Introduction

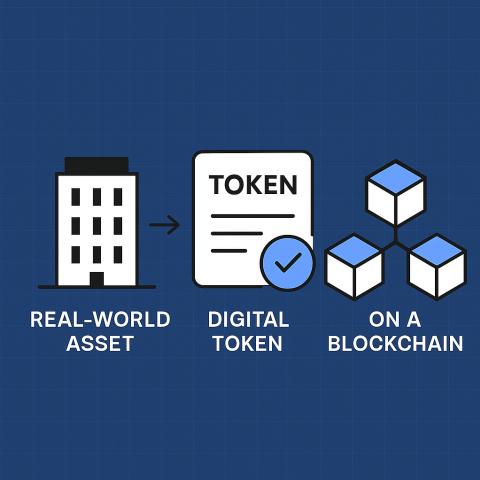

A real world asset tokenization development company helps businesses digitize physical and financial assets using blockchain technology. By converting assets such as real estate, gold, or bonds into digital tokens, companies can make ownership more transparent, tradable, and secure. This process is a key part of Web3 development, which focuses on decentralization, transparency, and digital ownership.

Partnering with a tokenization development company allows organizations to connect traditional assets with blockchain networks, enabling global access and automated asset management. This partnership helps enterprises build trust, improve liquidity, and prepare for the future of finance powered by Web3.

This article explains how working with a real world asset tokenization development company can help businesses achieve Web3 success through secure, scalable, and compliant blockchain solutions.

1. Understanding Real World Asset Tokenization and Its Role in Web3

Real world asset tokenization means creating blockchain-based tokens that represent ownership rights or value linked to a tangible asset. Each token corresponds to a portion of an asset, such as property, metals, or securities, allowing investors to buy and trade smaller shares.

In the Web3 ecosystem, tokenization plays a key role by making real assets interoperable with decentralized platforms. Through smart contracts and blockchain, asset ownership becomes transparent and traceable.

For example, instead of selling a whole building, a company can issue digital tokens that represent fractional ownership. Investors can trade these tokens in real-time, and all transactions remain publicly verifiable on the blockchain.

A real world asset tokenization development company builds this digital infrastructure by combining blockchain programming, legal compliance, and secure asset management solutions.

2. Why Web3 Businesses Need Asset Tokenization

The Web3 environment focuses on digital transparency, decentralized control, and inclusivity. Tokenization fits perfectly into this framework by giving digital form to real assets.

Here’s why Web3 businesses benefit from asset tokenization:

-

Decentralized Ownership: Blockchain-based ownership replaces centralized intermediaries, creating trust between participants.

-

Improved Liquidity: Illiquid assets like real estate or art become tradable in smaller fractions.

-

Global Participation: Investors across borders can invest without complex paperwork or currency restrictions.

-

Smart Contract Automation: Transactions happen automatically without manual intervention.

-

Transparency and Security: Every record is stored on the blockchain, ensuring tamper-proof traceability.

These benefits make tokenization a vital part of Web3 adoption, allowing businesses to move traditional value systems into the digital economy.

3. What Does a Real World Asset Tokenization Development Company Do?

A real world asset tokenization development company provides the technical, legal, and operational infrastructure needed to create, manage, and trade tokenized assets securely on blockchain networks.

Their main responsibilities include:

-

Designing token structures that represent asset ownership or value.

-

Building secure blockchain platforms for token creation and trading.

-

Writing smart contracts to automate ownership transfers and compliance rules.

-

Integrating KYC (Know Your Customer) and AML (Anti-Money Laundering) verification systems.

-

Providing wallet and custody solutions for token storage and asset linkage.

-

Offering post-deployment technical and legal support to maintain system reliability.

These companies combine blockchain development with regulatory understanding, allowing businesses to tokenize assets without technical or legal obstacles.

4. Core Services Offered by a Real World Asset Tokenization Development Company

A professional tokenization development company provides a range of services to support the entire process—from asset evaluation to token trading.

4.1 Token Design and Development

The company defines the structure of tokens based on the asset type and investment goals. Tokens can be fungible (interchangeable) or non-fungible (unique), depending on what they represent.

Key elements in token design include:

-

Token supply and divisibility.

-

Blockchain network selection (Ethereum, Polygon, Solana, etc.).

-

Ownership rights associated with tokens.

-

Compliance integration with financial laws.

This design ensures that tokens reflect real-world asset ownership in a legally valid and technically sound way.

4.2 Smart Contract Creation

Smart contracts form the foundation of a tokenized system. These self-executing codes automate processes like token issuance, transfers, dividend payments, and compliance verification.

The company writes and audits these smart contracts to maintain accuracy, transparency, and security in every transaction.

By integrating automation, businesses save time and reduce administrative work, while investors gain trust through transparent blockchain operations.

4.3 Legal Structuring and Compliance

Tokenization must comply with financial laws across different jurisdictions. A real world asset tokenization development company collaborates with legal professionals to structure compliant frameworks.

This includes:

-

KYC/AML verification.

-

Security classification for tokens.

-

Investor eligibility management.

-

Regulatory documentation for token issuance.

Such measures help businesses avoid legal risks while maintaining credibility with investors.

4.4 Platform and Wallet Development

The company builds a real world asset tokenization platform that acts as a secure digital marketplace where users can issue, trade, and manage tokens.

Main platform features include:

-

Asset management dashboards.

-

Secure wallets for token storage.

-

Transaction tracking and reporting tools.

