Introduction

The Indian healthcare landscape is evolving rapidly, and so is the demand for medical insurance. With rising medical costs, life>

This article explores the key trends shaping the Indian health insurance sector, highlights the significant benefits of having a health cover, and recommends some of the best medical insurance plans available in 2025.

Why Medical Insurance Is More Crucial Than Ever

1. Skyrocketing Healthcare Costs

India has witnessed a significant surge in hospitalization and treatment expenses. Even a basic surgery or treatment for chronic illnesses like diabetes or hypertension can cost lakhs. Without insurance, such unexpected expenses can cripple a family’s finances.

2. Increasing Life>

Modern life>

3. Pandemic Lessons

COVID-19 exposed the healthcare vulnerabilities in Indian households. In 2025, families are more aware and proactive in protecting themselves from unforeseen health emergencies through robust insurance coverage.

Key Trends in Indian Medical Insurance (2025)

1. Rise of Digital Insurance

From comparing policies to claim settlement, everything is now digital. Insurtech companies and online aggregators offer easy-to-navigate platforms to buy and manage policies in minutes.

2. Customized & Modular Plans

Insurers now offer highly customizable policies. You can select base coverage and add riders like maternity cover, critical illness, or OPD benefits as per your family’s needs.

3. Cashless Network Expansion

Most insurers now provide cashless treatment at 10,000+ hospitals, even in Tier 2 and Tier 3 cities. This accessibility gives policyholders peace of mind during emergencies.

4. Wellness Rewards & Preventive Care

Modern plans reward you for staying healthy. Features like free annual check-ups, fitness tracking benefits, and discounts on premiums for healthy behavior are becoming common.

5. Portability & No-Claim Bonuses

Increased competition has improved customer benefits like policy portability and cumulative bonuses (up to 150%) for claim-free years.

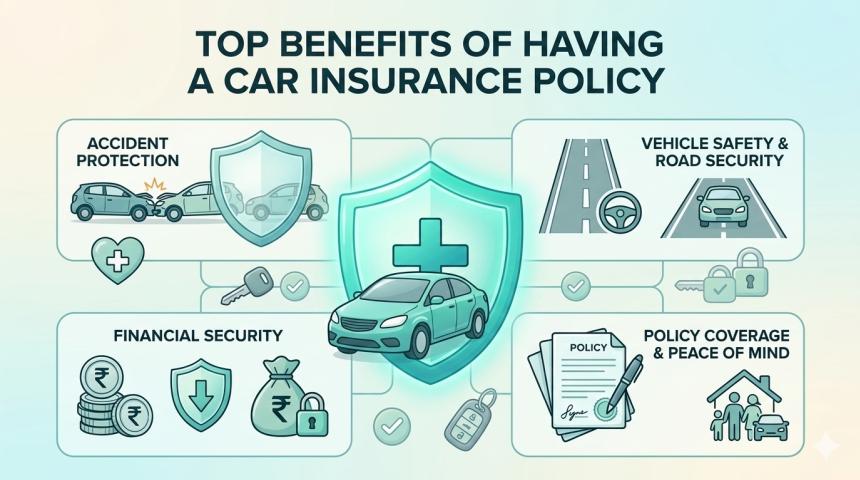

Benefits of Having a Family Health Insurance Plan

A family floater health insurance plan provides comprehensive coverage for all members under a single sum insured. Here's why it’s a smart investment:

1. Financial Security

Medical insurance cushions your savings against sudden medical expenses, allowing you to focus on treatment rather than money.

2. Tax Benefits

Under Section 80D of the Income Tax Act, you can claim deductions of up to ₹75,000 depending on the premium and age of the insured members.

3. Wide Coverage

Modern plans cover everything from hospitalization, daycare procedures, ambulance charges, AYUSH treatments to COVID-related treatments and more.

4. Cashless Facility

No need to arrange funds during hospitalization. Insurers settle bills directly with network hospitals.

5. Additional Perks

Add-ons like maternity cover, newborn cover, annual check-ups, organ donor cover, and mental health treatment are commonly available in top-tier plans.

How to Choose the Right Medical Insurance Plan in 2025

1. Assess Family Needs

Age of family members

Existing illnesses or health risks

Likely medical requirements (maternity, pediatric, senior care)

2. Coverage & Inclusions

Look for plans that cover:

Pre and post-hospitalization (minimum 60/90 days)

Daycare procedures

Organ transplant and mental health

Critical illness & alternative therapies (AYUSH)

3. Sum Insured

Given the rising medical inflation, opt for at least ₹10-20 lakhs coverage for a family of four. Consider top-up or super top-up plans for added protection.

4. Claim Settlement Ratio (CSR)

Choose insurers with a high CSR (above 90%) and a quick, hassle-free claim process.

5. Network Hospitals

Ensure your preferred hospitals are in the insurer’s cashless network, especially in your city.

Top Medical Insurance Plans for Families in India (2025)

Here are some of the best-rated plans offering comprehensive benefits, ideal for Indian families in 2025:

1. HDFC ERGO Optima Restore

- Sum insured up to ₹50 lakhs

- Automatic recharge of sum insured

- No room rent limits

- Good claim settlement experience

2. Niva Bupa ReAssure 2.0

- 100% restoration benefit

- Health check-up from Day 1

- Coverage for mental illness, HIV, etc.

3. TATA AIG MediCare Premier

- Coverage for organ donor, AYUSH, and maternity

- Global coverage for 50+ critical illnesses

- Preventive health check-ups

4. Care Health Insurance – Care Advantage

- Sum insured up to ₹6 crores

- 100% No Claim Bonus yearly

- COVID-19 & daycare procedures covered

5. ICICI Lombard Complete Health Insurance

- Wellness programs with rewards

- Optional maternity and newborn cover

- Fast cashless settlement

Mistakes to Avoid While Buying a Plan

Choosing Based on Premium Only: A low premium often means limited coverage. Focus on overall benefits and hidden costs.

Not Reading the Fine Print: Understand sub-limits, waiting periods, co-payments, and exclusions.

Skipping Add-Ons: Riders like maternity cover or critical illness can make a huge difference.

Delaying Purchase: Buy early when premiums are lower and waiting periods don’t affect you.

The Future of Medical Insurance in India

India’s health insurance penetration is increasing, but still under 40%. In 2025 and beyond, we expect:

AI-powered underwriting and claims

Fully digital policy onboarding and renewal

Greater focus on mental health and OPD care

Health + Life bundled insurance plans

These advancements will make medical insurance even more accessible, affordable, and user-friendly.

Conclusion

Medical insurance in 2025 is more than just a financial product—it’s an essential tool for family protection. With rising medical costs and increasing health risks, the importance of a comprehensive, reliable plan cannot be overstated.

Whether you’re buying your first policy or switching to a better one, always compare features, understand your needs, and invest in a plan that offers the best balance of coverage, claims support, and affordability.

Secure your family’s future today with a health insurance plan that truly cares—because when health is protected, peace of mind follows.