Insurance plays a vital role in financial protection by safeguarding individuals and families from unexpected events such as medical emergencies, accidents, disability, or the loss of an earning member. Life,..

Corporate leaders often focus their attention on revenue growth, innovation, and operational efficiency, but one of the most underestimated pillars of sustainable success is insurance. Far from being a mere..

Launching a startup means navigating uncertainty, tight budgets, and constant pressure to grow. Amid the hustle of product development, hiring, and fundraising, insurance is often overlooked—until it's too late.Risk Is..

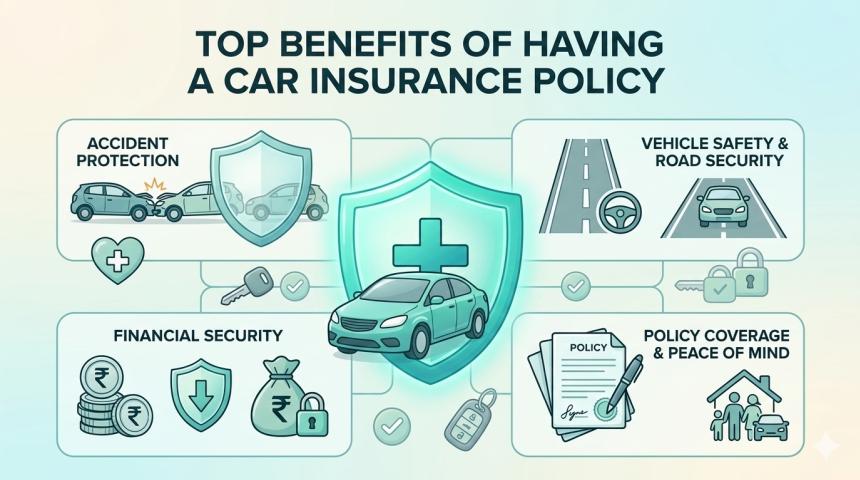

Owning a car is a significant

financial investment that offers comfort, convenience, and mobility in daily

life. However, vehicle ownership also comes with several risks such as road

accidents, theft,..

Car insurance is an

essential part of owning a vehicle. It protects you from financial loss caused

by accidents, theft, natural disasters, and other unexpected situations. In

India, having at..

Buying car insurance is not just

about fulfilling a legal requirement—it is about protecting your financial

stability. With increasing traffic density, rising repair costs, and

unpredictable weather conditions in India,..

Car ownership in India continues to grow rapidly in 2026, driven by rising

incomes, improved road infrastructure, and easier financing options. However,

owning a vehicle also brings legal and financial..

AI-powered insurance compliance software is redefining how insurers manage regulatory complexity while preserving customer trust. By automating compliance monitoring, policy validations, documentation checks, and audit trails, AI-driven systems reduce manual..

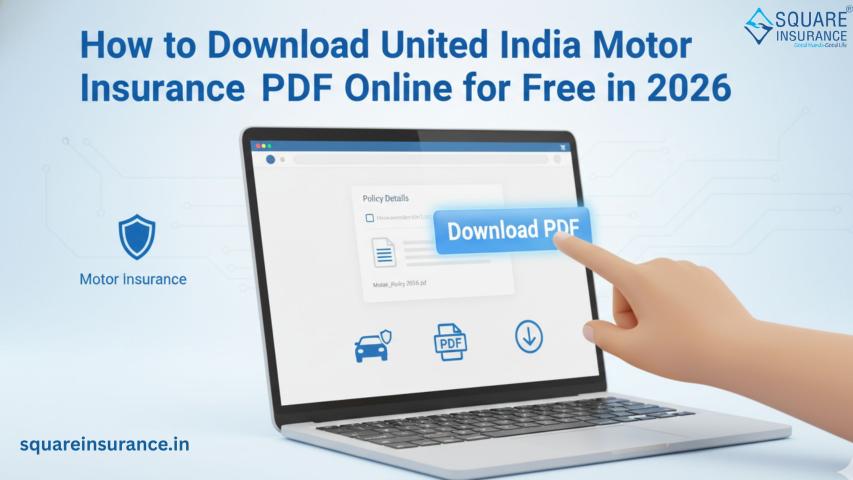

In today’s digital age, managing

insurance documents has become much easier than before. You no longer need to

depend only on printed papers or worry about losing your policy file...

IntroductionNo Claim Bonus (NCB) is one of the

most valuable benefits in car

insurance. It rewards policyholders with a discount on their renewal

premium for not making any claims during..

Total and Permanent Disability (TPD) insurance is designed to provide financial protection when an illness or injury prevents you from ever working again in your usual occupation or any suitable..

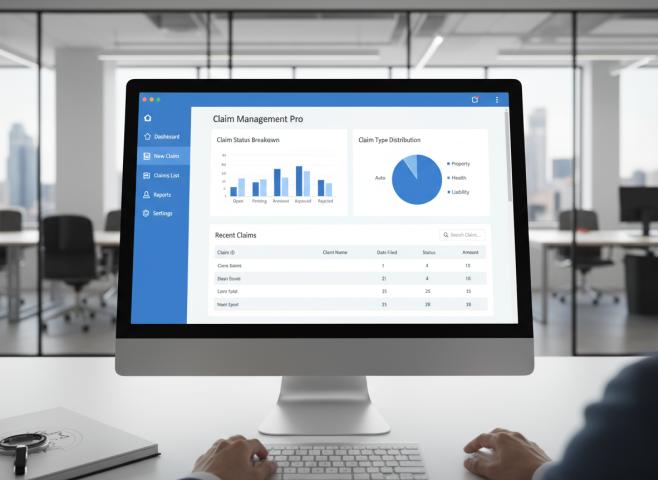

The claims process serves as the moment of truth between insurers and policyholders. Software powering this process must deliver operational efficiency and exceptional customer experiences. Companies that successfully implement the..

Regulatory compliance becomes seamless with built-in workflow checks. Insurance claims adjuster software maintains unalterable digital audit trails, documenting every decision and action taken during claims processing. This automatic documentation eliminates..

Claims processing success depends on customer trust. Policyholders expect clear explanations when filing claims, especially during stressful situations. Explainable AI insurance claims processing software delivers this transparency while maintaining processing..

Automation makes every claim processing step more efficient from the first notice of loss to final payment. The automated claims processing insurance solutions handle routine cases without human intervention. This..

The right claims automation solution delivers advantages that extend beyond basic efficiency improvements. Fraud detection capabilities in automated claims processing solutions improve significantly when advanced algorithms analyze claim patterns. Staff..

Insurance companies should approach claims automation as a strategic investment rather than just a technology upgrade. Those who assess their specific requirements before insurance claims processing automation solution implementation achieve..

Revolutionize payer operations with AI-powered healthcare claims management software that enhances claims accuracy, minimizes denials, and accelerates settlements — delivering a seamless experience for payers while reducing administrative burdens.Streamline claims..