In today’s digital age, managing financial and insurance-related matters online has become not only convenient but also essential. For policyholders of the Life Insurance Corporation of India (LIC), the LIC Customer Portal Login provides a centralized platform to access all policy-related information quickly and securely. Whether you are a new policyholder or have multiple policies under your name, the portal offers a wide range of features designed to make insurance management simple, transparent, and efficient.

Understanding the benefits of the LIC Customer Portal Login can help policyholders fully leverage its capabilities and make insurance management less stressful. Here’s a detailed look at the top benefits of using this platform.

1. Secure Access to Personal Insurance Information

Security is one of the most important aspects when it comes to managing insurance online. The LIC Customer Portal Login ensures that all your personal and policy-related information is protected with advanced security measures. Each login is authenticated, and sensitive data such as premium payments, policy numbers, and personal details are stored securely.

This secure environment gives policyholders peace of mind, knowing that their information is protected from unauthorized access or misuse. Unlike physical documents that can be lost or misplaced, the online portal keeps everything safe and readily available whenever needed.

2. Easy and Convenient Login Anytime, Anywhere

The LIC Customer Portal is designed to be user-friendly, allowing policyholders to access their accounts at any time and from anywhere. Whether you are at home, traveling, or at work, you can log in with your credentials and manage your policies.

This flexibility eliminates the need to visit an LIC branch for basic tasks, saving both time and effort. With internet access, everything from checking policy status to updating contact details can be done in just a few clicks.

3. Quick Access to Policy Details

One of the key advantages of the LIC Customer Portal Login is instant access to policy information. Policyholders can view details such as:

- Policy number and type

- Premium amounts and due dates

- Policy maturity or end dates

- Nominee details

- Policy status and payment history

Having all this information in one place ensures that you are always aware of your policy’s status and can take necessary actions promptly. It also reduces the likelihood of missed payments or confusion regarding policy terms.

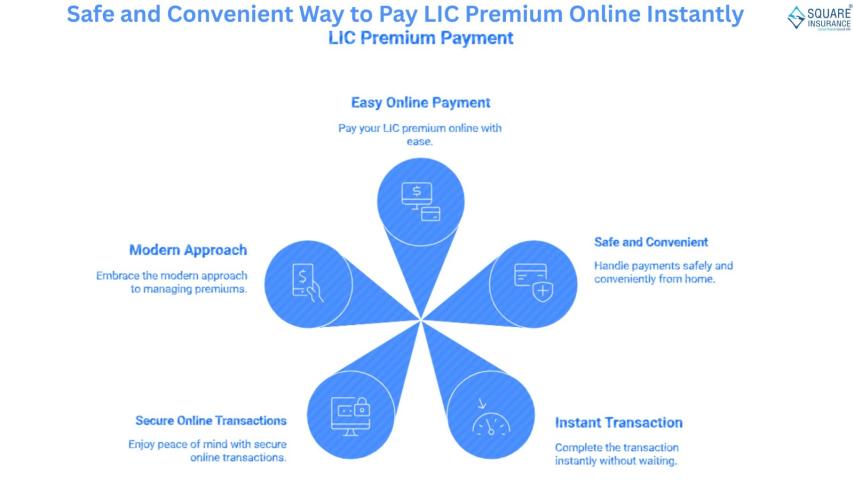

4. Hassle-Free Premium Payments

Making premium payments has never been easier. Through the LIC Customer Portal Login, policyholders can pay premiums online without the need to visit a branch. The portal often provides multiple payment options, allowing flexibility to choose what suits you best.

Payments made online are updated immediately, and digital receipts are generated instantly. This eliminates the risk of losing payment proofs or having to wait for confirmation. It also simplifies record-keeping for future reference.

5. Timely Reminders and Notifications

Managing insurance policies can sometimes be challenging, especially if you have multiple policies with different due dates. The LIC Customer Portal Login provides timely reminders and notifications about upcoming premium payments, policy renewals, or changes in policy terms.

These reminders help policyholders stay organized and avoid lapses in their coverage. Being notified in advance ensures that you never miss an important deadline and can plan your finances accordingly.

