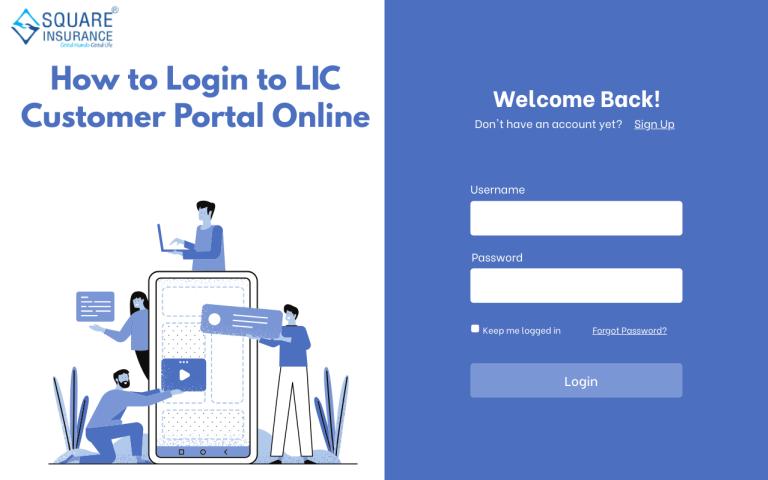

As someone who has spent over 15 years writing extensively in the insurance domain, I have witnessed how digital transformation has reshaped customer interactions with insurers. The Life Insurance Corporation of India (LIC), a trusted name for decades, has steadily evolved to meet the expectations of today’s policyholders.One of the most impactful steps in this direction is the LIC Customer Portal—a secure, user-centric platform that empowers policyholders to manage their insurance journey independently through a seamless LIC Customer Portal Login process.

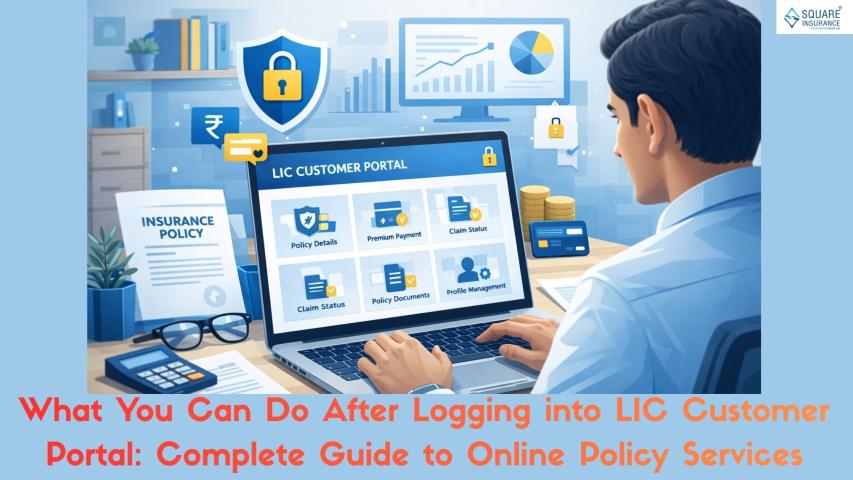

Once you log into the LIC Customer Portal, a wide range of services becomes instantly accessible. This guide explains what you can do after logging into the LIC Customer Portal, how it simplifies policy management, and why it is an essential tool for every LIC policyholder.

Overview of the LIC Customer Portal

The LIC Customer Portal is designed to give customers complete control over their policies without relying on branch visits or intermediaries. Whether you hold a traditional endowment plan, term insurance, or pension policy, the portal centralizes all your policy-related information under one dashboard.

After successful login, you gain access to real-time data, secure transactions, and essential policy services—all available 24/7.

1. View and Manage Policy Details

One of the first and most frequently used features after logging into the LIC Customer Portal is policy viewing.

You can:

- Check policy number, commencement date, and maturity date

- View premium amount, payment frequency, and next due date

- See sum assured, bonus details, and policy status

This transparency helps policyholders stay informed and plan their finances more effectively.

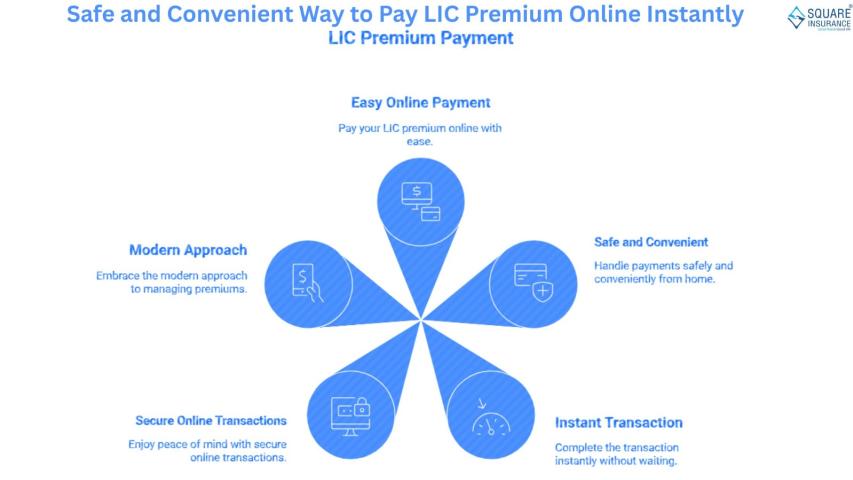

2. Pay Premiums Online Securely

Online premium payment is one of the biggest advantages of the LIC Customer Portal.

