The Life Insurance Corporation of India (LIC) has steadily strengthened its digital infrastructure to meet the evolving expectations of policyholders. As we move into 2026, accessing insurance services online is no longer a convenience—it is a necessity. The LIC Customer Portal Login is designed to give policyholders seamless access to their policy details, premium payments, service requests, and important updates, all from one secure platform.

With over 15 years of experience writing in the insurance domain, I have closely observed how digital portals improve transparency, efficiency, and customer satisfaction when used correctly. This comprehensive guide explains how to access the LIC Customer Portal login easily in 2026, what you need beforehand, and how to make the most of the platform.

What Is the LIC Customer Portal?

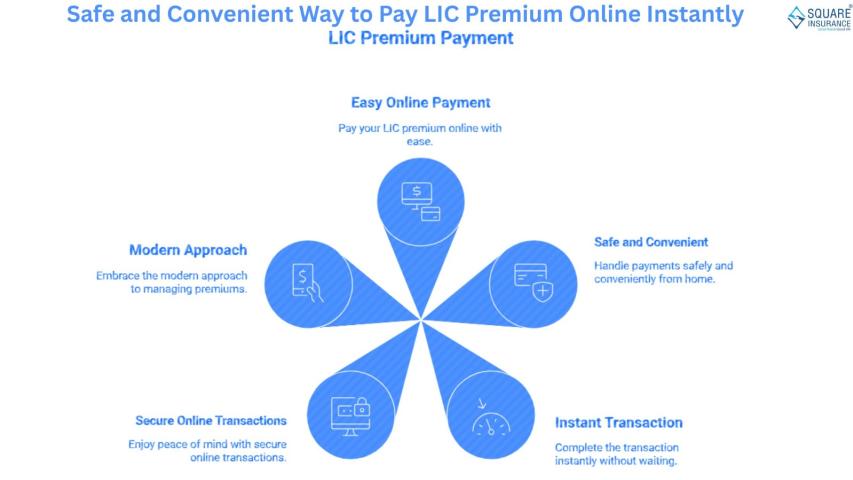

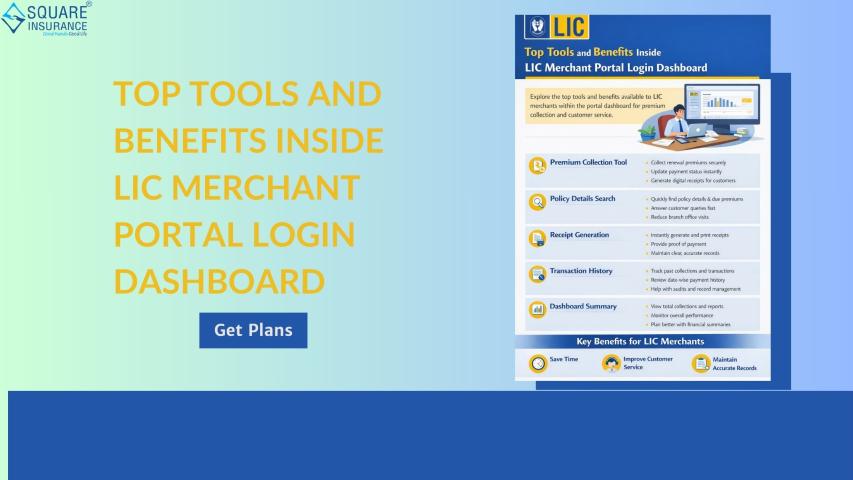

The LIC Customer Portal is an online self-service platform created for policyholders to manage their life insurance policies digitally. Once logged in, users can:

- View policy details and status

- Pay premiums online

- Download premium receipts

- Update contact information

- Track service requests

The portal reduces dependency on physical branches and empowers customers with real-time access to their insurance information.

Why LIC Customer Portal Login Is Important in 2026

In 2026, insurance services are increasingly driven by digital-first experiences. The LIC Customer Portal login plays a critical role by:

- Saving time through self-service options

- Enhancing data accuracy with real-time updates

- Improving transparency across policy records

- Enabling secure, paperless transactions

For policyholders managing multiple policies or long-term plans, regular portal access is essential.

Prerequisites Before Accessing LIC Customer Portal Login

Before attempting to log in, ensure the following:

- A valid LIC policy number

- Date of birth as per LIC records

- Registered mobile number and email ID

- Stable internet connection

Having these details ready ensures a smooth login experience.

Step-by-Step Guide to Access LIC Customer Portal Login Easily in 2026

Step 1: Visit the LIC Customer Portal Page

Open the official LIC customer portal using a secure browser. Always ensure you are on the authentic platform before entering personal details.

Step 2: Enter Your Login Credentials

Use your registered User ID and password to log in. For new users, a one-time registration is required before first-time access.

Step 3: Complete Security Verification

In 2026, enhanced security protocols may include OTP verification sent to your registered mobile number or email to confirm identity.

Step 4: Access Your Dashboard

Once logged in successfully, you will be directed to your dashboard, where all linked policies and services are visible.

How to Register for LIC Customer Portal (If Not Registered)

If you are a first-time user:

- Select the “New User Registration” option

- Enter policy number and personal details

- Verify your identity using OTP

- Create a secure User ID and password

Registration is a one-time process and enables long-term digital access.