6. Digital Policy Documents

Another major benefit of using the portal is the access to digital policy documents. Policyholders no longer have to rely solely on physical copies, which can be misplaced or damaged. Through the portal, you can download, print, or store your policy documents digitally for easy access whenever required.

This not only makes it convenient to share documents when needed but also promotes a paperless approach, which is environmentally friendly and reduces clutter at home.

7. Easy Updates and Personal Information Management

The LIC Customer Portal Login allows policyholders to update their personal information easily. Changes such as address, contact number, email ID, or nominee details can be updated online without visiting a branch.

Keeping your information up to date is crucial to ensure smooth communication from LIC and avoid issues during claim processing or premium reminders. The portal makes this process simple and hassle-free.

8. Transparency and Real-Time Status Tracking

Transparency is a critical aspect of any financial service. Through the LIC Customer Portal Login, policyholders can check the real-time status of their premiums, policy terms, and maturity benefits.

This feature eliminates ambiguity and helps you make informed decisions regarding your insurance policies. Knowing exactly where your policy stands at any given time gives a sense of control and confidence in managing your financial planning.

9. Accessible Support and Help Features

While the LIC Customer Portal is designed to be intuitive, it also provides support features for policyholders who may face difficulties or have questions. Whether it’s guidance on premium payment, accessing policy documents, or understanding policy details, the portal often provides instructions, FAQs, or support contact options.

This ensures that policyholders have assistance readily available whenever needed, making the entire experience smoother and less stressful.

10. Saves Time and Effort

Before digital portals, policyholders had to visit LIC branches for almost every task, from premium payments to document verification. This process often required waiting in queues, filling forms manually, and spending significant time.

With the LIC Customer Portal Login, all these tasks can be accomplished online, saving time and reducing effort. Policyholders can manage multiple policies quickly and efficiently without leaving their home or office.

11. Ideal for Multiple Policy Management

Many people hold more than one LIC policy, which can make management complicated. The LIC Customer Portal Login consolidates all your policies in one place, allowing you to view and manage them easily.

You can track premium payments, maturity dates, and policy details for multiple policies in a single dashboard. This centralization simplifies the process and reduces the chances of overlooking any policy obligations.

12. Enhances Financial Planning

Insurance policies are an essential part of financial planning, and having easy access to policy information can help policyholders plan better. Through the portal, you can track investments, maturity amounts, and premium obligations, making it easier to align your insurance policies with your financial goals.

This insight allows you to make informed decisions about renewing, upgrading, or modifying your policies in a timely manner.

FAQs: Frequently Asked Questions

Q1. What is the LIC Customer Portal Login?

The LIC Customer Portal Login is an online platform provided by LIC that allows policyholders to access their insurance policies, pay premiums, download documents, and manage their accounts securely and conveniently.

Q2. Who can use the LIC Customer Portal?

Any LIC policyholder with a registered policy can use the portal. You need to have your policy details and register for an account to access the portal.

Q3. How do I register for the LIC Customer Portal?

To register, visit the LIC customer portal and select the “New User Registration” option. You will need to provide your policy number, personal details, and contact information. After verification, you can create a username and password to log in.

Q4. Is the LIC Customer Portal Login secure?

Yes, the portal uses secure login and encryption methods to protect your personal and financial information. Policyholders’ data is kept confidential and safe from unauthorized access.

Q5. Can I access the LIC Customer Portal on my mobile device?

Yes, the portal is mobile-friendly and can be accessed via any device with an internet browser. Some features may also be available through LIC mobile applications.

Conclusion

The LIC Customer Portal Login is more than just a digital platform—it is a comprehensive tool designed to make insurance management secure, easy, and convenient. From real-time access to policy information and digital premium payments to timely notifications and secure storage of documents, the portal offers numerous advantages for policyholders.

By using this portal regularly, policyholders can save time, avoid errors, stay organized, and gain greater control over their insurance management. In a world where convenience and security are paramount, the LIC Customer Portal Login provides a reliable solution that meets the needs of modern policyholders, ensuring a smooth and hassle-free insurance experience.