The cryptocurrency market is thriving in 2025, with millions of users trading digital assets daily. As blockchain adoption spreads across industries, the demand for secure, scalable, and innovative cryptocurrency exchanges continues to grow.

For startups, launching a crypto exchange presents a golden opportunity to enter a rapidly expanding market, yet it comes with a fair share of challenges.

Startups looking to develop a crypto exchange must balance regulatory compliance, user experience, liquidity, and security while standing out in a competitive space.

This guest post explores the key opportunities in crypto exchange development for new businesses and outlines the major challenges they should prepare for to succeed in this high-potential sector.

Opportunities for Startups in Cryptocurrency Exchange Development

The growing global interest in digital currencies presents multiple avenues for startups to innovate and create value. From regional exchanges to niche DeFi platforms, the crypto space offers numerous opportunities for entrepreneurs with the right vision and technology partner.

Exploding Market Demand

Cryptocurrency adoption is no longer limited to early adopters. With growing mainstream interest and institutional involvement, the global market for digital assets has reached unprecedented levels. Startups have the opportunity to cater to underserved markets, such as regional traders, emerging economies, or specific crypto communities.

DeFi and Web3 Integration

Modern crypto exchanges aren’t just for spot trading. Startups can develop exchanges that integrate DeFi features, such as staking, yield farming, and liquidity pools. With Web3 support and wallet integration, users get direct control over their funds while benefiting from on-chain functionalities.

Niche-Specific Exchanges

There’s growing demand for specialized exchanges focusing on privacy coins, security tokens, GameFi tokens, and NFTs. Startups can create tailored platforms for these niche segments, building brand loyalty and a dedicated user base that mainstream exchanges often overlook.

White-Label Solutions and Faster Time to Market

Partnering with a cryptocurrency exchange development company like Technoloader enables startups to launch faster using customizable white-label solutions. These ready-to-deploy frameworks reduce development time and cost, allowing startups to focus on marketing, compliance, and community building.

Revenue Generation Models

A crypto exchange offers multiple income streams trading fees, withdrawal fees, listing charges, staking programs, premium account tiers, and more. With the right monetization strategy, startups can build a sustainable and scalable business model within months of launch.

Control Over Platform Rules

Startups launching their exchange have full control over policies such as listing procedures, KYC requirements, withdrawal limits, and supported tokens. This autonomy allows greater flexibility in adapting to changing market trends and regulatory updates.

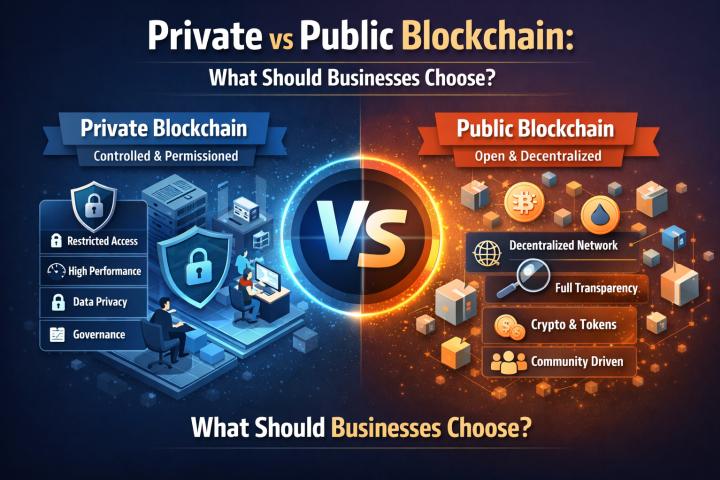

Blockchain Transparency and Security

With blockchain-backed audit trails, startups can deliver a transparent, tamper-proof experience to users, building trust, especially among new entrants. By offering robust security protocols from day one, startups can position themselves as reliable alternatives to vulnerable, outdated platforms.

Cross-Platform Compatibility

Modern exchanges are expected to support both web and mobile users. By leveraging Android app development services, startups can offer responsive, intuitive mobile trading experiences to meet the demand of on-the-go users and attract a broader customer base.

