Introduction

Buying car insurance is no longer just a legal formality—it is an essential step toward safeguarding your vehicle and financial well-being. With countless car insurance providers, policy formats, add-ons, and premium options available in the market, choosing the right plan can feel overwhelming. Whether you are a new vehicle owner or renewing an old policy, a structured approach ensures you make an informed decision that offers the best protection. Understanding how car insurance works and what factors to consider can help you select a policy that truly meets your needs.

Step

1: Understand the Types of Car Insurance Policies

Before purchasing a policy, you must

understand the two primary types of car insurance available:

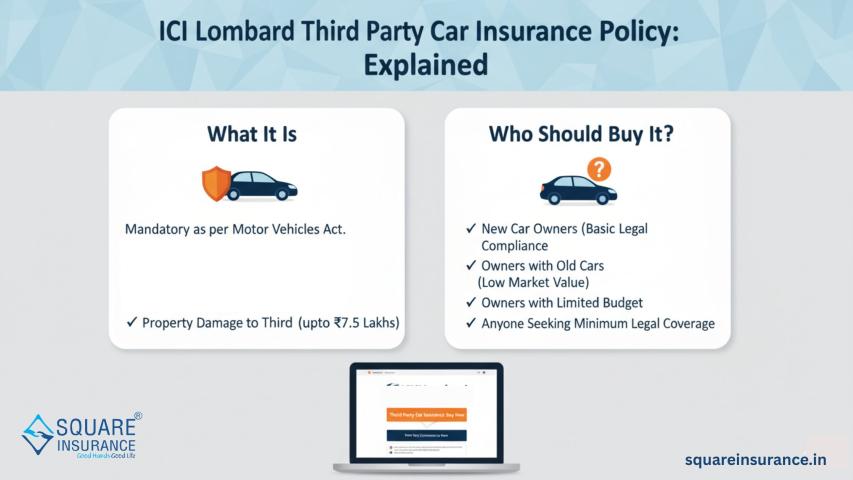

1.

Third-Party Car Insurance

This covers damage caused to a third

party, including:

- Injury or death of a third party

- Third-party property damage

It is mandatory by law, but it does

not protect your own vehicle.

2.

Comprehensive Car Insurance

This policy offers broader

protection, including:

- Third-party liabilities

- Own damage coverage

- Theft, fire, natural calamities, man-made disasters

- Additional customization through add-on covers

For better personal and financial

safety, comprehensive insurance is the preferred choice.

Step

2: Evaluate Your Coverage Requirements

The right insurance depends on your

vehicle type, usage, and risk factors. Analyze the following points:

- How old is your vehicle?

- Do you live in a theft-prone or flood-prone area?

- Do you travel long distances frequently?

- Do you want full security or only basic mandatory

coverage?

This evaluation helps you decide

whether you need a simple policy or a more detailed coverage plan with add-ons.

Step

3: Check the Insured Declared Value (IDV)

IDV is the current market value of

your car and determines the amount you receive during total loss or theft. A

higher IDV gives better protection but increases the premium.

Make sure your IDV is neither:

- Too low (cheaper premium but insufficient claim amount)

- Nor too high (unnecessarily expensive)

Choose a balanced IDV that reflects

the actual market value of your vehicle.

Step

4: Select Essential Add-On Covers

Add-on riders enhance your policy

and protect against situations not covered under standard insurance. Some

recommended add-ons include:

- Zero Depreciation Cover – Ensures depreciation isn’t deducted during claims.

- Engine Protect Cover – Covers engine and gearbox damages.

- Roadside Assistance Cover – Helps during breakdowns.

- Key Replacement Cover – Covers lost or damaged keys.

- Consumables Cover – Includes oils, nuts, bolts, and other consumables.

- Return to Invoice Cover – Helps if your vehicle is stolen or declared a total

loss.

Choose add-ons based on usage, risk

factors, and vehicle category.

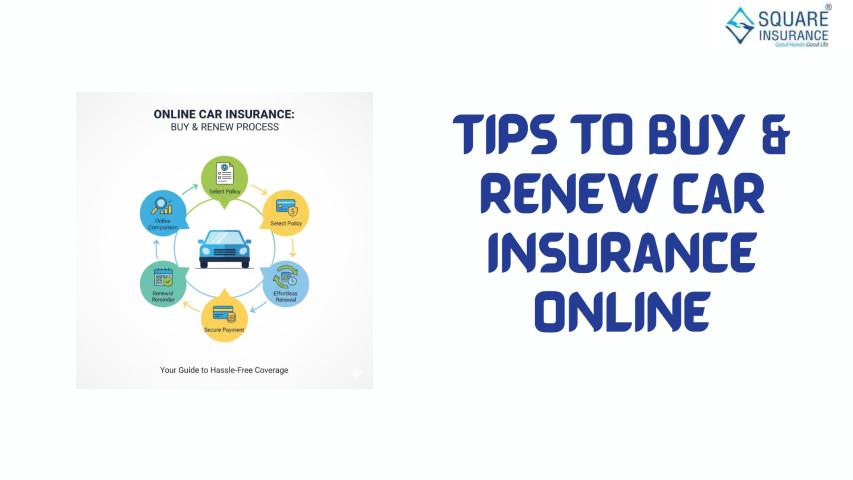

Step

5: Compare Multiple Car Insurance Plans

Never purchase a policy without

comparing. Evaluate insurers based on factors like:

- Coverage offered

- Premium cost

- Network garage availability

- Claim Settlement Ratio

- Customer reviews

- Additional benefits

Comparison ensures better value for

money and helps identify plans tailored to your requirements.

