- Managing insurance policies has become much easier over the years, thanks to digital platforms designed to give policyholders faster access to their information. The LIC Customer Portal is one such platform that helps users manage their policies without needing to visit a branch or rely on paperwork. With just a few clicks, policyholders can check details, make payments, download statements, and track important updates.

The portal is designed to be simple and user-friendly, which makes the login process easy even for those who are not very familiar with online systems. Once policyholders complete the LIC Customer Portal Login, they gain access to several helpful features that save time, offer convenience, and improve overall policy management.

In this article, we explore the top 10 benefits of the LIC Customer Portal Login and how it helps policyholders stay organized and informed.

1. Easy Access to Policy Information

One of the biggest advantages of using the LIC Customer Portal Login is the ability to access all your policy details in one place. You do not need to search through physical documents or visit an office to get basic information. After logging in, you can instantly view:

- Policy numbers

- Policy status

- Premium due dates

- Policy type and term

- Sum assured

- Premium payment history

This quick access makes it easier for policyholders to stay updated and avoid missing important deadlines.

2. Online Premium Payment Facility

The portal allows users to pay their premiums online without any hassle. Instead of standing in long queues or visiting a branch, policyholders can complete payments from their home, office, or even while traveling. The online platform supports several payment methods, offering flexibility and convenience.

After payment, a receipt is automatically generated, which can be downloaded for personal records.

3. Check and Download Premium Statements

Financial documentation is essential for tax planning, maintaining records, and verifying payments. Through the LIC Customer Portal Login, customers can download:

- Premium paid statements

- Policy status reports

- Consolidated policy documents

These documents can be accessed anytime, which helps policyholders stay organized and maintain clear financial records.

4. Track Policy Claims and Requests

Another major benefit of the portal is the ability to track claims. Policyholders can check the status of their submitted claims, such as maturity claims or survival benefits, without needing to contact customer support. This reduces uncertainty and keeps the process transparent.

In addition, any service requests raised through the portal, such as updating details or requesting certificates, can be tracked easily.

5. Update Personal Information Easily

Keeping details updated is important for smooth communication, timely notifications, and error-free policy servicing. The LIC Customer Portal allows users to update:

- Mobile numbers

- Email addresses

- Communication preferences

- Certain editable personal details

This ensures that all future alerts and updates reach the policyholder without delays.

6. Manage Multiple Policies in One Account

Many customers hold more than one policy. Without a digital system, managing multiple policy documents can be confusing.

Through the LIC Customer Portal Login, users can add all their policies under one account. This helps them:

- Track everything from one dashboard

- Check upcoming due dates

- Review benefits and maturity dates

- Monitor premium schedules

This feature is especially helpful for families managing plans for multiple members.

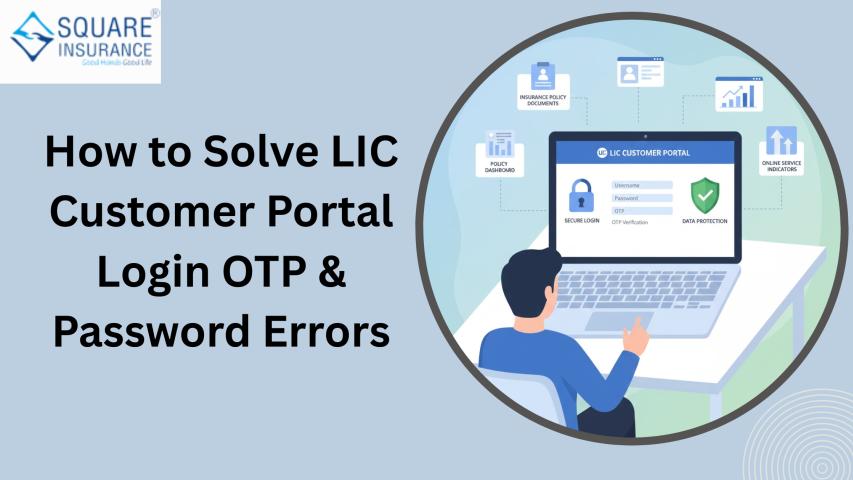

7. Secure Digital Platform for All Transactions

Security is a top priority when dealing with financial information. The portal uses secure login methods, encryption, and verification steps to protect sensitive data. This ensures that:

- Personal information stays confidential

- Payment details remain secure

- Unauthorized access is prevented

A secure digital environment gives policyholders confidence while managing their policies online.

8. Downloading Policy Documents and Forms

Instead of visiting an office to collect forms or waiting for documents to be delivered, policyholders can download various forms through the portal. These may include:

- Loan forms

- Policy servicing forms

- Maturity claim forms

- Nomination update forms

This saves time and makes the overall process more convenient.

9. Notifications and Alerts for Due Dates

Missing premium payments can lead to penalties or policy lapses. The LIC Customer Portal helps prevent this by sending timely reminders and alerts. After logging in, policyholders can view:

- Upcoming premium dues

- Grace periods

- Policy renewal reminders

- Important updates or announcements

This ensures that policyholders always stay informed and avoid missing important deadlines.

10. Convenient, Time-Saving, and User-Friendly

The overall user experience of the LIC Customer Portal makes it extremely beneficial. Instead of visiting a branch, waiting in line, or searching for documents, users can:

- Access information anytime

- Complete tasks within minutes

- Manage everything from one platform

Whether you want to review a policy, make a payment, download a statement, or submit a request, the portal makes every process quick and simple.

Why the LIC Customer Portal Matters

As more people rely on online platforms for banking, shopping, and communication, insurance services have also adapted to digital needs. The LIC Customer Portal reflects this shift by allowing policyholders to take control of their policy management.

- It helps users:

- Reduce dependence on physical documents

- Stay informed about policy updates

- Make payments without hassle

- Access services from anywhere

- Handle tasks independently

This level of convenience can greatly improve the overall experience for policyholders.

Also Read:-

Conclusion

The LIC Customer Portal Login offers a range of benefits that make policy management easier, faster, and more convenient. From accessing policy details and paying premiums online to downloading statements and updating personal information, the portal simplifies every step. It also enhances transparency, improves data security, and helps users manage multiple policies from one account.

For policyholders who want a smooth and organized experience, the customer portal is a valuable tool. With its digital features and user-friendly design, managing insurance becomes more efficient and accessible for everyone.

Note:- With Square Insurance – Buy & Renew, managing your insurance becomes faster, easier, and completely hassle-free.