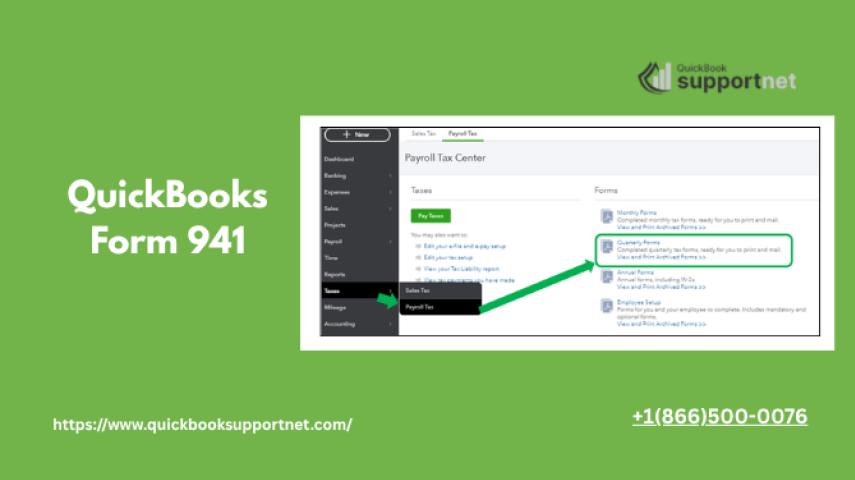

Steps to Access and File Form 941 in QuickBooks Online:

- Go to the Taxes tab.

- Click Payroll Tax → Quarterly Forms.

- Select Form 941 for the appropriate quarter.

- Review the auto-filled details.

- Submit electronically through the E-file option or print and mail the form if preferred.

QuickBooks Online offers the advantage of anytime access, making it easy to review or amend your filings even if you’re not in the office.

If you encounter an issue during e-filing or need assistance reconciling your payroll tax data, you can contact QuickBooks experts at +1(866)500-0076 for instant support.

Form 941 in QuickBooks Desktop Version

The QuickBooks Form 941 Desktop Version functions similarly to its online counterpart but caters to businesses that manage payroll locally. QuickBooks Desktop Payroll offers the ability to generate and e-file Form 941 directly from your company file.

Steps to File Form 941 in QuickBooks Desktop:

- Go to the Employees menu.

- Choose Payroll Tax Forms & W-2s → Process Payroll Forms.

- Select Form 941 from the list of federal forms.

- Choose the quarter and year you want to file.

- Verify all auto-filled information.

- Click Submit Form to e-file, or select Print for Signature to mail it manually.

The QuickBooks Desktop interface provides comprehensive control over payroll records, giving you the flexibility to cross-check details before submission.

Why Form 941 is Important for Businesses

1. Compliance with IRS Regulations

Filing Form 941 ensures that your business stays compliant with IRS laws by reporting employee wage taxes and federal contributions correctly. Missing or late filings can lead to severe financial penalties and interest accruals.

2. Avoiding Costly Errors

With QuickBooks automating your form population, you minimize manual data entry and avoid common errors that lead to IRS notices or discrepancies.

3. Simplified Payroll Management

Both QuickBooks Online and Desktop versions streamline quarterly reporting by automatically tracking employee tax withholdings and applying the data directly to Form 941.

4. Saves Time and Effort

Manual preparation of Form 941 can take hours, especially if you manage multiple employees. QuickBooks populates Form 941 instantly, saving you valuable time that can be better spent running your business.

5. Builds IRS Filing Confidence

Since QuickBooks uses IRS-approved formatting and e-filing standards, you can file with confidence knowing your submission is accurate and secure.

Common Errors When Filing Form 941 in QuickBooks

Even though QuickBooks simplifies the filing process, a few common mistakes can still occur:

- Incorrect EIN (Employer Identification Number) entries

- Wrong employee tax setup in payroll preferences

- Incomplete or outdated payroll updates

- Not reconciling payroll liabilities before filing

If any of these occur, QuickBooks might show mismatched totals or rejected submissions. The best solution is to ensure payroll is updated and data is verified before generating the form.

Need help resolving Form 941 issues? Contact QuickBooks payroll support at +1(866)500-0076 for expert assistance and troubleshooting guidance.

Tips for Accurate Form 941 Filing in QuickBooks

- Keep Payroll Updated: Always install the latest QuickBooks Payroll updates before generating any tax forms.

- Verify Employee Data: Ensure Social Security Numbers and wage details are accurate.

- Reconcile Liabilities: Confirm that your payroll liabilities match what’s reported on the 941 form.

- Review Before Submission: Double-check totals for accuracy and consistency across all quarters.

- Use E-File Option: Electronic submission reduces errors and ensures faster IRS acknowledgment.

Filing Deadlines for Form 941

Form 941 is filed quarterly, and the deadlines are as follows:

- Quarter 1 (Jan–Mar): Due April 30

- Quarter 2 (Apr–Jun): Due July 31

- Quarter 3 (Jul–Sep): Due October 31

- Quarter 4 (Oct–Dec): Due January 31 (following year)

QuickBooks will notify you before each due date to help you file on time and stay compliant.

Troubleshooting QuickBooks Form 941 Issues

If you notice that your Form 941 QuickBooks Online or QuickBooks Form 941 Desktop Version is not showing correctly, it may be due to:

- Outdated payroll tax table

- Missing employee setup

- Damaged form files or company data issues

- Incorrect mapping of payroll items

To fix these, update QuickBooks, verify payroll setup, and rebuild company data. You can also reach professionals at +1(866)500-0076 for advanced troubleshooting support.

Conclusion: Simplify Your Tax Filing with QuickBooks Form 941

Filing Form 941 is a legal necessity and a key part of maintaining compliance with federal payroll tax obligations. With QuickBooks Form 941, business owners can confidently handle quarterly filings with precision and minimal stress.

Whether you’re using Form 941 QuickBooks Online or the QuickBooks Form 941 Desktop Version, the automated system ensures that your payroll data translates seamlessly into accurate IRS filings. Plus, features like e-filing, data verification, and real-time payroll tracking make the process effortless.

For any technical issues, filing errors, or guidance on how QuickBooks populates Form 941, you can always contact the certified support experts at +1(866)500-0076.

To learn more or get professional help with QuickBooks payroll and tax compliance, visit QuickBooksupportnet — your trusted source for QuickBooks assistance.