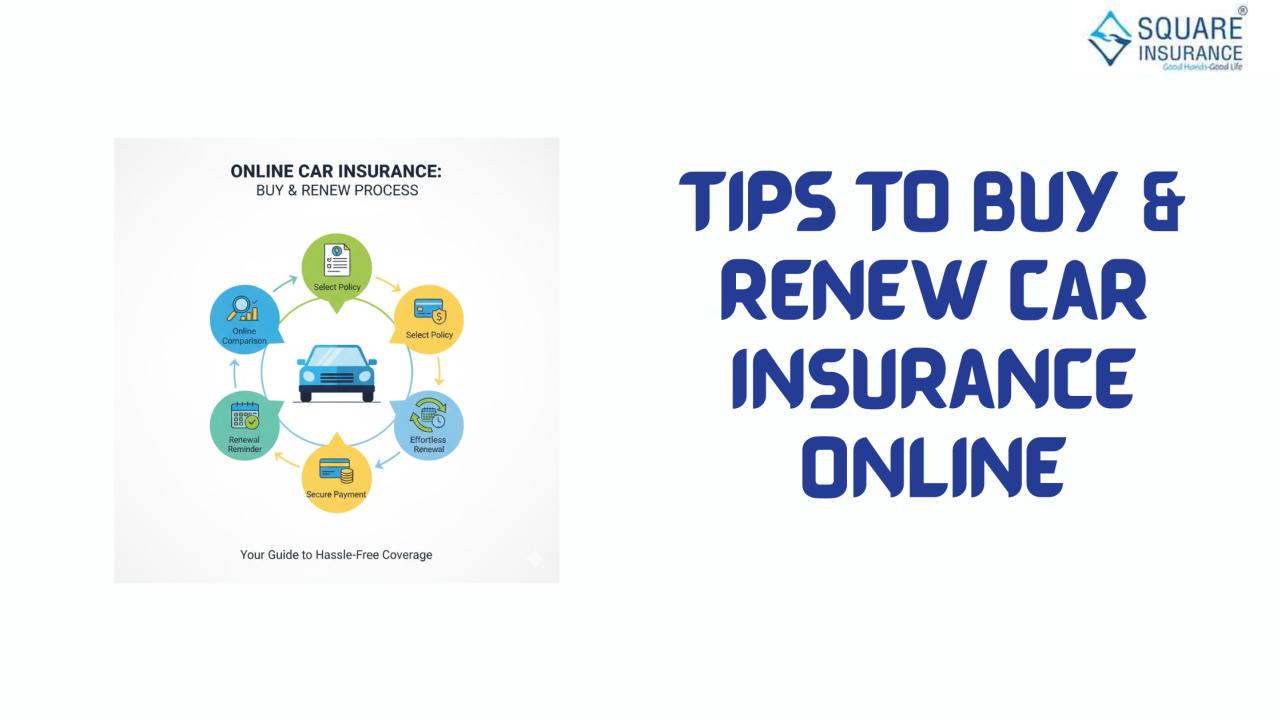

Car insurance is a necessary safeguard for your vehicle and finances. With more people turning to digital platforms, learning how to buy car insurance and renew it online has become simpler, faster, and more convenient. However, without proper guidance, it’s easy to make mistakes that could lead to higher costs or denied claims. This guide provides practical tips to help you navigate the process efficiently.

Why Choose Online Car Insurance?

Buying or renewing car insurance online offers several advantages over

traditional methods:

1. Convenience:

Complete the entire process from your home or office.

2. Time-Saving:

Avoid long queues and paperwork at physical offices.

3. Easy

Comparison: Quickly compare multiple policies, premiums, and coverage

options.

4. Instant

Issuance: Many insurers provide immediate policy documents.

5. Cost

Savings: Online platforms often provide discounts or lower premiums.

Tips for Buying Car Insurance Online

Purchasing car insurance online requires careful planning to ensure you get

the right coverage at the best price.

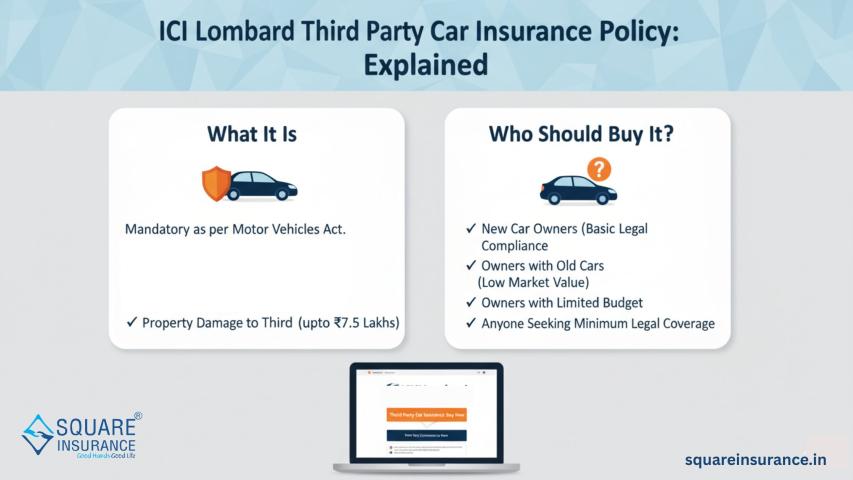

1. Determine the Right Coverage

Car insurance comes in two main types:

·

Third-Party Liability Insurance:

Covers damages to others in an accident. Mandatory in most regions.

