In today’s insurance ecosystem, digital platforms play a vital role in improving efficiency, transparency, and customer experience. For agents, merchants, and authorized partners of Life Insurance Corporation of India (LIC), the LIC Merchant Portal Login provides access to an essential digital tool that simplifies premium collection, policy servicing, and transaction management through a secure online interface.

With over 15 years of experience writing in the insurance domain and closely analyzing how digital portals impact insurers and intermediaries, it is evident that platforms like the LIC Merchant Portal are not just convenience tools—they are now business enablers. This blog provides a comprehensive, easy-to-understand explanation of what the LIC Merchant Portal is, how to log in, the services it offers, and the advantages it brings to merchants and agents.

Understanding the LIC Merchant Portal

The LIC Merchant Portal is an online platform designed for authorized LIC merchants, agents, and collection partners to manage insurance-related transactions digitally. Its primary purpose is to enable secure and efficient collection of LIC policy premiums and provide access to essential transaction records.

The portal bridges the gap between LIC’s operational systems and its on-ground partners, reducing dependency on manual processes. It allows merchants to serve policyholders better while maintaining transparency and compliance.

Who Can Use the LIC Merchant Portal?

The portal is accessible only to authorized users, which typically include:

- LIC-approved merchants

- LIC agents and development officers (as applicable)

- Banking or payment partners authorized by LIC

- Institutions involved in premium collection

Access credentials are issued by LIC after proper verification, ensuring that the platform remains secure and compliant with regulatory standards.

LIC Merchant Portal Login Steps

Logging into the LIC Merchant Portal is a straightforward process, but accuracy is crucial to avoid access issues. Below is a general step-by-step explanation:

Step 1: Visit the Official Portal

Open the official LIC Merchant Portal login page provided by LIC during merchant onboarding.

Step 2: Enter Login Credentials

Input your assigned Merchant ID/User ID and password. These credentials are unique and should be kept confidential.

Step 3: Complete Security Verification

Some logins may require additional verification, such as a CAPTCHA or one-time authentication step, to ensure secure access.

Step 4: Access the Dashboard

Once authenticated, users are directed to the merchant dashboard, where all available services and reports can be accessed.

Step 5: Logout After Use

For security reasons, merchants should always log out after completing transactions, especially when using shared systems.

If login credentials are forgotten or compromised, LIC provides a structured recovery or reset process through authorized channels.

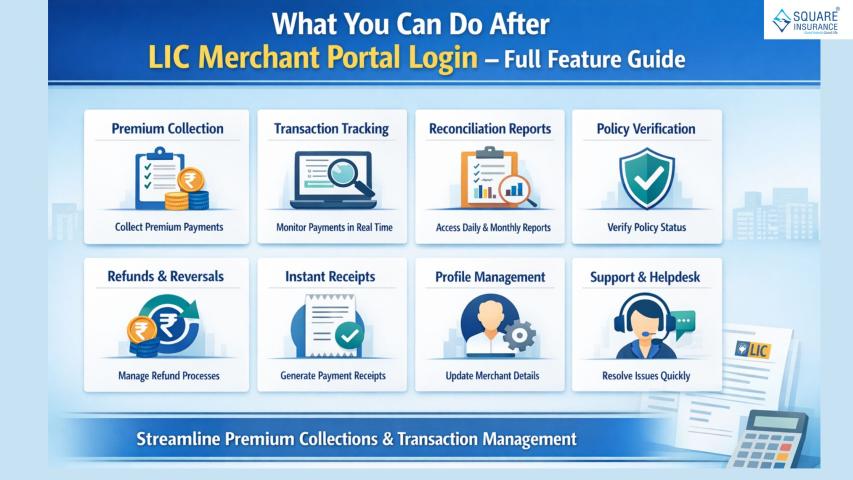

Key Services Available on the LIC Merchant Portal

The LIC Merchant Portal offers a wide range of services that help streamline insurance operations. These services are designed to reduce paperwork, improve accuracy, and enhance service speed.

1. Premium Collection

Merchants can collect LIC policy premiums digitally using multiple payment modes. This ensures faster processing and instant acknowledgment for policyholders.

2. Transaction History and Reports

The portal allows users to view, download, and maintain detailed transaction records. This helps with reconciliation, audits, and performance tracking.

3. Real-Time Payment Status

Merchants can instantly check whether a payment has been successfully processed, pending, or failed, reducing customer follow-ups.

4. Policy Reference Management

Basic policy-related details linked to transactions can be accessed for verification and servicing support.

5. Settlement and Commission Tracking

Depending on authorization level, merchants may view settlement status and commission-related information, improving financial transparency.

