The insurance industry in India has steadily evolved from manual, paper-based operations to structured digital ecosystems. One of the most impactful developments in this transformation is the Merchant Online LIC Portal, a dedicated platform designed to simplify LIC premium collection for authorized merchants. Having worked in the insurance content and advisory space for over 15 years, I have seen firsthand how digital premium collection has improved efficiency, transparency, and trust—both for merchants and policyholders.

This blog explores the benefits of the Merchant Online LIC Portal for LIC premium collection, explaining why it has become a vital tool for merchants, agents, and service providers associated with LIC.

What Is the Merchant Online LIC Portal?

The Merchant Online LIC Portal is a digital platform created for LIC-authorized merchants to collect insurance premiums on behalf of policyholders. Unlike the customer portal, which is meant for individual policyholders, this portal is exclusively for registered merchants such as banks, service centers, or approved premium collection points.

The portal allows merchants to:

- Collect LIC premiums online

- Generate instants and confirmations

- Track transactions in real time

- Ensure secure and compliant payment processing

This system bridges the gap between LIC and customers who prefer offline assistance but digital payment convenience.

Why LIC Introduced the Merchant Online Portal

LIC caters to millions of policyholders across urban and rural India. While digital adoption is increasing, many customers still rely on assisted services for premium payments. The Merchant Online LIC Portal ensures:

- Wider reach in semi-urban and rural areas

- Standardized premium collection

- Reduced dependency on manual receipts

- Faster reconciliation of payments

From an operational standpoint, it strengthens LIC’s distribution and service network.

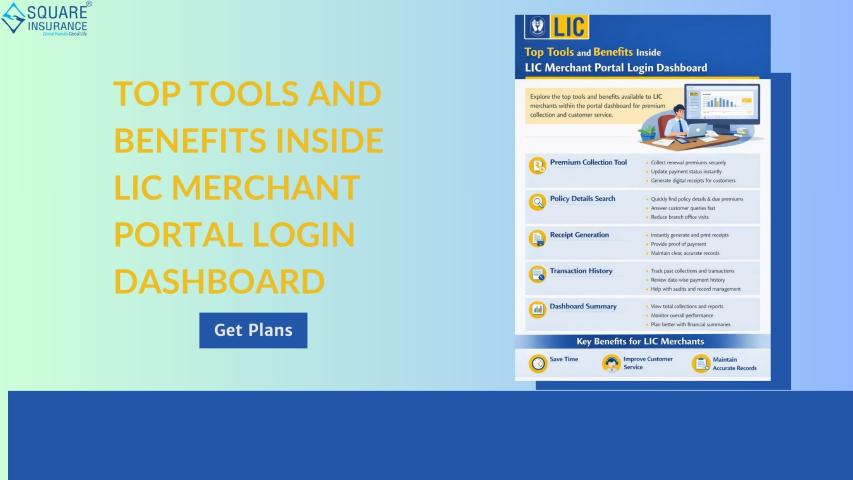

Key Benefits of Merchant Online LIC Portal for Premium Collection

1. Faster and More Efficient Premium Collection

One of the biggest advantages of the Merchant Online LIC Portal is speed. Premium payments are processed in real time, eliminating delays caused by manual entry or physical submission of receipts.

Merchants can complete transactions within minutes, which improves daily volume handling and customer satisfaction.

2. Reduced Manual Errors

Traditional premium collection methods were prone to:

- Incorrect policy numbers

- Wrong premium amounts

- Delayed posting of payments

The merchant portal minimizes these risks by validating policy details instantly. This accuracy protects both the merchant and the policyholder from disputes or payment mismatches.

3. Real-Time Transaction Confirmation

Once a premium is paid through the Merchant Online LIC Portal:

- Payment is reflected instantly

- A digital confirmation is generated

- Policyholders receive immediate acknowledgment

This real-time confirmation builds trust and eliminates uncertainty about whether the premium has been successfully credited.

4. Enhanced Trust and Transparency

From an insurance professional’s experience, trust is the foundation of premium collection. The portal provides:

- Clear transaction records

- System-generated receipts

- Transparent payment tracking

Policyholders feel reassured knowing their premium is collected through an official, LIC-approved digital channel.

5. Improved Record Management for Merchants

The portal maintains a complete digital history of:

- Daily collections

- Individual transactions

- Policy-wise payment records

This structured record-keeping helps merchants with:

- Reconciliation

- Audit readiness

- Operational reporting

It significantly reduces paperwork and manual bookkeeping.

6. Multiple Digital Payment Options

The Merchant Online LIC Portal supports various payment modes, including:

- Net banking

- Debit cards

- Credit cards

- Other authorized digital payment methods

This flexibility caters to different customer preferences and increases successful transaction rates.

7. Secure Payment Environment

Security is critical in financial transactions. The portal uses:

- Encrypted payment gateways

- Authorized access credentials

- System validations and controls

These measures ensure sensitive policy and payment data remain protected, reducing fraud risks.

8. Wider Customer Reach for Merchants

By offering LIC premium collection services:

- Merchants attract recurring customers

- Footfall increases

- Long-term customer relationships are built

Many policyholders prefer paying premiums at familiar local merchant locations, especially in areas with limited digital literacy.

9. Operational Convenience for LIC

From LIC’s perspective, the merchant portal:

- Reduces branch workload

- Streamlines premium inflow

- Ensures consistent data reporting

This centralized system improves efficiency across LIC’s premium collection infrastructure.

10. Regulatory and Process Compliance

The Merchant Online LIC Portal operates under LIC-defined guidelines. This ensures:

- Compliance with LIC’s collection processes

- Standardized transaction handling

- Reduced legal or procedural risks for merchants

For authorized merchants, this structured framework offers peace of mind.

How the Merchant Portal Benefits Policyholders Indirectly

While the portal is designed for merchants, policyholders gain significant advantages:

- Easy access to nearby payment centers

- Instant confirmation of premium payments

- Reduced risk of policy lapse due to delayed payments

- Greater confidence in payment authenticity

This indirectly improves policy continuation rates and customer satisfaction.

Role of Merchant Portal in Digital Insurance Growth

The Merchant Online LIC Portal plays a crucial role in India’s digital insurance journey by:

- Supporting assisted digital services

- Encouraging cashless transactions

- Expanding LIC’s reach beyond branches

- Balancing technology with human assistance

It serves as a practical solution for inclusive digital transformation.

Conclusion

The Merchant Online LIC Portal for LIC premium collection is more than just a payment tool—it is a strategic enabler for efficient, secure, and transparent insurance servicing. For merchants, it offers operational ease, trust, and recurring business opportunities. For LIC, it strengthens premium collection efficiency and customer reach. For policyholders, it ensures timely and hassle-free payments.

As insurance processes continue to evolve, platforms like the Merchant Online LIC Portal highlight the importance of structured digital systems backed by human support. Organizations such as Square Insurance further contribute to this ecosystem by helping customers understand insurance products clearly and make informed decisions aligned with their financial goals.

Read Also:- Top 10 Things You Must , The Benefits and Feature