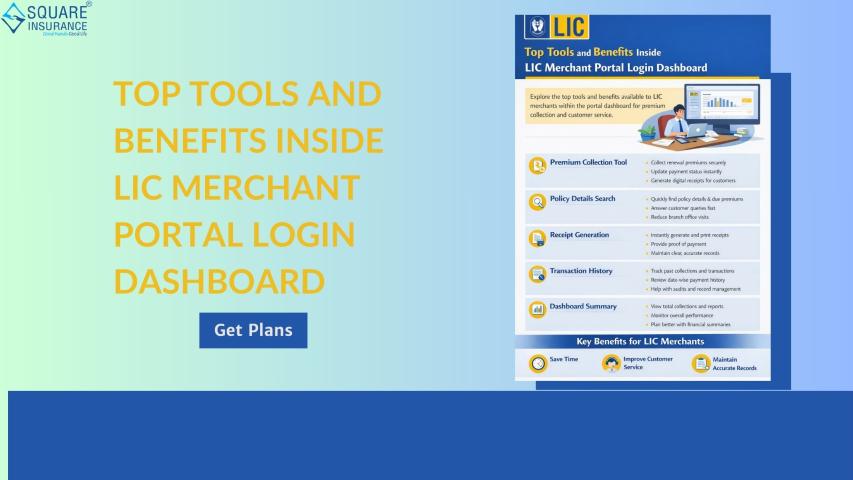

The LIC Merchant Portal is a powerful digital platform designed to simplify premium collection, policy servicing, and transaction management for authorized merchants and LIC partners. Over the years, LIC has steadily enhanced this portal to support faster payments, real-time tracking, and better transparency.

After completing the LIC Merchant Portal login, users gain access to multiple features that help manage LIC-related transactions efficiently, reduce manual errors, and improve customer service. In this detailed guide, I’ll walk you through everything you can do after logging in, based on practical industry experience and real usage scenarios.

Understanding the LIC Merchant Portal

The LIC Merchant Portal is primarily used by authorized merchants, banks, payment facilitators, and collection partners who assist LIC policyholders in paying premiums and accessing policy-related services. Unlike the agent portal, this platform focuses more on payment processing, reconciliation, and reporting.

Once logged in, merchants get a centralized dashboard that acts as a control panel for all LIC-related financial activities.