6. Secure Data Handling

All transactions are processed through encrypted systems, ensuring policyholder data protection and regulatory compliance.

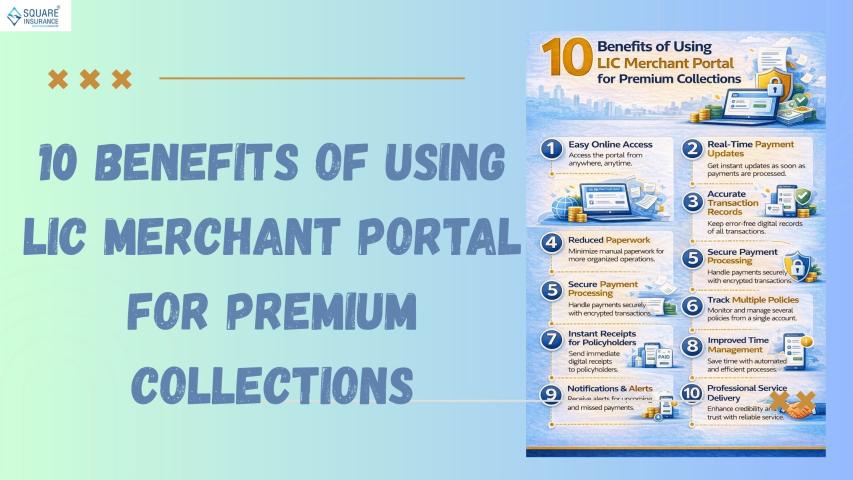

Advantages of Using the LIC Merchant Portal

The LIC Merchant Portal offers several practical and strategic advantages that make it indispensable for merchants and agents.

Improved Operational Efficiency

Manual premium collection is time-consuming and error-prone. The portal automates processes, saving time and reducing administrative burden.

Faster Customer Service

Real-time transaction updates allow merchants to resolve customer queries quickly, improving trust and satisfaction.

Enhanced Transparency

Clear visibility into transactions and settlements helps merchants maintain accurate financial records and avoid disputes.

Reduced Cash Handling Risks

Digital premium collection minimizes cash-related risks such as theft, misplacement, or reconciliation errors.

Compliance and Audit Readiness

Digital records ensure easy compliance with internal audits and regulatory checks, which are increasingly important in the insurance sector.

Business Scalability

As insurance demand grows, merchants can handle higher transaction volumes without increasing manpower or infrastructure costs.

Security and Compliance Considerations

Security is a core strength of the LIC Merchant Portal. Access is restricted to verified users, and transactions are monitored continuously. Merchants are advised to:

- Never share login credentials

- Regularly update passwords

- Use secure networks for login

- Monitor transaction activity frequently

These practices help maintain data integrity and prevent unauthorized access.

Why the LIC Merchant Portal Matters in Today’s Insurance Landscape

Insurance customers now expect speed, transparency, and digital convenience. Platforms like the LIC Merchant Portal help bridge traditional insurance processes with modern digital expectations. For merchants, it’s not just a payment tool—it’s a system that supports long-term business sustainability.

As regulatory oversight increases and digital adoption accelerates, merchants who leverage such portals are better positioned to grow while staying compliant.

Conclusion

The LIC Merchant Portal is a powerful digital solution that simplifies premium collection, enhances transparency, and supports efficient insurance operations. For authorized merchants and agents, understanding how to use the portal effectively can significantly improve service quality and operational control.

When combined with broader risk management and insurance advisory support from trusted providers like Square Insurance, merchants can build a more resilient, compliant, and customer-focused insurance business. Digital tools, backed by expert insurance guidance, are shaping the future of insurance distribution.

Also Read:- Benefits of Using LIC Customer

Frequently Asked Questions (FAQs)

Q1. What is the main purpose of the LIC Merchant Portal?

The LIC Merchant Portal is designed to enable authorized merchants to collect premiums digitally and manage LIC-related transactions securely.

Q2. Who provides login credentials for the LIC Merchant Portal?

Login credentials are issued by LIC to approved merchants after completing the required onboarding and verification process.

Q3. Can policyholders use the LIC Merchant Portal directly?

No, the portal is meant only for authorized merchants and agents. Policyholders interact through merchants or other LIC customer platforms.

Q4. What should I do if I forget my LIC Merchant Portal password?

Merchants should follow the official password recovery process or contact the designated LIC support channel for assistance.

Q5. Is the LIC Merchant Portal safe to use for premium collection?

Yes, the portal uses secure systems and access controls to protect transaction data and ensure compliance with insurance regulations.