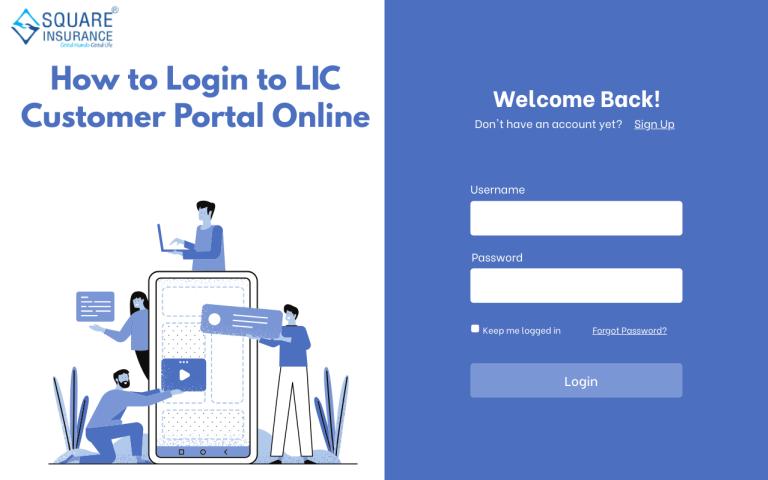

The Indian insurance sector has undergone a remarkable digital transformation over the past decade. As policyholders increasingly prefer online convenience over traditional branch visits, Life Insurance Corporation of India (LIC) has strengthened its digital ecosystem through the LIC Customer Portal. This portal empowers policyholders to manage their insurance needs independently, securely, and efficiently.

Drawing on extensive experience in insurance content and deep understanding of customer behavior, this article explores the key advantages of LIC Customer Portal Login and how it supports modern digital insurance services while improving customer trust and engagement.

Understanding the LIC Customer Portal

The LIC Customer Portal is an online self-service platform designed for LIC policyholders. Once registered and logged in, customers can access policy information, track premium payments, download statements, and request services without visiting an LIC office.

This portal reflects LIC’s commitment to digital inclusion, transparency, and customer-centric service delivery in an increasingly tech-driven insurance environment.

1. 24/7 Access to Policy Information

One of the most valuable advantages of LIC Customer Portal Login is round-the-clock access to policy details. Policyholders can log in at any time to view:

- Policy status

- Sum assured and maturity details

- Premium due dates

- Nominee information

This eliminates dependency on office hours or intermediaries and allows customers to stay informed about their insurance coverage whenever needed.

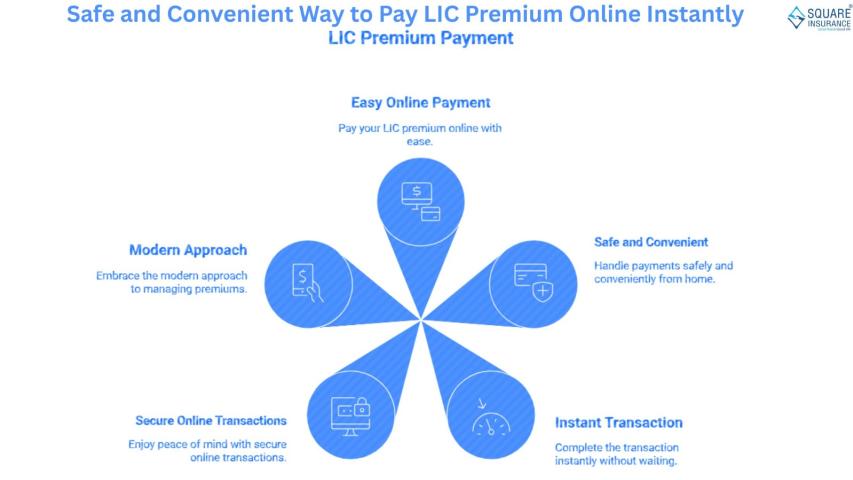

2. Seamless Online Premium Payments

Digital insurance services are incomplete without smooth online payments. Through the LIC Customer Portal Login, policyholders can pay premiums securely using digital payment modes.

Key benefits include:

- Instant payment acknowledgment

- Reduced risk of missed due dates

- Automated transaction records

This feature supports timely premium payments and helps policyholders maintain uninterrupted coverage without administrative stress.