-

Compliance modules for identity verification.

These platforms are designed to provide smooth user experiences for both issuers and investors, supporting real-time asset tracking and safe trading.

4.5 Custody and Security Solutions

To maintain a link between physical assets and their digital tokens, strong custody systems are required. The company sets up trusted third-party custodians or blockchain-based custody frameworks.

Security systems involve:

-

Cold storage for token protection.

-

Multi-signature authentication.

-

Encryption for sensitive data.

-

Regular audits and monitoring.

These measures prevent fraud, hacking, or unauthorized access, ensuring that both assets and tokens remain secure.

4.6 Token Issuance and Distribution

After the technical and legal setup, tokens are minted and distributed to verified investors. Distribution can take place through private offerings, token sales, or Initial Token Offerings (ITOs).

Each token issuance is recorded on the blockchain, maintaining full transparency and traceability in ownership.

4.7 Secondary Market Integration

The company connects tokens to secondary markets or decentralized exchanges (DEXs) to allow post-issuance trading. This step is key for liquidity, giving investors the flexibility to trade their asset shares anytime.

Through blockchain integration, these trades are instant, secure, and verifiable without intermediaries.

4.8 Post-Deployment Support and Maintenance

Once the tokenization system goes live, continuous updates and support are needed to keep it stable and compliant. The company offers services such as:

-

Smart contract upgrades.

-

Security monitoring.

-

Compliance updates.

-

Technical troubleshooting.

This ongoing support ensures smooth performance and investor satisfaction in the long run.

5. How Tokenization Supports Web3 Business Models

Web3 represents the next generation of the internet where users control their data, assets, and identities. Tokenization is a major pillar of this new model.

Here’s how asset tokenization benefits Web3 businesses:

5.1 Decentralized Ownership Structures

Web3 platforms allow distributed ownership. Tokenization aligns with this by letting multiple investors own fractions of a single asset, giving everyone a share in decentralized wealth creation.

5.2 Digital Transparency

Every tokenized transaction is recorded publicly on the blockchain, removing the need for centralized verification systems.

5.3 Global Financial Inclusion

Tokenized assets can reach investors worldwide, giving everyone access to investment opportunities that were previously limited to large institutions.

5.4 Automated Governance

Smart contracts replace manual operations with automated, rule-based actions, making asset management efficient and error-free.

5.5 Liquidity and Market Expansion

Traditionally illiquid assets—like property or private equity—become tradeable, expanding investment opportunities in Web3 ecosystems.

6. Benefits of Partnering with a Real World Asset Tokenization Development Company

Partnering with experts offers both technical and strategic advantages.

6.1 Access to Expert Blockchain Knowledge

These companies have specialized blockchain developers who can create secure, compliant, and scalable token ecosystems.

6.2 Compliance Confidence

They build token structures that meet regional legal requirements, keeping your project aligned with investor protection laws.

6.3 Reduced Development Time

Instead of building from scratch, businesses can save time through ready-made frameworks and tokenization platforms.

6.4 Enhanced Investor Trust

Smart contracts and transparent processes strengthen investor confidence in the project.

6.5 End-to-End Support

From token design to secondary market integration, the company handles every phase of the process, ensuring consistency and quality.

7. Industries Driving Web3 Growth with Asset Tokenization

Several industries are using tokenization to modernize their business models in the Web3 space:

-

Real Estate: Fractional property ownership and tokenized real estate funds.

-

Commodities: Digital tokens backed by gold, oil, or agricultural goods.

-

Art and Collectibles: Tokenized art ownership and royalty systems.

-

Financial Assets: Tokenized bonds, equities, and private credit markets.

-

Intellectual Property: Tokenization of patents, music rights, and licensing agreements.

Each sector gains liquidity, transparency, and global reach through tokenization systems designed by professional development companies.

8. Key Factors to Consider When Selecting a Tokenization Development Partner

When choosing a real world asset tokenization development company, consider these points:

-

Proficiency in blockchain and smart contract development.

-

Experience across multiple blockchain networks.

-

Security infrastructure and audit capabilities.

-

Knowledge of global regulations and compliance.

-

Ability to scale systems as business needs grow.

-

Post-launch technical and legal support.

Evaluating these factors helps identify a trustworthy partner who can support long-term Web3 goals.

9. The Future of Tokenization in Web3

As blockchain technology matures, tokenization will continue shaping the Web3 economy. In the near future, we will see:

-

Interoperable Token Systems: Tokens moving seamlessly between blockchains.

-

Integration with DeFi (Decentralized Finance): Asset-backed tokens used in lending and yield-generating protocols.

-

Institutional Adoption: Banks and financial institutions tokenizing real assets.

-

Global Regulatory Frameworks: Governments introducing legal standards for tokenized assets.

This growth will make tokenization an integral part of global finance, empowering businesses that adopt it early.

Conclusion

Partnering with a real world asset tokenization development company gives businesses the tools they need to succeed in the Web3 era. These companies combine blockchain technology, compliance knowledge, and digital innovation to create secure and scalable ecosystems for real asset ownership. Get a Custom RWA Tokenization Strategy Tailored to Your Business.

By building trusted tokenization platforms, organizations can connect physical and digital markets, open access to global investors, and manage assets transparently. As Web3 continues to grow, tokenization will serve as a foundation for a new financial system built on trust, security, and decentralization.

Choosing the right development partner today can help businesses build sustainable success in the Web3 future.