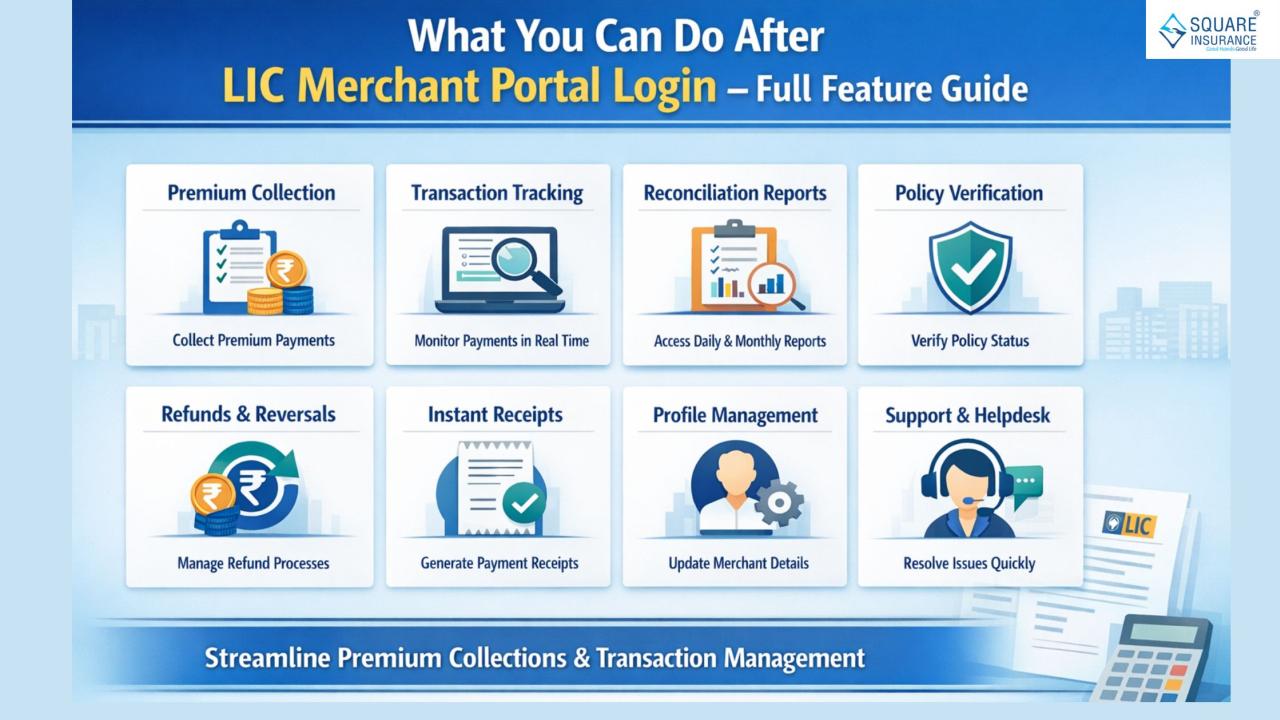

Key Features Available After LIC Merchant Portal Login

1. Premium Collection Services

One of the most important functions of the LIC Merchant Portal is premium collection. After logging in, merchants can:

- Accept LIC policy premium payments on behalf of customers

- Process payments using multiple modes such as net banking, UPI, debit cards, or authorized payment channels

- Ensure instant acknowledgment of successful transactions

This feature helps policyholders avoid long queues and enables quicker premium updates in LIC records.

2. Real-Time Transaction Tracking

After login, merchants can track every transaction in real time. This includes:

- Successful premium payments

- Failed or pending transactions

- Reversed or refunded payments

The real-time tracking system ensures transparency and allows merchants to immediately resolve issues faced by policyholders.

3. Daily and Monthly Reconciliation Reports

Reconciliation is critical in insurance premium collection. The LIC Merchant Portal provides detailed reports such as:

- Daily transaction summaries

- Monthly collection statements

- Settlement and commission-related data

These reports help merchants maintain accurate financial records and simplify accounting and auditing processes.

4. Policy Validation and Verification

Another essential feature available after LIC Merchant Portal login is policy validation. Merchants can:

- Verify policy numbers before accepting payments

- Check policy status (in-force, lapsed, or matured

- Confirm premium due amounts

This reduces payment errors and ensures customers pay the correct premium for active policies.

5. Instant Payment Acknowledgment & Receipts

Once a payment is processed successfully, the system generates instant acknowledgment. Merchants can:

- View transaction confirmation immediately

- Provide digital receipts to policyholders

- Reprint receipts if required

This feature improves customer trust and reduces disputes related to premium payments.

6. Refund and Reversal Management

- In cases of failed transactions or duplicate payments, the LIC Merchant Portal allows merchants to:

- Track refund statusInitiate reversals as per LIC guidelines

- Monitor timelines for credited refunds

This structured refund mechanism helps maintain service quality and customer satisfaction.

7. Merchant Profile and Account Management

After logging in, merchants can manage their profile details, including:

- Updating contact information

- Viewing merchant ID and authorization status

- Checking bank settlement details

Keeping profile information updated ensures smooth settlements and uninterrupted access to services.

8. Secure Access and Compliance Controls

LIC has implemented strong security measures within the merchant portal. After login, users benefit from:

- Encrypted transactions

- Role-based access control

- Session monitoring and auto-logout features

These controls help protect sensitive financial and policyholder data while complying with regulatory standards.

