Buying car insurance online has

become one of the easiest and most efficient ways to secure protection for your

vehicle. It saves time, offers better transparency, and allows you to compare

coverage options without pressure from agents. However, to make the right

decision, it is important to follow a structured process instead of choosing a

policy only based on price.

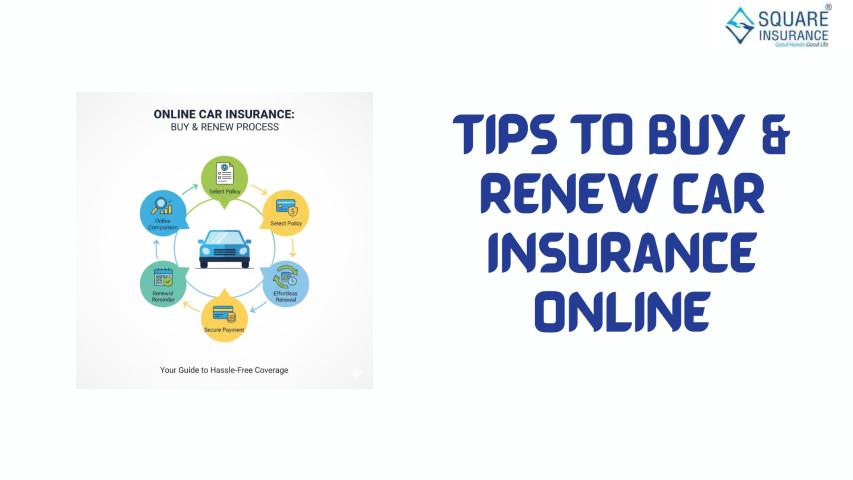

This step-by-step guide explains how

to buy car insurance online in a smart and safe way, ensuring that you get the

right coverage at the right cost.

Step

1: Keep Your Vehicle and Personal Details Ready

Before you begin, gather all

essential information to avoid errors during the purchase process. You will

typically need:

- Vehicle registration number

- Car make, model, and fuel type

- Year of manufacture

- Previous insurance details (if applicable)

- No Claim Bonus status

- Personal contact details

Accurate details ensure correct

premium calculation and prevent claim issues later.

Step

2: Decide the Type of Car Insurance You Need

There are two main types of car

insurance available online:

Third-Party

Car Insurance

This is legally mandatory and covers

only third-party injury, death, and property damage. It does not cover your own

car’s damages.

Comprehensive

Car Insurance

This covers both third-party

liabilities and damages to your own vehicle due to accidents, theft, natural

disasters, and vandalism.

If your car is relatively new or

valuable, comprehensive coverage is generally the better option for financial

safety.

Step

3: Select the Right Insured Declared Value (IDV)

IDV is the current market value of

your car and determines the maximum claim amount in case of total loss or

theft. Choosing the right IDV is critical:

- Higher IDV means higher premium

- Lower IDV means lower claim payout

While buying online, you usually get

a recommended IDV range. Choose a realistic value based on your car’s age and

condition, not just the lowest premium.

Step

4: Choose Add-On Covers Based on Your Needs

Add-ons enhance your car insurance

policy and provide extra protection. Some useful add-ons include:

- Zero depreciation cover for full claim on parts

- Engine protection for water-damaged engines

- Roadside assistance for breakdown support

- Return to invoice for total loss cases

Avoid selecting unnecessary add-ons,

as they increase premium without adding practical value to your situation.

Step

5: Compare Plans, Not Just Premiums

One of the biggest advantages of

buying car insurance online is easy comparison. While comparing plans, look

beyond the price and check:

- Coverage limits

- Add-on benefits

- Claim settlement support

- Cashless garage availability

- Policy terms and exclusions

A slightly higher premium may offer

significantly better protection and service.

Step

6: Verify No Claim Bonus Eligibility

If you have not made any claims in

the previous policy period, you are eligible for No Claim Bonus. This discount

can significantly reduce your premium during online purchase.

Always confirm that your NCB

percentage is correctly applied. Giving incorrect NCB information can lead to

claim rejection or policy cancellation later.

Step

7: Enter Details Carefully Before Payment

Before proceeding to payment,

recheck all the information you entered, especially:

- Registration number

- Engine number (if asked)

- Policy type

- Add-on selections

- Personal details

Small mistakes can create big

problems during claim settlement, so accuracy is essential.

Step

8: Make Secure Online Payment

After confirming policy details,

complete payment using secure online methods such as:

- Debit or credit card

- UPI

- Net banking

Once payment is successful, your

policy is usually issued instantly and sent to your registered email.

Step

9: Download and Save Policy Documents

After purchase, download your policy

document and keep both digital and printed copies safely. Your insurance

details are also linked to your vehicle registration, but having access to

documents helps in:

- Traffic checks

- Accident reporting

- Claim registration

Always verify that all policy

details mentioned in the document are correct.

Step

10: Know the Claim Process in Advance

Buying insurance is only half the

job. Understanding how to file a claim is equally important. Check:

- Emergency contact numbers

- Documents required for claim

- Cashless garage procedures

- Time limits for claim reporting

Knowing these steps beforehand can

save time and stress during emergencies.

Benefits

of Buying Car Insurance Online

Buying car insurance online offers

several advantages:

- Faster policy issuance

- Transparent pricing

- Easy comparison of plans

- No agent commissions included

- Simple renewal process

- Digital access to documents

These benefits make online insurance

purchase both convenient and cost-effective for most car owners.

Common

Mistakes to Avoid While Buying Car Insurance Online

Even though the process is simple,

buyers often make mistakes such as:

- Choosing lowest premium without checking coverage

- Selecting incorrect IDV

- Ignoring policy exclusions

- Forgetting to apply NCB

- Not reviewing add-on benefits

- Entering incorrect vehicle details

Avoiding these errors ensures a smooth

claim experience and better financial protection.

Conclusion

Buying car insurance online is

convenient, quick, and offers greater control over your coverage choices. By

following a step-by-step approach—checking IDV, selecting suitable add-ons,

verifying NCB, and comparing coverage—you can avoid common mistakes and choose

a policy that truly protects your vehicle and finances.

Instead of rushing through renewal

or new purchase, take time to evaluate your options and choose coverage that

suits your driving habits and car value. For buyers who want simplified

comparison and informed guidance while purchasing car insurance online, Square Insurance can help in identifying suitable plans and making confident

insurance decisions with clarity and ease.

Frequently

Asked questions

1.

Is it safe to buy car insurance online?

Yes, buying car insurance online is

safe when you use trusted platforms and secure payment methods.

2.

Can I buy car insurance online for a new car?

Yes, you can purchase insurance

online for new cars before registration or immediately after receiving the

registration number.

3.

Do I need physical documents after buying insurance online?

No, digital policy documents are

legally valid and accepted during traffic checks.

4.

Can I transfer No Claim Bonus when buying insurance online?

Yes, NCB is linked to the

policyholder, not the insurer, and can be transferred while switching policies.

5.

How long does it take to get policy after online payment?

In most cases, the policy is issued

instantly and sent to your email within minutes.

6.

Can I change add-ons after buying the policy online?

Add-ons usually cannot be changed

during the policy period and can be modified only at renewal.

7.

What should I do if I entered wrong details while buying online?

You should immediately contact

customer support to request policy correction before making any claim.