Innovation with Layer-2 and Multi-Chain Support

Incorporating support for Layer-2 protocols and multi-chain trading opens up opportunities for startups to attract advanced traders. Providing lower fees, faster transactions, and access to emerging blockchain ecosystems increases the platform’s appeal.

Opportunity to Build Trust Through Community

Startups have the unique chance to build communities from the ground up, engaging users through education, reward programs, referrals, and social media. A strong community adds to platform stickiness and can drive organic growth through word-of-mouth marketing.

The above-mentioned opportunities can be fully availed if you hire the best cryptocurrency exchange development service provider.

Challenges Startups Face in Cryptocurrency Exchange Development

Despite the vast opportunities, launching a cryptocurrency exchange isn’t a plug-and-play endeavour. Startups must navigate a landscape filled with regulatory hurdles, technical risks, liquidity concerns, and market competition. Below are the most critical challenges to watch out for:

Regulatory Compliance and Licensing

The legal status of crypto exchanges varies by region. Startups must understand and comply with local laws, including KYC/AML rules, data protection regulations, and financial conduct standards. Obtaining licenses in jurisdictions like the U.S., Europe, or the UAE can be time-consuming and expensive.

Liquidity Management

Without liquidity, even the most advanced exchange will fail. Startups must either partner with liquidity providers or build internal market-making capabilities to ensure smooth trading. Low liquidity can lead to slippage, poor user experience, and lost credibility.

Cybersecurity Risks

Crypto exchanges are prime targets for hackers. Startups must invest in multi-layer security, including cold wallet storage, DDoS protection, two-factor authentication, and regular smart contract audits. One breach can destroy user trust and cause irreversible reputational damage.

User Trust and Brand Credibility

Established exchanges enjoy user trust by virtue of scale and recognition. For startups, gaining that trust is harder. A secure platform, transparent policies, and strong customer support are essential to win and retain users in a crowded market.

High Initial Development Cost

Custom exchange development—including backend architecture, APIs, admin dashboards, wallet integration, and smart contracts—requires significant investment. Startups must budget wisely or choose scalable white-label cryptocurrency exchange development options to reduce costs while ensuring future scalability.

Integration with Payment Gateways and Banks

To support fiat transactions, exchanges must integrate with banking systems and payment processors. This process can be challenging due to regulatory limitations, anti-crypto sentiments among banks, or compliance gaps, especially in certain regions.

Technical Complexity

Building an exchange involves numerous technical components order matching engines, liquidity modules, multi-currency wallets, real-time price feeds, KYC systems, and more. Poor architecture or a lack of scalability can hinder performance and limit future upgrades.

Continuous Maintenance and Updates

Crypto exchanges require round-the-clock maintenance, including bug fixes, UI enhancements, and security updates. Startups must allocate a team or partner with a provider offering ongoing support to ensure high uptime and evolving feature sets.

Intense Market Competition

New exchanges must compete with giants like Binance, Coinbase, and Kraken, who have brand equity, liquidity, and resources. To succeed, startups must offer something different—be it better UX, lower fees, or a unique niche focus.

Onboarding and Educating Users

Many first-time crypto users are unfamiliar with trading interfaces, wallet management, and security practices. Startups must design onboarding flows, tutorials, and support systems to educate users and reduce friction during their initial platform experience.

Final Thoughts

Cryptocurrency exchange development for startups is a promising yet demanding venture. While the opportunities to create revenue, scale globally, and innovate are immense, the challenges—from regulatory compliance to liquidity management—require strategic planning, technical expertise, and a user-first approach.

Partnering with an experienced cryptocurrency exchange development company like Technoloader gives startups a competitive advantage. With deep blockchain knowledge, smart contract development experience, and customizable white-label solutions, Technoloader helps bring your crypto exchange vision to life securely, efficiently, and cost-effectively.

Have a crypto exchange idea in mind? Get in touch with Technoloader today to turn your concept into a powerful, future-ready trading platform tailored to your business goals.