Offering secure and seamless mobile payment services should be your top priority. When your customers feel safe and enjoy a smooth payment experience, they trust your brand more. This trust turns into loyalty, which directly impacts your growth and profits.

Host Card Emulation (HCE) is one of the key technologies behind this. It helps you deliver fast, safe, and scalable payment experiences through mobile wallets.

If you want to know how HCE affects the performance and future of your mobile money payment system, this blog gives you a clear picture.

In this blog, you will explore the role of HCE in making digital wallets more secure and scalable.

Come! Let’s dive right in.

Understanding host card emulation (HCE) in mobile payments

HCE allows your mobile wallet app to perform contactless payments without needing a physical secure element. It’s a software-based solution that turns mobile phones into virtual cards.

You don’t need to rely on mobile carriers or hardware manufacturers. This gives you full control and flexibility while launching your mobile money payment system. It also works well with Android, which holds over 70% of the global smartphone market. That means you can reach more users without spending more on infrastructure.

With this base in place, let’s look at how HCE works with tokenization to boost security.

The role of HCE tokenization in strengthening wallet security

Security is always a top concern for you and your customers. That’s where HCE tokenization comes in. It adds an extra layer of safety to every transaction.

What is HCE tokenization?

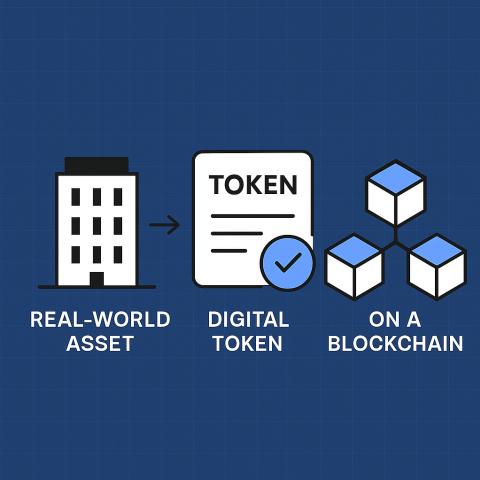

HCE tokenization replaces sensitive card data with a unique token during each transaction. This token carries no actual value outside that transaction. If someone intercepts it, they can’t use it again or trace it back to the card.

This means your customer’s actual card details stay hidden. Even if someone tries to hack the system, there’s nothing useful for them to steal.

Enhanced fraud prevention

Each token is generated for a specific use and time. Once used, it becomes invalid. That stops fraudsters from reusing payment data.

You also reduce the risk of card-not-present fraud, which makes up around 73% of all card fraud, according to Juniper Research. HCE tokenization protects your users and lowers your risk.

Boosting trust with end-to-end encryption

When you use HCE tokenization, your entire transaction stays encrypted from start to finish. No sensitive information is exposed at any point.

This gives your users peace of mind. They know their money and data are safe. In return, you earn their trust and improve customer satisfaction.

Now that you understand the security side, let’s move on to how HCE supports growth and scalability.

How HCE enables scalable mobile wallet deployments

You want to grow without hitting technical limits. HCE helps you scale your mobile wallet solution faster and smarter.

No hardware dependency = easier expansion

HCE removes the need for hardware-based secure elements. You don’t need to depend on device manufacturers or mobile carriers.

This opens up your wallet service to more users, especially in emerging markets. Plus, it also makes app updates and maintenance easier, while keeping your system flexible.

Faster time-to-market

You can launch your mobile wallet solution more quickly with HCE. It requires less setup, fewer approvals, and simpler integration.

The sooner you go to market, the faster you start gaining users and profits. That’s important when you’re competing in a fast-moving digital space.

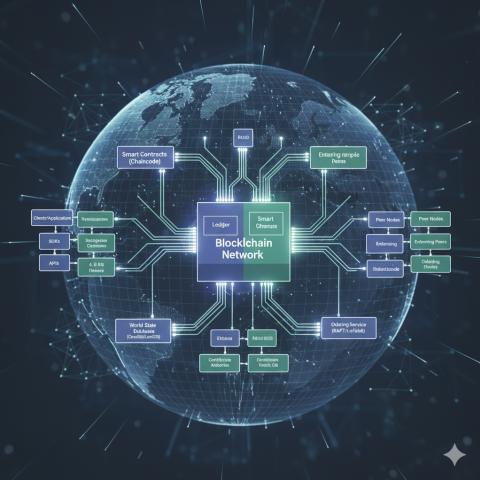

Interoperability and cross-border capabilities

HCE works well with cross-border mobile money payment systems. It supports contactless payments across banks, fintechs, and financial institutions.

Your customers can send and receive money anytime, anywhere, in any way. This kind of flexibility drives adoption and keeps your e-wallet payment system future-ready.

Why HCE Is Ideal for Banks, Fintechs, and FIs

As digital wallets evolve, security and scalability aren’t enough on their own. Banks, fintechs, and financial institutions also need control, flexibility, and readiness for what’s next.

That’s where Host Card Emulation (HCE) steps in—offering more than just a secure payment method. It helps you build a future-ready, customer-first digital wallet solution.

White-Label Wallet Enablement

HCE removes the need for specialized hardware, making it easier for you to launch a fully branded wallet experience. Since the card credentials are emulated via software, you’re not tied to device manufacturers or telcos. This flexibility accelerates your go-to-market plan, reduces development costs, and allows you to focus on delivering a smooth, branded user journey across devices.

Bottom line? You can offer a bank-grade wallet under your own brand—without the infrastructure headache.

Supports Omnichannel Experience

Today’s users switch between channels without blinking. They might tap to pay in-store, scan a QR at a café, or complete a subscription online—all within the same day. HCE supports this fluidity. It enables seamless transactions across NFC, QR codes, and in-app payments—using one secure backend.

That means you can serve customers wherever they choose to transact, all while maintaining consistent security and user experience.

Future-Proofing Digital Payment Infrastructure

Digital payments are expanding into wearables, IoT devices, and connected ecosystems. HCE keeps you prepared. Its software-driven architecture is easier to integrate with emerging technologies, making it the smart choice for long-term scalability.

Whether it's enabling contactless payments via smartwatches or powering IoT-enabled transit cards, HCE gives you the agility to adapt—without overhauling your tech stack.

Conclusion

HCE does more than support contactless payments. It helps you offer secure, scalable, and modern digital wallet services that meet customer expectations.

When you combine HCE with tokenization, you reduce fraud, protect user data, and speed up market growth. These benefits are real and measurable.

If you want to deliver a mobile wallet experience that’s fast, safe, and built to scale HCE is the way forward.