Life Insurance Corporation of India (LIC) is one of the most trusted insurance providers in the country. Millions of policyholders rely on LIC for long-term financial stability and peace of mind. When it comes to paying premiums, many people still follow the traditional methods—visiting LIC offices or logging in to their online accounts.

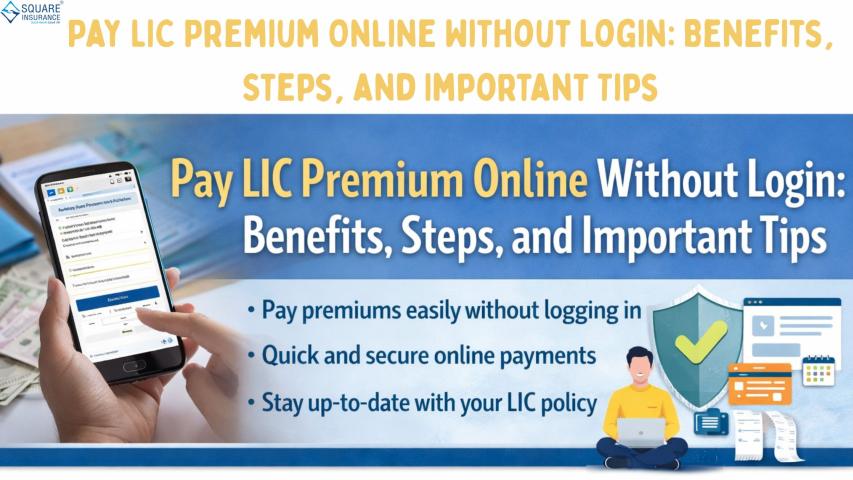

However, in recent years, LIC has introduced the option to Pay LIC Premium Online Without Login. This feature has been a welcome change, offering policyholders a simpler and quicker way to keep their policies active. But why should you consider paying your LIC premium online without login?

Here are 7 key reasons to explore this convenient method:

1. Quick and Easy Process

One of the biggest advantages of paying LIC premiums online without login is how quick and straightforward it is. You don’t need to remember your user ID or password, which saves time—especially if you’re in a hurry or on the move.

You simply need your policy number, date of birth, and a few basic details to proceed. The interface is designed to be user-friendly and guides you step by step. For people who prefer a no-fuss process, this method is a perfect fit.

2. No Need to Create or Manage an Online Account

Creating an online account involves setting up usernames, passwords, and sometimes even security questions. For those who aren’t tech-savvy or simply don’t want the hassle of managing yet another login, this can feel like a burden.

Paying without logging in eliminates all of that. There's no need to register, verify emails, or manage passwords. You can make a payment in just a few clicks without any account-related complications.

3. 24/7 Availability

The option to pay online without a login is available at any time—24 hours a day, 7 days a week. Whether it’s early morning or late at night, you don’t have to wait for working hours or stand in long queues.

This is especially helpful during the last few days before the premium due date. You can avoid the stress of missing payments due to office closures or login issues.

4. Safe and Secure Payment Options

Despite the simplicity, paying LIC premiums online without login is still very secure. The payment gateway is encrypted, and all transactions go through trusted banking systems. You can use a variety of methods, including debit cards, credit cards, net banking, or UPI.

Even though you are not logging into a registered account, your policy and payment details are kept confidential and secure. You also receive an instant receipt and confirmation message after the transaction, offering peace of mind.

5. Ideal for Senior Citizens or Occasional Users

Many senior policyholders are uncomfortable with online registrations, sophisticated interfaces, and digital account management. For them, the no-login payment option is much easier to navigate.

Similarly, if you're someone who rarely needs to log into the LIC portal—perhaps because you only have one policy or don’t need to update your profile often—this method is perfect. It allows you to complete your premium payment without diving into unnecessary steps.

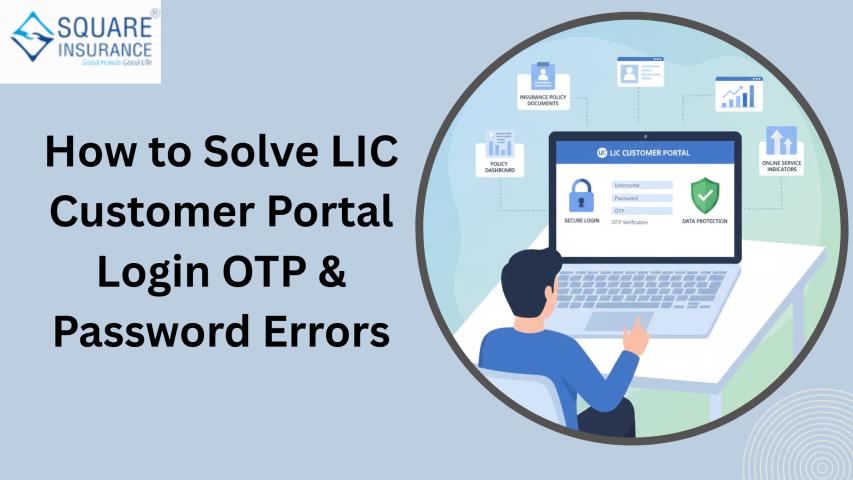

6. No Risk of Account Lockouts

Many users face login issues due to forgotten passwords or incorrect attempts, leading to account lockouts. Recovering access can take time and may even require visiting the branch or calling customer service.

By using the no-login option, you bypass all those potential roadblocks. You won’t face login errors, password resets, or system timeouts. This smooth, frictionless process is ideal if you want to pay quickly and move on with your day.

7. Environmentally Friendly and Paperless

When you pay your LIC premium online, you help reduce the use of paper—no printed forms, no receipts to be collected manually. The entire process is digital, and receipts are shared electronically via email or SMS.

This small change contributes toward a larger cause of reducing paper waste and embracing digital habits. Plus, it makes it easier to keep a record of your transactions, since everything is stored on your phone or computer.

Frequently Asked Questions (FAQs)

Q1. Can I pay my LIC premium online without logging in?

Yes. LIC provides a facility to pay premiums online without logging into the customer portal. You just need your policy details to proceed.

Q2. What details are required to pay LIC premium without login?

Generally, you will need your policy number, date of birth, and a valid payment method such as net banking, debit card, UPI, or credit card.

Q3. Is it safe to pay LIC premium online without login?

Yes. The payment process is secure and uses authorized gateways. However, it is always recommended to use a secure internet connection and trusted devices for transactions.

Q4. Will I get a receipt if I pay without login?

Yes. After completing the payment, you receive an acknowledgment or receipt, which you can download or have sent to your email for record keeping.

Q5. Can I pay for someone else’s LIC policy without login?

Yes. As long as you have the correct policy details, you can pay premiums on behalf of another person, such as a family member.

Q6. What if I enter the wrong policy details while paying?

The transaction may fail if incorrect details are entered. Always double-check the policy number and related information before proceeding.

Conclusion

Paying your LIC premium online without login is a modern convenience that suits many types of users. Whether you’re in a hurry, not comfortable with technology, or just want a quick way to pay your dues, this method offers a safe and effective solution.

To recap, it’s quick, account-free, always available, secure, and user-friendly for all age groups. It removes many of the common barriers associated with digital payments, while still offering the full benefits of convenience and safety.

Of course, those who prefer using their registered LIC accounts for managing multiple policies or accessing detailed information can still do so. But for a simple, fast, and stress-free premium payment experience, the no-login online method is a great alternative worth trying. Squareinsurance could help further streamline your insurance management, but this method remains a solid option for those who prioritize ease and efficiency.