9. Support and Communication Features

The portal also offers access to support-related tools such as:

- Transaction-related grievance submission

- Status tracking for raised issues

- Important LIC notifications and updates

This reduces dependency on offline communication and speeds up problem resolution.

10. Improved Operational Efficiency

By centralizing all services on one platform, the LIC Merchant Portal significantly improves operational efficiency. Merchants can handle higher transaction volumes with minimal manual intervention, making it ideal for banks, digital payment centers, and service providers.

Benefits of Using LIC Merchant Portal for Merchants

- Faster premium collection and settlements

- Reduced paperwork and manual errors

- Better transparency and recordkeeping

- Improved trust among LIC policyholders

- Scalable solution for high-volume transactions

These advantages make the portal an essential tool in LIC’s digital ecosystem.

Also Read:- Top 10 LIC Policies for Investment

Conclusion

The LIC Merchant Portal login opens the door to a wide range of features that simplify premium collection, transaction management, reconciliation, and customer support. For authorized merchants, this platform is not just a payment gateway but a comprehensive service management system that enhances efficiency and reliability.

As the insurance industry continues to move toward digital-first operations, platforms like the LIC Merchant Portal play a crucial role in bridging the gap between insurers and customers. Whether you are managing daily collections or handling large-scale premium transactions, understanding and utilizing these features can significantly improve your workflow.

At Square Insurance, we believe that informed use of digital insurance platforms empowers both service providers and policyholders, ensuring smoother transactions and better financial planning outcomes.

Frequently Asked Questions (FAQs)

Q1. Who can use the LIC Merchant Portal?

The LIC Merchant Portal is designed for authorized merchants, banks, and payment collection partners approved by LIC.

Q2. Is LIC Merchant Portal different from LIC Agent Portal?

Yes, the merchant portal focuses on premium collection and transaction management, while the agent portal is meant for policy sales and servicing.

Q3. Can merchants generate reports after login?

Yes, merchants can access daily, monthly, and transaction-wise reports for reconciliation and recordkeeping.

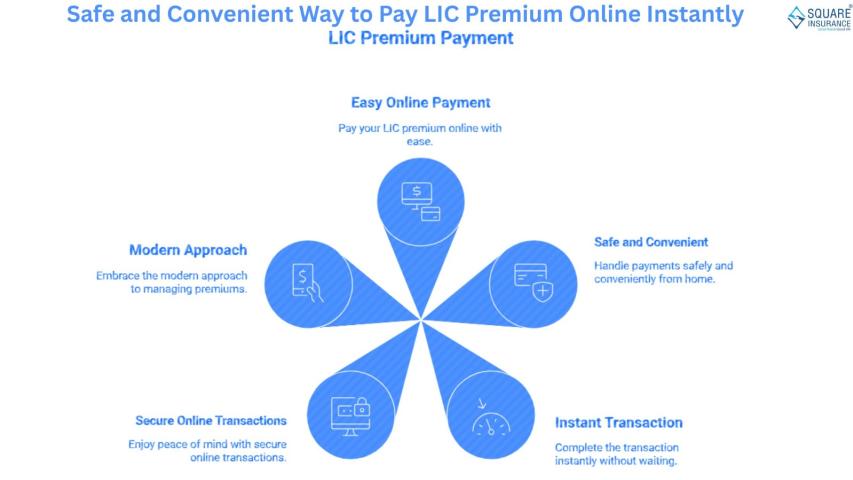

Q4. What payment modes are supported on the LIC Merchant Portal?

The portal supports multiple payment modes such as net banking, UPI, debit cards, and authorized digital channels.

Q5. Is the LIC Merchant Portal secure?

Yes, LIC uses advanced security protocols, encrypted transactions, and role-based access to ensure data safety.

Q6. What should I do if the transaction fails?

Failed transactions can be tracked through the portal, and refunds or reversals are processed as per LIC guidelines.