Buying car insurance is a critical step for every vehicle owner. It not only

fulfills legal requirements but also safeguards your car and finances against

accidents, theft, and other unforeseen events. However, choosing the right

policy can be overwhelming due to the variety of insurers, coverage options,

and add-ons available. Following a systematic approach ensures you select the

best policy for your needs while avoiding unnecessary costs or gaps in

coverage.

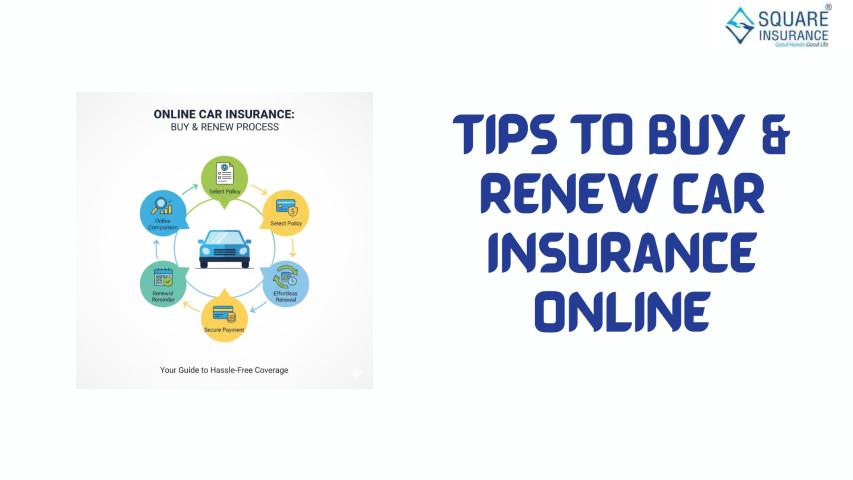

This guide outlines the top 10 steps to follow while buying car insurance to make

the process smooth, informed, and secure.

1. Assess Your Coverage Needs

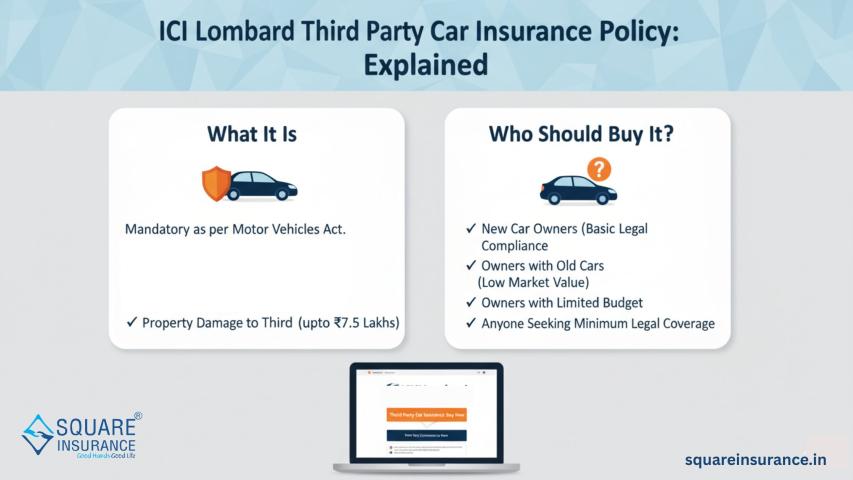

Before buying car insurance, determine what type of coverage suits you best.

Car insurance policies generally fall into two categories:

·

Third-Party Liability Insurance:

Covers damages to other vehicles, property, or individuals in an accident. It

is the minimum legal requirement in most countries.

·

Comprehensive Insurance: Covers

both your own vehicle and third-party liabilities. It may also include coverage

for natural disasters, theft, and vandalism.

Evaluate your car’s age, usage frequency, and personal risk tolerance to

decide which policy type aligns with your needs.

2. Research and Compare Insurers

Not all car insurance providers offer the same benefits, claim process, or

customer service quality. Research multiple insurers and compare:

·

Premium costs

·

Coverage limits

·

Add-on options

·

Claim settlement ratio

·

Customer support ratings

Choosing a reliable insurer ensures faster claim processing and reduces the

likelihood of disputes during emergencies.

3. Check Policy Inclusions and Exclusions

Every insurance policy comes with inclusions (what is covered) and exclusions

(what is not covered). Common inclusions are accident coverage, theft, and fire

damages, while exclusions may include:

·

Driving under the influence

·

Unauthorized modifications

·

Using the car for commercial purposes without

prior declaration

Understanding these details prevents surprises during claims and helps you

choose additional coverage if needed.