·

Comprehensive Insurance: Covers

damages to your own car and third-party property, including theft, natural

disasters, and accidents.

Consider your vehicle’s age, usage, and personal budget before deciding

which type suits you best.

2. Compare Policies

Don’t settle for the first policy you see. Online comparison tools allow you

to review:

·

Premium costs

·

Coverage limits

·

Add-ons like roadside assistance or zero

depreciation

·

Claim settlement ratios

Choosing a provider with a good claim history ensures smoother claims when

needed.

3. Review Inclusions and Exclusions

Every policy has what it covers (inclusions) and what it doesn’t

(exclusions). Common exclusions include:

·

Driving under the influence

·

Unauthorized vehicle modifications

·

Commercial use without prior notice

Carefully reading the policy ensures there are no surprises later.

4. Use Online Discounts

Many insurers offer online-only discounts for buying or renewing policies.

Examples include:

·

Cashback offers

·

No-claim bonus benefits

·

Free add-ons for a limited period

Check the terms and conditions to maximize your savings.

5. Provide Accurate Information

Mistakes in vehicle details or personal information can lead to claim

rejection. Double-check:

·

Vehicle registration number

·

Make and model

·

Year of manufacture

·

Personal contact information

6. Keep Documents Ready

Having the necessary documents handy makes the process smooth:

·

Vehicle Registration Certificate (RC)

·

Driver’s license

·

Previous insurance policy (for renewals)

·

No-claim bonus certificate (if applicable)

7. Understand Premium Factors

Car insurance premiums depend on:

·

Vehicle age and model

·

Location

·

Past claim history

·

Coverage type and add-ons

Understanding this helps you select a policy that balances protection and

cost.

Tips for Renewing Car Insurance Online

Renewing your car insurance online is often simpler than buying a new

policy, but certain steps ensure you don’t face coverage gaps or higher

premiums.

1. Renew Early

Start the renewal process 15–30 days before your policy expires. Early

renewal helps:

·

Avoid lapses in coverage

·

Retain your no-claim bonus

·

Access better offers

2. Review Your Existing Policy

Check your current policy before renewing:

·

Are the coverage limits sufficient?

·

Do you need additional add-ons?

·

Has the vehicle’s value changed significantly?

Adjust coverage if necessary to match your current needs.

3. Compare Renewal Offers

Even if you’re happy with your current insurer, online comparisons can

reveal better rates or new add-ons. Many insurers provide loyalty benefits for

online renewals.

4. Make Online Payment

Digital payments are fast and secure. Most insurers confirm policy renewal

instantly through:

·

Net banking

·

UPI

·

Credit/debit cards

·

Digital wallets

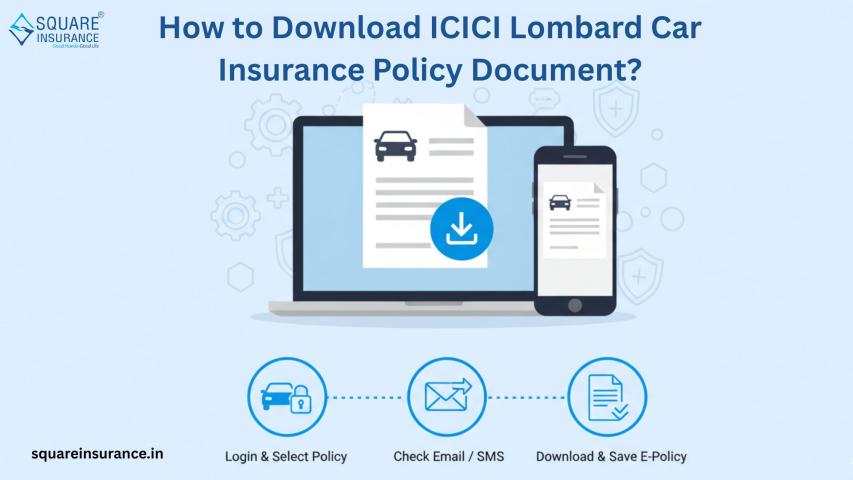

5. Download Your E-Policy

Once renewed, download your digital policy and keep it accessible. Most

platforms also allow email delivery for convenience during emergencies or

roadside checks.

Conclusion

Buying and renewing car insurance online is convenient, efficient, and often

more cost-effective. By carefully evaluating your coverage needs, comparing

policies, reading the fine print, and taking advantage of online discounts, you

can secure the best protection for your vehicle. Platforms like Square Insurance make this process seamless, offering easy purchase, renewal,

and policy management all in one place.

Frequently Asked Questions

1. Can I renew my car insurance after it expires?

Yes, most insurers allow renewal within a grace period (usually 30 days), but

delays may increase premiums and cause coverage gaps.

2. Are online car insurance policies valid legally?

Yes, digital policies issued by licensed insurers are fully legal and

recognized by authorities.

3. What documents are required for online renewal?

Vehicle RC, driver’s license, previous policy, and no-claim bonus certificate

(if applicable).

4. Can I add optional covers during online renewal?

Yes, add-ons such as zero depreciation, roadside assistance, and personal

accident coverage can be added.

5. How do I ensure my policy provides adequate coverage?

Review your vehicle’s value, usage patterns, and potential risks to select the

right type and amount of coverage.