Introduction

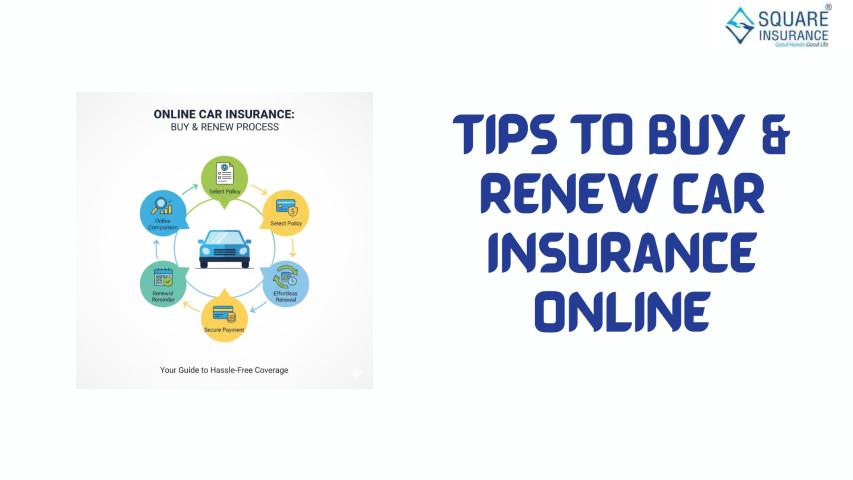

Car insurance is a necessity for every vehicle owner, but the process of

purchasing it has evolved significantly over the years. Earlier, customers had

limited access to information and relied heavily on agents for quotes and

recommendations. Today, digital transformation has reshaped how people

research, compare, and buy car insurance. Online platforms have simplified the

entire experience, offering convenience, transparency, and control to

customers.

Buying car insurance online is no longer just a

trend—it has become the preferred method for millions of policyholders. This

detailed guide highlights the major benefits of purchasing car insurance online

and explains why shifting to digital platforms can save time, money, and

effort.

1.

Instant Policy Purchase Without Any Hassle

One of the biggest advantages of buying car

insurance online is the speed at which it can be completed. The entire

process—from choosing a policy to making payment—takes only a few minutes. You

can instantly access quotes, compare plans, and purchase the policy without

waiting for an agent or visiting a branch office.

Online processes eliminate long paperwork,

reducing the overall time required to buy or renew a policy. This seamless

experience not only enhances convenience but also ensures you can get coverage

even at the last minute without complications.

2.

Transparent Comparison of Multiple Insurance Plans

When buying offline, customers often receive

limited options, depending on what the agent provides. Online platforms, on the

other hand, allow you to compare several insurers at once. This includes:

·

Premium costs

·

Coverage details

·

Add-on availability

·

Exclusions

·

Claim settlement performance

·

Network garages

This transparent comparison helps you identify

the best plan based on your needs and budget. Such clarity empowers you to make

informed decisions without relying solely on external guidance.

3.

Cost-Effective Policies with Better Discounts

Buying car insurance online often results in

lower premiums because there are no middlemen involved. Many insurers offer

digital-exclusive discounts, making online purchases more affordable than

offline methods.

You also get access to:

·

No Claim Bonus retention options

·

Savings on add-ons

·

Promotional offers

·

Discounts for anti-theft devices

·

Voluntary deductible benefits

Since online platforms eliminate agent

commissions, the savings are often passed on to customers, resulting in more

economical pricing.

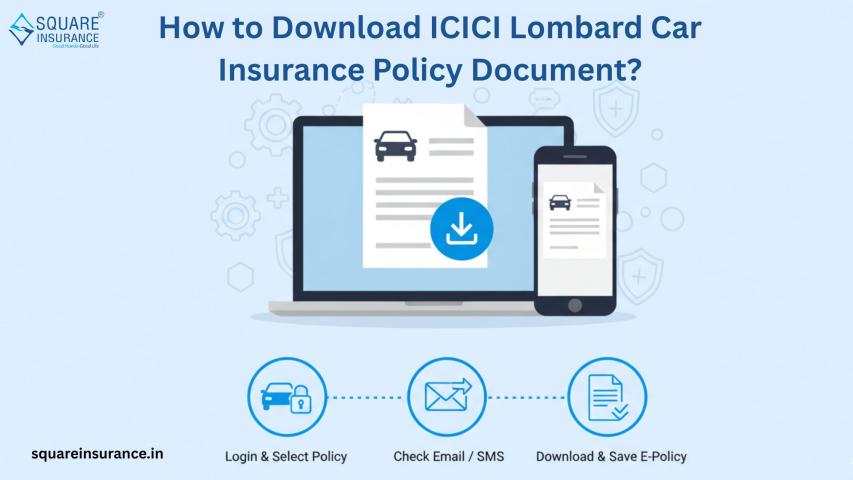

4. Easy

Access to Information and Policy Documents

When buying offline, understanding policy

terms can be difficult because the information may not be readily available.