4. Consider Optional Add-on Covers

Add-ons enhance the protection offered by your base policy. Common car

insurance add-ons include:

·

Zero Depreciation Cover

·

Engine and Gearbox Protection

·

Return to Invoice Cover

·

Roadside Assistance

·

Tyre and Consumables Cover

Select add-ons based on your car’s age, value, and your personal

requirements. While they may increase premiums, the long-term benefits often

outweigh the cost.

5. Verify Premium Calculation Factors

Car insurance premiums are influenced by multiple factors:

·

Vehicle age and model

·

Geographic location

·

Past claim history

·

Chosen coverage and add-ons

·

No Claim Bonus (NCB) eligibility

Understanding these factors helps you anticipate the cost and identify ways

to reduce premiums, such as choosing a higher deductible or maintaining a clean

driving record.

6. Gather Necessary Documents

Having all required documents ready simplifies the application process.

Typically, you will need:

·

Vehicle Registration Certificate (RC)

·

Driver’s license

·

Previous insurance policy (for renewals)

·

No Claim Bonus proof (if applicable)

Accurate documentation prevents delays and ensures your policy is issued

without complications.

7. Evaluate Discounts and Offers

Many insurers provide discounts for online purchases, loyal customers, or

claim-free records. Some common discounts include:

·

No Claim Bonus (NCB)

·

Digital policy purchase discounts

·

Multi-car or family policies

Compare available offers and ensure you meet eligibility requirements before

finalizing your policy.

8. Review Policy Terms Carefully

Before completing the purchase, carefully review your policy documents,

including:

·

Sum insured and coverage limits

·

Deductibles or voluntary excess

·

Renewal terms

·

Add-on details

Confirm that all information is accurate, as mistakes or omissions may

affect claim approvals in the future.

9. Make Secure Payment

Choose a secure and reliable payment method when purchasing car insurance

online. Most insurers accept:

·

Net banking

·

Credit/Debit cards

·

UPI

·

Digital wallets

Ensure you receive a payment confirmation and keep proof of payment for

records.

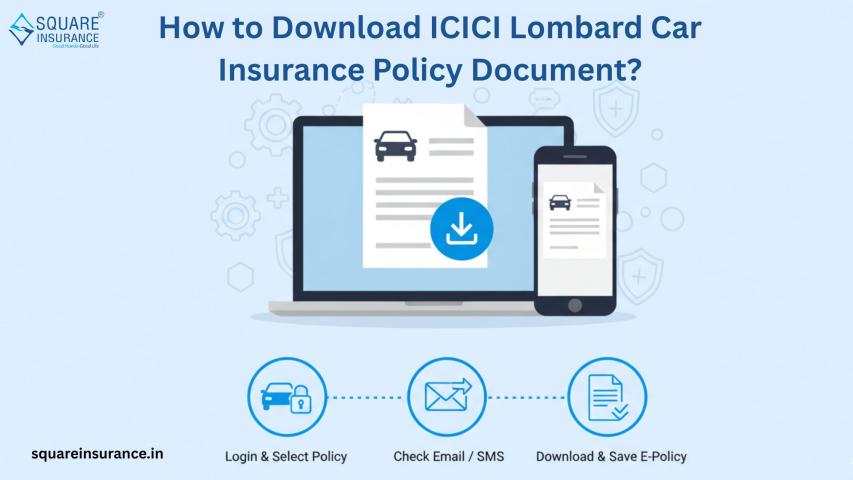

10. Download and Store Your E-Policy

Once your payment is processed, download your electronic insurance

policy (e-policy). Store it safely on your device or cloud storage and

keep a printed copy in your vehicle if needed. The e-policy is legally valid

and can be used for claims, roadside inspections, or verification purposes.

Conclusion

Buying car insurance doesn’t have to be complicated. By following these top 10 steps,

you can select the right coverage, minimize financial risks, and enjoy peace of

mind while driving. From assessing your coverage needs to comparing insurers,

understanding policy terms, and choosing relevant add-ons, a structured

approach ensures a smooth and efficient process. Platforms like Square Insurance simplify online car insurance purchases, offering a seamless

experience with transparent pricing, customizable add-ons, and instant e-policy

issuance.

Frequently Asked Questions

1. What documents are required to buy car insurance?

Vehicle Registration Certificate (RC), driver’s license, previous insurance

(for renewals), and proof of No Claim Bonus if applicable.

2. Can I buy car insurance online instantly?

Yes, most platforms allow instant online purchase and policy issuance after

document verification and payment.

3. Are add-on covers necessary?

Add-ons are optional but recommended for additional protection, especially for

new, high-value, or frequently used vehicles.

4. How is car insurance premium calculated?

Premiums are based on factors such as vehicle age, model, location, coverage

type, past claim history, and add-ons.

5. Is an e-policy legally valid?

Yes, electronic insurance policies issued by licensed insurers are fully legal

and recognized by authorities.