The Merchant Online LIC Portal is a digital platform created to help authorized merchants manage LIC-related services in a simple and organized way. It brings together many daily tasks into one online system, reducing the need for paperwork and manual processes. The portal is especially useful for merchants who handle multiple customers, payments, and service requests on a regular basis.

This article explains what the Merchant Online LIC Portal is, why it is important, and how it works in practical terms.

Understanding the Merchant Online LIC Portal

The Merchant Online LIC Portal is an online interface designed for merchants who are approved to provide LIC-related services. Instead of relying on physical records or visiting offices frequently, merchants can use this portal to carry out most tasks digitally.

The main goal of the portal is to make work easier, faster, and more accurate. It allows merchants to manage payments, view policy information, check transaction status, and maintain records from one place. By offering a centralized system, the portal helps merchants stay organized and provide better service to customers.

Why the Merchant Online LIC Portal Is Important

Merchants often manage many responsibilities at the same time. These include collecting premiums, answering customer questions, checking policy details, and keeping track of daily transactions. Doing all this manually can take a lot of time and increase the chances of errors.

The Merchant Online LIC Portal helps solve these problems by:

- Reducing paperwork

- Saving time on routine tasks

- Improving record management

- Providing quick access to information

With most services available online, merchants can focus more on customer support and less on administrative work.

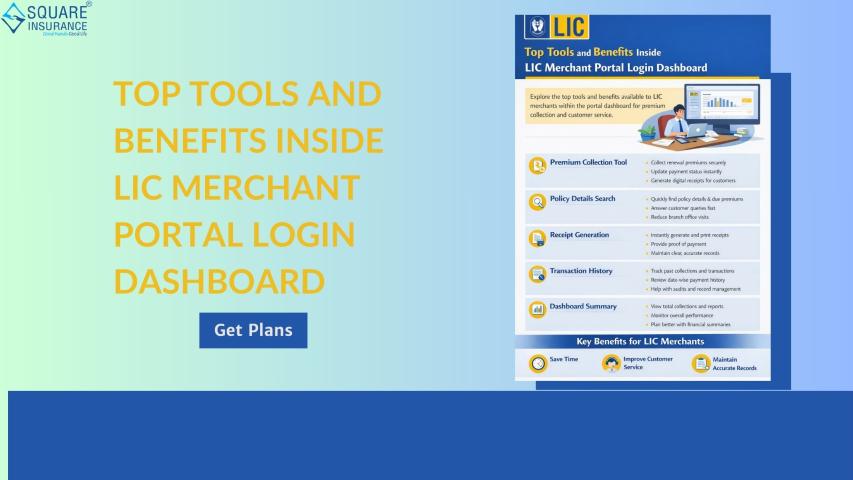

How the Merchant Online LIC Portal Works

The portal works through a secure login system. Once merchants log in using their authorized credentials, they can access the dashboard. The dashboard acts as the main control panel where all available services are displayed.

From the dashboard, merchants can choose the task they want to perform, such as checking policy details, collecting payments, or generating reports. Each action follows a clear process, making the portal easy to use even for those with basic technical knowledge.

Logging in to the Portal

To use the Merchant Online LIC Portal, merchants must first log in with their user ID and password. These login details are provided during registration. The login mechanism ensures that only authorized individuals have access to sensitive information.

Once logged in successfully, merchants are taken to the main dashboard. If login details are entered incorrectly, access is denied to protect data security.

Viewing Policy Details

One of the key functions of the portal is the ability to view policy information. Merchants can search for policy details using relevant information and quickly access important data.

This helps merchants:

- Answer customer queries accurately

- Confirm policy status

- Review premium due details

Having policy information available online reduces delays and improves service quality.

Collecting Premium Payments

The portal allows merchants to collect premium payments in an organized way. Each payment made through the portal is recorded automatically. This removes the need for manual entry and reduces errors.

After a payment is processed, merchants can view the transaction status instantly. This helps in confirming payments and providing timely updates to customers.

Checking Payment Status

Payment status tracking is another useful feature of the Merchant Online LIC Portal. Merchants can check whether a payment is successful, pending, or unsuccessful.

This feature helps:

- Avoid confusion regarding payment completion

- Reduce repeated follow-ups

- Maintain clear transaction records

Real-time updates make the process transparent and reliable.

Generating Reports and Records

The portal allows merchants to generate various reports related to transactions and collections. These reports can be viewed and downloaded as needed.

Reports help merchants:

- Track daily and monthly performance

- Maintain financial records

- Review past transactions easily

Digital reports also make it easier to store information safely for future reference.

Managing Customer Information

Customer information linked to policies can be accessed through the portal. This helps merchants maintain accurate records and communicate clearly with customers.

By having updated information in one place, merchants can avoid mistakes and provide more personalized service.

Reducing Manual Work and Errors

One of the biggest advantages of the Merchant Online LIC Portal is the reduction in manual work. Since most tasks are handled digitally, the chances of data entry mistakes are much lower.

Digital systems also reduce the risk of lost documents and make information retrieval faster and easier.

Accessing the Portal from Different Locations

The portal can be accessed from different locations as long as login credentials and an internet connection are available. This gives merchants flexibility in managing their work.

Whether at an office or another location, merchants can stay connected and handle urgent tasks without delay.

Security and Data Protection

The Merchant Online LIC Portal uses secure access controls to protect data. Login credentials ensure that only authorized users can access sensitive customer and transaction information.

This focus on security helps build confidence and trust while using the platform.

Conclusion

The Merchant Online LIC Portal is a practical and reliable digital solution for managing LIC-related services. By bringing together payment collection, policy management, reporting, and customer information in one place, the portal makes daily work easier and more organized.

For merchants who handle multiple transactions and customer interactions, the portal offers a clear advantage. It saves time, reduces errors, and improves service quality. Understanding how the Merchant Online LIC Portal works allows merchants to use it more effectively and get the most value from its features.

Related Article:- What You Can Do After LIC