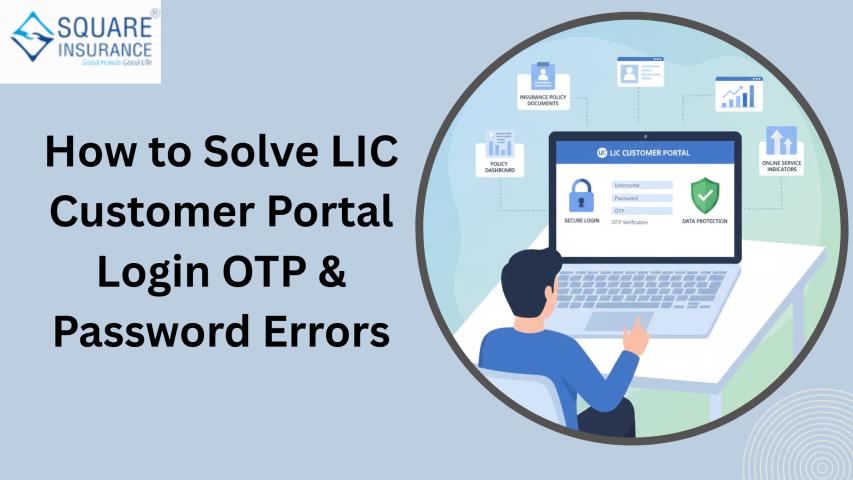

Common Login Issues and How to Fix Them

- Forgot User ID or Password

Use the “Forgot Credentials” option to reset your login details through OTP verification.

- Incorrect Policy Details

Ensure your entered details match LIC records exactly, including date of birth format.

- OTP Not Received

Check network connectivity and ensure your registered mobile number is active.

Understanding these common issues can save time and prevent frustration.

Best Practices for Secure Portal Access

To ensure safe usage of the LIC Customer Portal:

- Use a strong, unique password

- Avoid logging in from public devices

- Always log out after completing transactions

- Keep your registered contact details updated

Security awareness is a shared responsibility between LIC and policyholders.

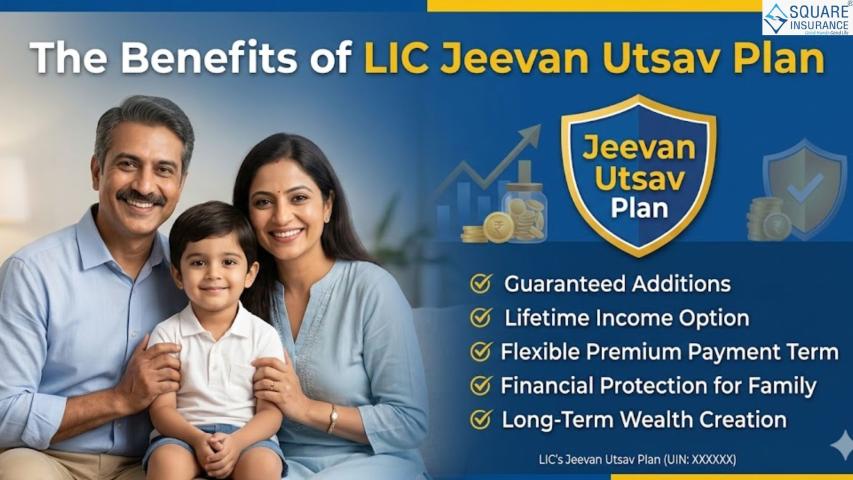

Key Benefits of Using LIC Customer Portal Login

- Convenience: Manage policies anytime, anywhere

- Transparency: Access real-time policy information

- Efficiency: Faster service request processing

- Accuracy: Reduced chances of manual errors

These benefits make the portal an essential tool for modern policy management.

Also Read:- Top 10 Things You Must , Top Features to Look for

Conclusion

Accessing the LIC Customer Portal Login easily in 2026 is key to managing life insurance efficiently in a digital-first environment. With proper registration, secure login practices, and awareness of available services, policyholders can enjoy seamless policy management without unnecessary delays.

As insurance continues to embrace digital transformation, advisory ecosystems like Square Insurance emphasize informed usage of online platforms, secure customer access, and simplified insurance management. Combining LIC’s digital tools with the right guidance ensures long-term financial protection and peace of mind.

Frequently Asked Questions (FAQs)

Q1. Is LIC Customer Portal login mandatory for all policyholders?

No, it is not mandatory, but it is highly recommended for easy policy management and online services.

Q2. Can I access multiple LIC policies using one login?

Yes, multiple policies linked to the same customer details can be managed under a single login.

Q3. What should I do if my login credentials stop working?

Use the credential recovery option or reset your password through OTP verification.

Q4. Is the LIC Customer Portal accessible on mobile devices?

Yes, the portal is compatible with most modern smartphones and tablets.

Q5. Can I pay LIC premiums after logging into the customer portal?

Yes, premium payment is one of the key services available after login.

Q6. How secure is the LIC Customer Portal?

The portal uses secure authentication methods and encrypted systems to protect customer data.