Every business and household operates within a financial structure built on two fundamental concepts: assets and liabilities. Knowing how to distinguish between them—and how they interact—can make the difference between long-term stability and financial distress.

What Are Assets?

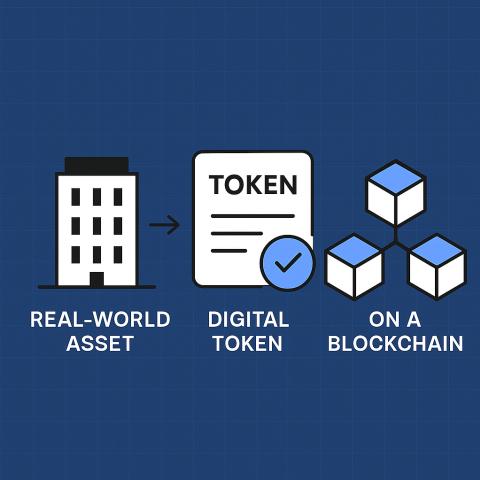

Assets represent anything of value that an individual or organization owns. These can be tangible, such as cash, real estate, inventory, or equipment, or intangible, like patents, trademarks, or goodwill. The key characteristic of an asset is its ability to generate future economic benefits. Whether through direct income, appreciation, or utility in operations, assets are considered positive contributors to net worth.

What Are Liabilities?

Liabilities, on the other hand, are financial obligations—debts or responsibilities—that a person or entity owes to others. These include loans, accounts payable, mortgages, and other forms of debt. Essentially, liabilities are claims that others have on a portion of your assets, and they typically require repayment over time, often with interest.

The Relationship Between Assets and Liabilities

Together, assets and liabilities form the backbone of the balance sheet—a snapshot of financial position at a given moment. The difference between total assets and total liabilities is known as equity (or net worth in personal finance). A healthy balance sheet shows a strong asset base relative to liabilities, signaling financial strength and resilience.

Why This Matters

For businesses, managing assets and liabilities efficiently is crucial to maintaining liquidity, securing funding, and ensuring long-term growth. For individuals, understanding this balance is key to budgeting, investing wisely, and achieving financial independence.

Conclusion

Mastering the concepts of assets and liabilities is not just for accountants or economists—it’s essential knowledge for anyone aiming to make informed financial decisions. By regularly evaluating what you own versus what you owe, you gain control over your financial future.