Introduction

Buying car insurance online has become the preferred choice for Indian car

owners due to its convenience, transparency, and cost-effectiveness. With

rising vehicle ownership and increasing awareness about insurance benefits,

more people are switching from traditional offline methods to digital platforms

to secure their cars.

However, despite the ease of online purchase,

many buyers still make mistakes due to lack of clarity about coverage, policy

terms, and premium calculations. This step-by-step guide explains how to buy car insurance online correctly, ensuring you get the right protection without

unnecessary expenses.

Why Buying Car Insurance Online Makes Sense

Online car insurance purchase gives you full

control over your decision. You can compare multiple plans, understand inclusions

and exclusions, customize coverage, and receive policy documents instantly.

Unlike offline purchases, there is no pressure from agents, making the process

transparent and user-focused.

Additionally, online platforms often provide

better pricing because operational costs are lower, and discounts are passed

directly to customers.

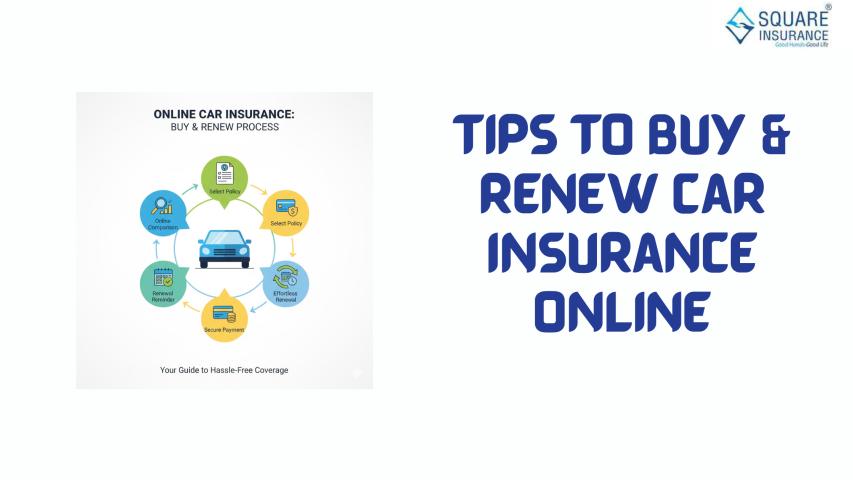

Step-by-Step Guide to Buy Car Insurance

Online

Step 1: Keep Your Vehicle Details Ready

Before starting, ensure you have accurate

information about your car, including:

·

Registration number

·

Make and model

·

Fuel type

·

Manufacturing year

·

Engine capacity

·

Previous policy details (if applicable)

Providing correct information ensures accurate

premium calculation and avoids issues during claims.

Step 2: Choose the Right Type of Car

Insurance

Understanding policy types is crucial before

making a purchase.

·

Third-Party

Insurance: Mandatory by law, covers damages or injuries to third

parties but does not protect your own car.

·

Comprehensive

Insurance: Covers third-party liability as well as damages to your own

vehicle due to accidents, theft, fire, or natural calamities.

·

Standalone

Own-Damage Cover: Suitable if you already have third-party insurance

and want protection for your own car.

For complete financial security, comprehensive

insurance is usually the best option.

Step 3: Compare Plans Carefully

Online comparison is one of the biggest

advantages of digital insurance buying. While comparing policies, focus on:

·

Coverage details

·

Insured Declared Value (IDV)

·

Add-on benefits

·

Claim settlement reputation

·

Network garages for cashless repairs

Avoid choosing a policy solely based on the

lowest premium. Instead, look for balanced coverage at a reasonable price.

Step 4: Select the Correct IDV

IDV represents your car’s current market value

and determines the claim amount in case of total loss or theft.

·

A higher IDV increases premium but offers better

compensation.

·

A lower IDV reduces premium but may result in

inadequate claim payout.

Choosing the right IDV ensures optimal

protection without overpaying.

-

Step 5: Choose Add-On Covers Wisely

Add-ons enhance coverage but should be

selected based on your car usage and risk profile. Common add-ons include:

·

Zero depreciation cover

·

Engine protection cover

·

Roadside assistance

·

Return to invoice cover

·

Key and lock protection

Avoid adding unnecessary riders, as they

increase the premium without adding real value.

Step 6: Check No Claim Bonus (NCB)

If you have not made any claims during the

previous policy period, you are eligible for a No Claim Bonus. NCB can reduce

your premium significantly and should always be transferred while buying or

renewing car insurance online.

Never let your policy lapse, as it may lead to

loss of NCB benefits.

Step 7: Review Policy Terms and Exclusions

Before proceeding to payment, carefully read:

·

Policy inclusions and exclusions

·

Claim process guidelines

·

Deductibles and limits

·

Coverage validity

This step ensures transparency and prevents

unpleasant surprises during claim settlement.

Step 8: Make Secure Online Payment

Once satisfied with the policy details,

proceed with payment using a secure online mode. After successful payment, the

policy document is issued instantly and sent to your registered email.

Always save a digital copy of the policy for

future reference.

Benefits of Buying Car Insurance Online

Transparency

You can view policy details clearly without

hidden conditions.

Time-Saving

The entire process takes only a few minutes,

from comparison to policy issuance.

Cost-Effective

Online purchases often include better pricing

and exclusive discounts.

Instant Access

Policy documents are available immediately,

ensuring continuous coverage.

Common Mistakes to Avoid While Buying Online

·

Entering incorrect vehicle details

·

Ignoring policy exclusions

·

Choosing the cheapest plan without coverage

review

·

Skipping add-ons for high-risk driving

conditions

·

Forgetting timely renewal

Avoiding these mistakes ensures long-term

benefits and smooth claim experiences.

Conclusion

Buying car insurance online is a smart and

efficient way to protect your vehicle and finances. By following a step-by-step

approach—understanding policy types, comparing plans, choosing the right IDV,

and reviewing terms carefully—you can secure comprehensive coverage without

confusion.

Platforms like Square Insurance simplify the online car insurance

journey by enabling customers to compare policies, understand coverage clearly,

and choose plans that suit their needs and budgets. With the right guidance and

informed decisions, buying car insurance online becomes a stress-free and

rewarding experience.

Frequently Asked Questions

1. Is buying car insurance online safe?

Yes, buying car insurance online is safe when

done through trusted and transparent platforms that follow secure payment

protocols.

2. Can I buy car insurance online for a new

car?

Yes, you can buy car insurance online for new

cars immediately after registration and receive instant policy documents.

3. What documents are required to buy car

insurance online?

Basic vehicle details and previous policy

information (if applicable) are sufficient. No physical documents are required.

4. Can I customize my car insurance policy

online?

Yes, online platforms allow you to select

add-ons and adjust IDV based on your requirements.

5. What happens if I enter wrong details

while buying insurance online?

Incorrect details may lead to claim rejection

or policy cancellation. Always verify information before completing payment.