Step

6: Check Cashless Garage Network

A strong network of cashless garages

is crucial for effortless claims. When your car needs repairs, you can visit a

partner garage where the insurer directly settles the bill.

Things to check:

- Availability of network garages in your city

- Proximity to your home or workplace

- Quality and reputation of partner garages

A wider network ensures convenience

during emergencies.

Step

7: Understand Policy Exclusions Carefully

Understanding what is not covered

is equally important as knowing what is covered. Common exclusions include:

- Driving without a valid license

- Drunk driving

- Mechanical/electrical breakdowns without add-ons

- Regular wear and tear

- Damages outside geographical limits

- Unauthorized modifications

- Commercial usage (unless specified)

Knowing exclusions helps prevent

surprises during claim filing.

Step

8: Calculate the Premium Correctly

Premium depends on several factors:

- Vehicle model and age

- Fuel type

- Engine capacity

- City of registration

- Add-ons selected

- No Claim Bonus

- Driver’s age and driving history

Use premium calculators to get

accurate quotes and adjust add-ons or IDV as needed.

Step

9: Verify No Claim Bonus (NCB) Benefits

If you have not filed a claim in the

previous policy year, you become eligible for a No Claim Bonus. NCB can reduce

your premium by 20% to 50%.

Keep these points in mind:

- NCB applies only for claim-free years

- It can be transferred if you switch insurers

- One claim may reduce NCB unless you opt for NCB

protection cover

NCB helps keep long-term premiums

low.

Step

10: Read the Policy Documents Thoroughly

Before finalizing your insurance

purchase, review the policy wordings clearly. Make sure you understand:

- Coverage terms

- Add-on details

- Claim procedure

- Exclusions

- Renewal guidelines

- Deductibles and liabilities

A careful review prevents

misunderstandings later.

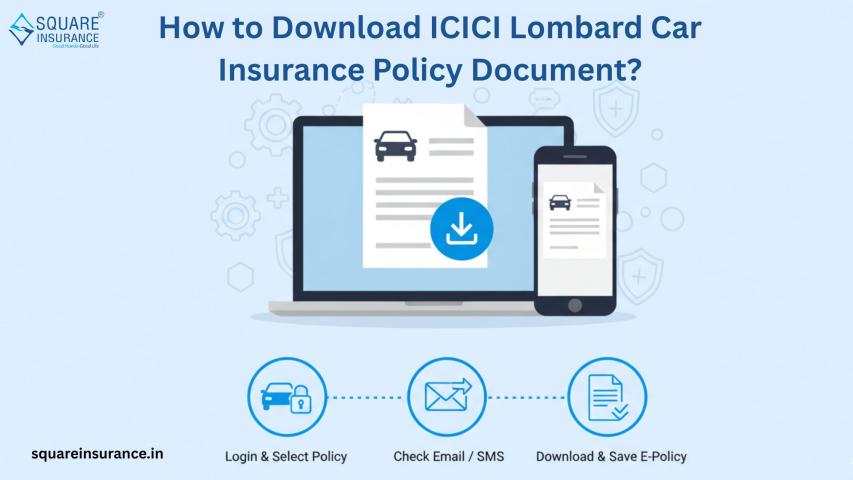

Step

11: Proceed with the Purchase Online

Purchasing car insurance online is

fast, secure, and transparent. Benefits include:

- Instant policy issuance

- Zero paperwork

- Easy comparison

- Quick premium payment

- Secure digital documentation

You will receive your policy copy

instantly in your email.

Step

12: Keep Necessary Documents Ready for Claims

Ensure you have:

- Policy document

- Registration certificate (RC)

- Driving license

- FIR (if required)

- Repair bills

- Photographs of the damage

Having these documents makes the

claim process smoother and faster.

Conclusion

Buying car insurance becomes simple

and stress-free when you follow the right steps and make well-informed

decisions. From analyzing your coverage needs to selecting add-ons, comparing

policies, evaluating IDV, and reading terms carefully—each step contributes to

securing a policy that offers the best protection for your vehicle. A

well-chosen insurance plan not only meets legal requirements but also shields

you from unexpected financial burdens.

If you want a reliable and

customer-focused platform to explore car insurance policies and add-ons, Square Insurance offers transparent, affordable, and comprehensive solutions

tailored to every car owner’s needs.

Frequently

Asked Questions

1.

Which type of car insurance is best for new cars?

Comprehensive car insurance with

important add-ons like zero depreciation and engine protection is ideal for new

cars.

2.

Is buying car insurance online safe?

Yes, online insurance buying is

secure, quick, and offers better transparency and pricing.

3.

How much IDV should I choose?

Select an IDV close to your car’s

current market value to balance premium and claim benefits.

4.

Can I switch insurers during renewal?

Yes, you can switch insurers anytime

during renewal without losing your No Claim Bonus.

5.

Is NCB available for third-party insurance?

No, No Claim Bonus is applicable

only on comprehensive and standalone own-damage policies.