Decentralized finance (DeFi) is changing how businesses and individuals interact with digital assets. A DeFi development company helps create blockchain-based platforms where users can trade, lend, borrow, or stake assets without relying on traditional financial intermediaries. Choosing the right company involves understanding the services they offer and how their solutions align with project goals.

In this article, we discuss the various services offered by DeFi development companies, the types of platforms they can build, and factors influencing the cost of these services.

Key Services Provided by a DeFi Development Company

A DeFi development company provides a range of services for startups and enterprises seeking blockchain-based solutions. These services are designed to create secure, scalable, and functional decentralized applications (DApps).

1. Smart Contract Development

Smart contracts are the foundation of any DeFi platform. A skilled DeFi development company writes secure smart contracts that automate transactions, manage assets, and enforce rules without human intervention.

Smart contracts must be accurate, tested, and free from vulnerabilities. Developers often use languages like Solidity, Rust, or Vyper to program contracts that operate on networks like Ethereum, Binance Smart Chain, or Solana.

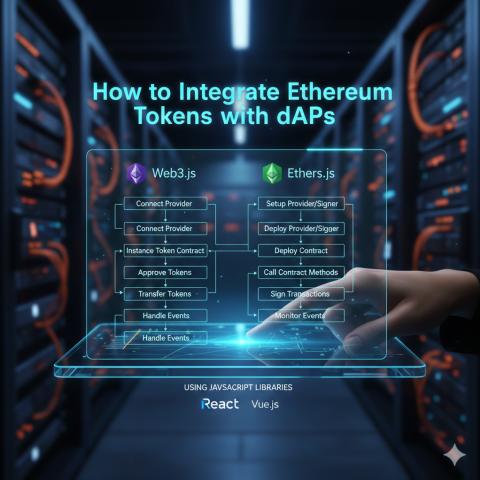

2. Decentralized Application (DApp) Development

DApps allow users to interact with the blockchain easily. A DeFi development company designs web and mobile applications where users can manage wallets, trade tokens, or participate in staking and lending activities.

Developers ensure DApps connect seamlessly with blockchain networks, provide real-time transaction updates, and integrate security features to protect user assets.

3. Decentralized Exchange (DEX) Development

Decentralized exchanges are platforms where users can trade cryptocurrencies directly with each other. A company specializing in DeFi development can create a DEX with features like order books, liquidity pools, and automated market makers (AMMs).

These platforms are built to offer fast transactions, low fees, and a user-friendly interface, ensuring that trading is accessible to both beginners and experienced users.

4. Token Development and Integration

Tokens are the currency of the DeFi ecosystem. A development company can design various types of tokens, including ERC-20, BEP-20, and utility tokens.

Token creation also involves planning tokenomics, which defines how tokens are distributed, circulated, and utilized within the platform. Proper token integration ensures smooth transactions and enhances platform engagement.

5. Staking and Yield Farming Platforms

Staking and yield farming allow users to earn rewards by locking their tokens in smart contracts. A DeFi development company builds platforms that manage these processes automatically, distributing rewards based on pre-set conditions.

These platforms encourage participation while maintaining transparency, as users can monitor their staked tokens and earned rewards directly on the blockchain.

6. Lending and Borrowing Platforms

Lending and borrowing platforms are core DeFi solutions. They allow users to lend assets for interest or borrow tokens against collateral.

Developers create smart contracts that automatically calculate interest rates, manage collateral, and execute transactions securely. This eliminates intermediaries while maintaining compliance with blockchain rules.

7. DeFi Wallet Development

A secure wallet is essential for managing assets on a DeFi platform. DeFi development companies design wallets that support multiple cryptocurrencies, integrate with DApps, and offer strong encryption to protect user funds.

Wallets often include features like private key management, multi-signature support, and seamless connection to exchanges or staking platforms.

8. Cross-Chain and Interoperability Solutions

Many modern DeFi platforms need to interact with multiple blockchains. A development company may provide cross-chain solutions that allow assets and data to move between different networks seamlessly.

Cross-chain integration improves accessibility for users, reduces transaction costs, and expands the reach of the platform to multiple blockchain ecosystems.

9. Security Audits and Risk Management

Security is critical in DeFi. A reliable company conducts audits to identify vulnerabilities in smart contracts and DApps.

Regular monitoring and risk assessments help prevent hacks, exploits, or accidental loss of funds. A strong security protocol also builds trust among users and ensures long-term platform reliability.

10. Governance and DAO Integration

Decentralized autonomous organizations (DAOs) allow users to vote on platform decisions. A DeFi development company can integrate governance systems where token holders influence the platform’s rules, policies, and upgrades.

This inclusion makes platforms more democratic and can improve community engagement while maintaining decentralized control.