After login, you can:

- Pay due premiums instantly

- Clear outstanding or overdue premiums

- Download premium payment receipts for records

The system updates payment status almost immediately, reducing the risk of policy lapse due to missed payments.

3. Download Policy Documents and Receipts

Policy documents are essential for financial planning, tax filing, and record-keeping. Once logged in, you can easily:

- Download e-policy documents

- Access premium payment receipts

- Retrieve annual premium statements

This eliminates the need to store physical documents and ensures easy access whenever required.

4. Track Policy Loans and Loan Eligibility

If your policy is eligible for a loan, the LIC Customer Portal allows you to monitor loan-related information.

You can:

- Check loan eligibility against your policy

- View outstanding loan balance

- Track interest charged on policy loans

This feature helps you make informed borrowing decisions without visiting a branch.

5. Update Personal and Contact Information

Keeping your personal details up to date is crucial for smooth communication and timely service.

- After logging in, you can update:Mobile number and email address

- Communication address

- Nominee details (as per applicable rules)

Accurate information ensures you receive alerts, reminders, and policy updates without delays.

6. Nomination and Beneficiary Management

Nomination plays a critical role in ensuring smooth claim settlement. The LIC Customer Portal allows you to:

- Check existing nominee details

- Update or change nominee information

- View nomination status for each policy

This reduces future disputes and ensures your loved ones receive benefits without complications.

7. Track Bonus and Policy Value Information

For participating LIC policies, bonuses form a significant part of returns.

Through the portal, you can:

- View accrued bonuses

- Track policy fund value (where applicable)

- Estimate maturity benefits

This helps policyholders assess long-term returns and align insurance with financial goals.

8. Submit and Track Service Requests

The LIC Customer Portal allows you to raise service requests online, saving time and effort.

Common requests include:

- Address or contact detail changes

- Duplicate policy bond requests

- Revival-related queries

You can also track the status of submitted requests, ensuring transparency in service delivery.

9. Access Tax-Related Information

Insurance policies offer tax benefits under applicable laws, and accurate records are essential during tax filing season.

After login, you can:

- Download premium paid certificates

- Access policy statements for tax planning

- Maintain digital records for compliance

This feature is particularly useful for salaried individuals and self-employed professionals.

10. Policy Revival and Status Monitoring

If a policy has lapsed due to missed premiums, the portal helps you stay informed.

You can:

- Check policy lapse status

- View revival eligibility

- Monitor updates related to policy continuity

While certain revival actions may require additional steps, having information readily available is a significant advantage.

11. Enhanced Security and Account Monitoring

Security is a cornerstone of the LIC Customer Portal. After logging in, customers benefit from:

- Encrypted sessions

- Secure authentication processes

- Account activity monitoring

This ensures that personal and financial information remains protected at all times.

Why the LIC Customer Portal Matters Today

In an era where speed, accuracy, and self-service matter, the LIC Customer Portal bridges the gap between traditional insurance and digital convenience. It empowers policyholders to take charge of their insurance without dependence on intermediaries, ensuring clarity and confidence.

Conclusion

The LIC Customer Portal is more than just a login interface—it is a comprehensive policy management ecosystem. From premium payments and document downloads to nominee updates and loan tracking, everything is designed to put control directly in the hands of the policyholder.

As insurance continues to evolve alongside digital platforms, tools like the LIC Customer Portal demonstrate how legacy institutions can successfully adapt while maintaining trust. Much like Square Insurance, which emphasizes transparency and customer-first digital solutions, LIC’s portal reflects a growing industry-wide commitment to accessibility, security, and informed decision-making.

Related Article:- Top 10 Things You Must

FAQs:- Frequently Asked Questions

Q1. Is it safe to use the LIC Customer Portal?

Yes, the portal uses secure authentication and encrypted connections to protect customer data and transactions.

Q2. Can I manage multiple LIC policies from one account?

Yes, once policies are linked to your profile, you can view and manage multiple policies under a single login.

Q3. What should I do if my policy details are not visible after login?

Ensure your policy is correctly linked to your registered profile. If not, you may need to add or update policy information.

Q4. Can I pay premiums for someone else’s policy through my login?

Premium payments can usually be made if you have the correct policy details, but policy management access remains limited to the registered user.

Q5. Is the LIC Customer Portal accessible at all times?

Yes, the portal is available 24/7, allowing customers to access services anytime, subject to occasional maintenance windows.

Square Insurance POS app helps insurance agents compare, sell, and manage policies easily. Explore plans, track leads, and grow your insurance business anytime.