Motor insurance, commonly known as car insurance, is more than just a legal formality. It is a financial safeguard that protects you from sudden expenses caused by accidents, theft, or damage to your vehicle. However, many people buy or renew their car insurance policies without clearly understanding what is included and what is not. This often leads to confusion and disappointment during claim time.

To help you make better decisions, here are five essential things you should know about car insurance before choosing or renewing your policy.

1. Understanding the Right Type of Coverage Is

Crucial

Motor insurance policies mainly come in two

forms:

Third-Party

Insurance

This is the minimum insurance required by law. It covers injury, death, or

property damage caused to another person. However, it does not cover damage to

your own vehicle or theft.

Comprehensive

Insurance

This policy includes third-party coverage along with protection for your own

vehicle against accidents, fire, theft, and natural or man-made disasters.

Choosing only third-party insurance may seem

cheaper, but it can become costly if your own vehicle gets damaged. For better

overall protection, comprehensive insurance is usually the safer choice,

especially for newer or high-value vehicles.

2. Add-On Covers Provide Extra Protection

When You Need It Most

Add-ons are optional benefits that can be

added to your comprehensive policy for wider coverage. Though they increase the

premium slightly, they can significantly reduce your expenses during repairs.

Some commonly chosen add-ons include:

·

Zero

Depreciation Cover: Ensures full claim amount without depreciation

deduction on parts.

·

Engine

Protect Cover: Covers engine damage due to waterlogging or oil

leakage.

·

Roadside

Assistance: Helps in case of breakdown, towing, or minor repairs.

·

Return to

Invoice Cover: Pays the original purchase price if the vehicle is

stolen or totally damaged.

Selecting add-ons based on your driving

conditions and vehicle age can offer strong financial protection during

emergencies.

3. Several Factors Decide How Much Premium

You Pay

Motor insurance premiums are calculated based

on risk-related factors such as:

·

Vehicle make, model, and age

·

Engine capacity and fuel type

·

City of registration

·

Claim history

·

Selected add-ons

·

Insured Declared Value (IDV)

IDV is the maximum amount you will receive if

your vehicle is stolen or declared a total loss. A higher IDV increases

premium, while a lower IDV reduces both premium and claim amount.

It is important to select a realistic IDV that

balances premium savings and adequate compensation.

4. No Claim Bonus Can Help You Save Every

Year

If you do not make any claim during your

policy period, you become eligible for a No

Claim Bonus (NCB). This bonus is given as a discount on your next

year’s premium and increases with each claim-free year.

Key points about NCB:

·

It belongs to the policyholder, not the vehicle

·

It can be transferred when you buy a new car

·

It is lost if you make a claim

Avoiding small claims can help you preserve

your NCB and reduce your premium significantly over time.

5. Claim Process and Policy Conditions Should

Never Be Ignored

Many people focus only on premium while buying

insurance, but claim experience depends on policy terms and service process.

Before purchasing, check:

·

Availability of cashless garages

·

Claim reporting time limits

·

Required documents

·

Policy exclusions such as drunk driving or

delayed reporting

Following proper claim procedures and keeping

documents ready helps in faster settlement and avoids rejection due to technical

reasons.

Conclusion

Motor insurance plays an important role in

protecting both your vehicle and your finances. By understanding coverage

types, selecting useful add-ons, maintaining a good claim record, choosing the

right IDV, and knowing the claim process, you can avoid common mistakes and

enjoy better protection.

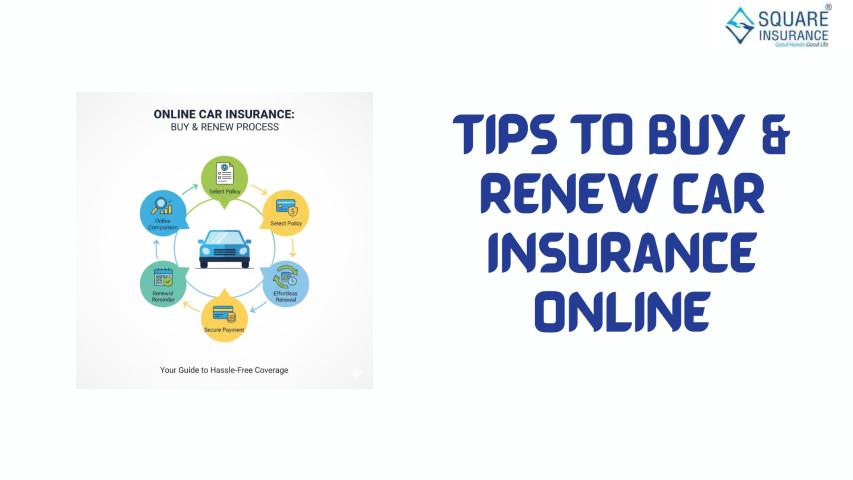

With platforms like Square Insurance, vehicle owners can compare policies

easily, understand coverage clearly, and choose plans that match their budget

and protection needs. Making informed insurance decisions today can save you

from major financial stress tomorrow.

1. Is

motor insurance mandatory in India?

Yes, third-party motor insurance is legally required for all vehicles on Indian

roads.

2. Which

motor insurance is better: third-party or comprehensive?

Comprehensive insurance offers wider protection, including damage to your own

vehicle, making it more suitable for most vehicle owners.

3. What

is IDV in motor insurance?

IDV is the maximum amount payable by the insurer if your vehicle is stolen or

completely damaged.

4. Can I

keep my No Claim Bonus when changing my car?

Yes, NCB can be transferred to your new vehicle as it belongs to the

policyholder.

5. Do

add-ons really make a difference in claims?

Yes, add-ons like zero depreciation and engine protect can significantly

increase claim payouts and reduce repair costs.