Factors Affecting the Cost of DeFi Development Services

The cost of building a DeFi platform depends on multiple factors. Understanding these can help startups and enterprises plan budgets effectively.

1. Platform Complexity

The complexity of the platform plays a significant role in determining cost. Basic DApps with simple token functionality will generally cost less than full-featured platforms with lending, staking, or multi-chain support.

Complex platforms require more development hours, additional testing, and advanced security measures, which can increase costs.

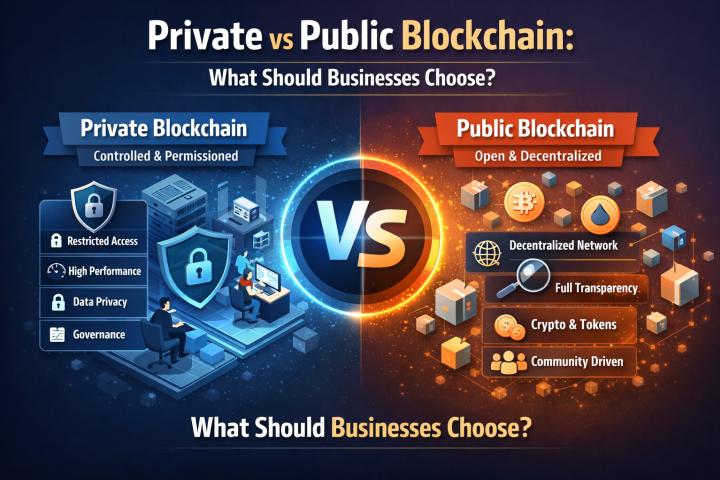

2. Blockchain Network Selection

Different blockchain networks have different requirements and fees. Platforms built on Ethereum, for instance, may face higher gas fees compared to networks like Polygon or Binance Smart Chain.

The chosen network influences development processes, smart contract deployment, and maintenance, impacting the overall cost of development.

3. Type of Tokens and Tokenomics

Developing multiple types of tokens or implementing advanced tokenomics features can affect costs. Utility tokens, governance tokens, and NFTs all require specific coding, smart contracts, and integration with DApps.

Platforms with complex reward mechanisms or deflationary token models may need additional development time, impacting expenses.

4. Security Requirements

Security audits, testing, and implementation of monitoring systems add to the overall cost. Platforms that handle large volumes of transactions or significant financial assets require more robust security measures.

Investing in security ensures platform reliability and protects user funds, which is critical for attracting and retaining users.

5. Platform Features

The more features a DeFi platform offers, the higher the development cost. Features such as multi-wallet integration, automated yield farming, decentralized exchanges, staking, borrowing, and lending increase development time.

Additional functionality often requires careful planning, testing, and deployment, which contributes to overall costs.

6. Maintenance and Post-Launch Services

Even after launch, platforms need ongoing maintenance to remain secure and functional. Regular updates, bug fixes, and network upgrades require time and resources.

Companies that provide continuous support add value to the platform but also influence the long-term cost of development services.

Choosing the Right DeFi Development Company

Selecting the right company involves more than just cost considerations. Look for companies that offer:

-

Comprehensive DeFi services covering smart contracts, DApps, token development, and security.

-

Knowledge of multiple blockchain networks for better platform compatibility.

-

Strong technical expertise in programming languages like Solidity, Rust, or JavaScript.

-

Ability to build secure and scalable platforms that handle high traffic and transactions.

Evaluating companies based on these factors ensures your DeFi platform is functional, secure, and user-friendly.

Benefits of Hiring a DeFi Development Company

Startups and enterprises benefit from hiring a professional DeFi development company in several ways:

-

Faster Development: Experienced developers can build and launch platforms more efficiently.

-

Security: Proper coding and audits reduce the risk of hacks.

-

Compliance: Developers can follow blockchain standards to ensure secure and functional systems.

-

Technical Support: Post-launch maintenance and upgrades keep the platform running smoothly.

These benefits allow businesses to focus on growth and user acquisition while technical teams handle the platform.

Future of DeFi and Development Services

DeFi is expected to grow as more users seek decentralized solutions for finance. Companies offering DeFi development services are now including cross-chain platforms, DeFi insurance, DAO governance, and real-world asset tokenization.

Staying aware of these trends helps businesses select partners that can build platforms capable of adapting to future innovations in the DeFi ecosystem.

Conclusion

A DeFi development company provides services ranging from smart contract creation to full-scale DApp development, staking, lending, and governance integration. The cost of these services depends on platform complexity, blockchain selection, tokenomics, security measures, and post-launch support.

Careful evaluation of the services offered and technical skills ensures startups and enterprises build secure, functional, and scalable DeFi platforms. Investing in the right company helps deliver reliable solutions that meet both user and business needs while staying competitive in the growing blockchain market. Partner with a Trusted DeFi Development Company.