3. Improved Transparency and Trust

Transparency plays a crucial role in long-term insurance relationships. The LIC Customer Portal provides clear visibility of all policy-related transactions, including premium history and policy status changes.

When customers can independently verify their data, it builds confidence in the insurer and reduces misunderstandings. This transparency strengthens trust—an essential factor in life insurance, where relationships often span decades.

4. Faster Service Requests and Reduced Turnaround Time

Traditionally, insurance service requests involved paperwork and multiple visits. With LIC Customer Portal Login, customers can initiate various service-related actions online, such as:

- Updating contact details

- Checking loan eligibility against policies

- Tracking service request status

This digital workflow reduces processing time, minimizes errors, and ensures faster resolution compared to offline methods.

5. Secure Digital Environment

Security is a top priority in digital insurance services. LIC Customer Portal Login uses secure authentication processes to protect customer data.

From a policyholder’s perspective, this means:

- Personal and financial information remains protected

- Reduced risk of unauthorized access

- Confidence in using digital insurance platforms

This secure framework encourages more customers to adopt online insurance management without fear of data misuse.

6. Easy Access to Statements and Certificates

Another significant advantage is the ability to download important documents instantly, including:

- Premium payment receipts

- Policy statements

- Revival and continuation details

These documents are often required for financial planning, audits, or tax-related purposes. Easy access saves time and ensures customers always have verified records available.

7. Better Financial Planning and Awareness

The LIC Customer Portal Login enables policyholders to view all their LIC policies in one place. This consolidated view supports better financial awareness and planning.

Customers can:

- Track multiple policies simultaneously

- Monitor long-term insurance goals

- Plan renewals and future coverage effectively

Such clarity helps individuals make informed decisions about their financial protection strategy.

8. Reduced Dependence on Physical Branches

Digital insurance services aim to reduce unnecessary physical interactions. The LIC Customer Portal minimizes the need to visit branches for routine queries, saving time and travel costs.

This advantage is particularly valuable for:

- Senior citizens

- Customers in remote areas

- Busy professionals

The portal brings LIC services directly to the customer, aligning with modern expectations of convenience.

9. Enhanced Customer Experience Through Self-Service

Self-service is a defining feature of digital insurance. LIC Customer Portal Login empowers customers to manage policies independently, fostering a sense of control and confidence.

Instead of waiting for assistance, customers can resolve basic needs instantly. This improves satisfaction and reduces frustration commonly associated with traditional insurance processes.

10. Alignment with India’s Digital Insurance Vision

The LIC Customer Portal supports India’s broader push toward digital financial services. By enabling online policy management, LIC ensures its customers remain connected to modern insurance practices while maintaining reliability and trust.

This digital alignment ensures LIC remains relevant and accessible to new generations of policyholders.

Conclusion

The LIC Customer Portal Login is a cornerstone of LIC’s digital insurance services. Its advantages—ranging from 24/7 policy access and secure premium payments to transparency and faster service—significantly enhance the policyholder experience.

As insurance continues to evolve digitally, platforms like the LIC Customer Portal empower customers with control, clarity, and convenience. Industry-focused advisory platforms such as Square Insurance consistently emphasize the importance of such digital tools in helping policyholders manage insurance efficiently while building long-term financial security.

Also Read:- How to Access LIC Customer Portal

Frequently Asked Questions (FAQs)

Q1. What is the LIC Customer Portal?

The LIC Customer Portal is an online platform that allows policyholders to manage their LIC policies digitally.

Q2. Who can use the LIC Customer Portal Login?

Any LIC policyholder who completes the registration process can access the portal.

Q3. Is LIC Customer Portal Login safe?

Yes, the portal uses secure authentication and data protection measures to safeguard user information.

Q4. Can I pay LIC premiums through the customer portal?

Yes, policyholders can pay premiums online and receive instant payment confirmation.

Q5. What details can I view after logging in?

You can view policy status, premium history, due dates, statements, and other policy-related information.

Q6. Does the portal reduce the need to visit LIC branches?

Yes, most routine services can be managed online, reducing dependency on physical branch visits.

Q7. Can I manage multiple LIC policies through one login?

Yes, the portal allows customers to view and manage all registered LIC policies in one account.

Square Insurance POS – Apps is a smart platform for agents to compare insurance plans, manage policies, track leads, and grow their insurance business digitally.