Online platforms provide clear, structured, and detailed descriptions of

coverage, exclusions, features, and add-ons. Policy documents, brochures, FAQs,

and terms and conditions can be downloaded instantly.

Furthermore, once you purchase the policy, the

digital document is sent directly to your email. This reduces the risk of

losing physical papers and ensures you can access the policy anytime, anywhere.

5.

Enhanced Transparency with No Hidden Charges

Digitally buying car insurance ensures

complete transparency. Since you have access to every detail, from premium

calculations to coverage specifics, there is no chance of hidden fees or

miscommunication.

You can verify:

·

Premium breakup

·

Tax details

·

IDV selection

·

Add-on cost

·

Discounts applied

·

Final payable amount

This level of clarity builds trust and reduces

the likelihood of disputes during claims.

6.

Quick and Simple Renewal Process

Online renewals are especially beneficial for

vehicle owners who frequently forget renewal dates or have busy schedules. The

system allows you to renew your policy in just a few clicks without submitting

physical documents again.

Benefits of online renewal include:

·

Automatic reminders

·

Pre-filled details

·

Easy payment options

·

Option to change or update add-ons

·

Opportunity to review IDV annually

This flexibility ensures your car remains

insured continuously, avoiding legal penalties and protection gaps.

7.

Access to Customer Reviews and Ratings

Before purchasing a policy, it is natural to

want reassurance about the insurer’s service quality. Online platforms offer

access to customer reviews, ratings, and feedback related to:

·

Claim settlement experience

·

Service responsiveness

·

Add-on usefulness

·

Renewal ease

·

Overall satisfaction

These real experiences help you judge insurers

beyond advertisements and promotional claims.

8.

User-Friendly Tools for Accurate Premium Calculation

Online car insurance buying platforms provide

tools such as:

·

Premium calculators

·

IDV calculators

·

Add-on estimators

·

Claim ratio indicators

These tools give you a clear idea of what you

are paying for and how different factors influence your premium. Such insights

help you optimize your policy to suit your requirements while staying within

budget.

9.

Secure and Multiple Payment Options

Digital insurance platforms offer secure

payment gateways that comply with advanced encryption standards. Buyers can

choose from:

·

Net banking

·

Credit or debit cards

·

UPI

·

Wallets

Instant payment confirmation ensures your

policy becomes active immediately. This reduces anxiety, especially when

renewing a policy close to its expiry date.

10.

Eco-Friendly and Paperless Process

Buying insurance online reduces the need for

printed documents, application forms, and physical signatures. This paperless

process lowers environmental impact while also improving efficiency.

Additionally, online storage of policy

documents ensures no damage, loss, or misplacement, which is common with

physical copies.

11.

Better Control Over Your Policy Choice

The online process gives you complete

control—from understanding features to comparing options and finalizing the

purchase. There is no external pressure from agents, and you can take as much

time as needed to review every detail carefully.

This independence leads to smarter

decision-making and a policy that truly matches your needs.

Conclusion

Digital transformation has revolutionized the

way people buy car insurance. The online method offers simplified processes,

transparent comparisons, cost-effective pricing, instant documentation, and

greater policy control. Whether you are buying a new policy or renewing an

existing one, the online route ensures a smoother, faster, and more reliable

experience.

For car owners looking for a trusted digital

platform that offers clarity, convenience, and comprehensive insurance

solutions, Square Insurance can be an excellent option to explore while

purchasing your next policy online.

Frequently Asked Questions

1. Is

it safe to buy car insurance online?

Yes, buying car insurance online is safe as

insurers use secure, encrypted payment gateways and provide instant digital

documents.

2. Are

online car insurance premiums cheaper than offline?

Online premiums are often lower because there

are no agent commissions, and insurers offer exclusive online discounts.

3. Do I

need to submit any physical documents for online insurance?

No, the entire process is digital. You only

need to enter vehicle and personal details online.

4. Can

I renew an expired car insurance policy online?

Yes, expired policies can be renewed online.

Some insurers may require vehicle inspection depending on the extent of expiry.

5. Will

I get the same coverage if I buy a policy online?

Absolutely. Online policies provide the same

coverage and benefits as those purchased offline, often with better

transparency and lower premiums.