Introduction

Buying car insurance is no longer just a regulatory requirement; it has

become a critical step in securing your vehicle, finances, and peace of mind.

With digital platforms and online services, car owners can now buy car insurance online quickly and

safely without visiting multiple offices or spending hours

comparing policies manually. This guide provides an in-depth, step-by-step

approach for choosing the right plan, understanding coverage, and completing

the process safely and efficiently.

Why Buying Car Insurance Online Is the Smart

Choice

Online car insurance offers several advantages

over traditional offline methods:

1.

Speed

and Convenience – Policies can be purchased within minutes from

anywhere with an internet connection.

2.

Transparency

– Online platforms allow users to compare multiple insurance plans, premiums,

and benefits side by side.

3.

Instant

Policy Issuance – Digital issuance eliminates waiting time,

giving you immediate proof of insurance.

4.

Cost-Effectiveness

– Online channels often provide lower premiums and exclusive discounts.

5.

Easy

Documentation – Policy documents, e-cards, and claim forms can

be accessed digitally at any time.

By leveraging online tools, car owners gain

control over their insurance decisions while ensuring timely coverage.

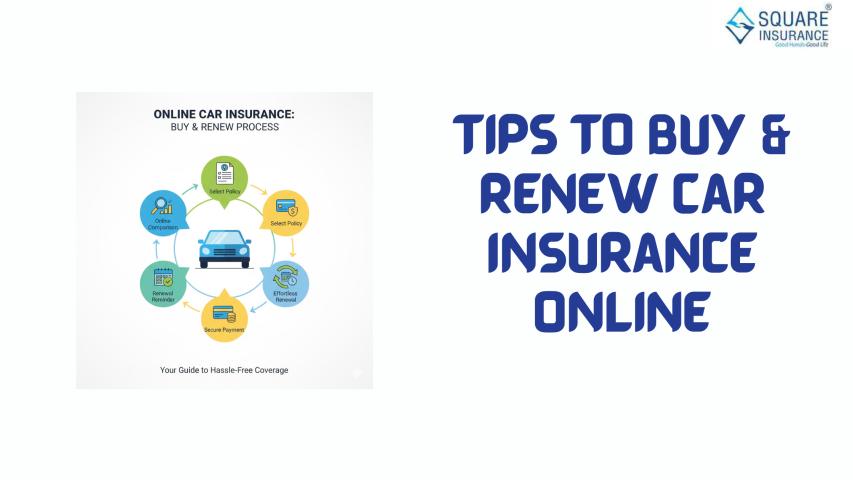

Step-by-Step Guide: How to Buy Car Insurance

Online

Step 1: Gather Your Vehicle and Personal

Details

Before starting the online process, keep the

following information handy:

·

Vehicle registration number

·

Make, model, and year of the car

·

Engine and chassis number (if required)

·

Driving license details

·

Previous insurance policy information (for

renewal or No Claim Bonus eligibility)

Having all these details ensures that the

process is smooth and accurate.

Step 2: Choose the Right Type of Car

Insurance

There are primarily two types of car insurance

policies:

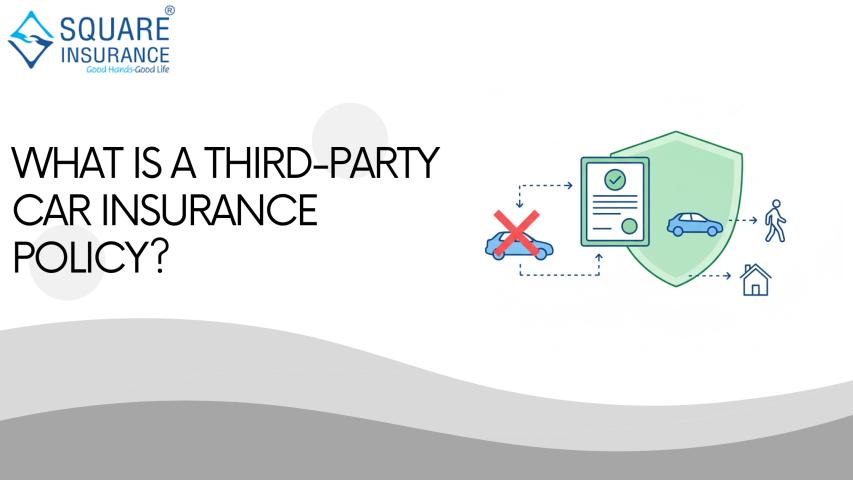

1.

Third-Party

Liability Insurance – Covers damages to a third party in case

of an accident. This is mandatory as per law.

2.

Comprehensive

Car Insurance – Covers both third-party liability and damages

to your own vehicle due to accidents, natural calamities, fire, theft, or other

perils.

Selecting the correct type depends on your

vehicle’s value, usage, and budget. For new or high-value cars, comprehensive

insurance is highly recommended.

Step 3: Compare Car Insurance Plans

Online platforms allow users to compare multiple insurance providers

in terms of:

·

Premium costs

·

Coverage benefits

·

Add-on options (like zero depreciation, roadside

assistance, engine protection)

·

Claim settlement ratio

·

Customer reviews and ratings

Compare at least 3–5 plans to choose one that

balances cost and coverage effectively.

Step 4: Add Optional Covers

Many insurance companies offer add-on covers for

enhanced protection:

·

Zero Depreciation Cover

·

Roadside Assistance

·

Engine and Gearbox Protection

·

Personal Accident Cover for Owner-Driver

·

Key Replacement Cover

Adding relevant covers enhances protection but

may increase premium. Evaluate the necessity based on your driving habits, car

value, and financial risk tolerance.

Step 5: Verify Your Details Before Proceeding

Accuracy is crucial. Double-check all personal

and vehicle information:

·

Name, address, and contact number

·

Vehicle registration and model details

·

Policy type and add-ons selected

Errors at this stage can cause claim

rejections or delays in policy issuance.

Step 6: Make the Payment Securely

Once you finalize the plan, proceed with secure online payment:

·

Use trusted payment methods like credit/debit

cards, net banking, or UPI.

·

Avoid unsecured or public Wi-Fi networks during

transactions.

·

Keep a screenshot or digital receipt for

reference.

Most platforms issue a policy instantly after

payment confirmation, giving you immediate proof of insurance.

Step 7: Download and Store Policy Documents

After payment, download and save the e-policy

documents, which include:

·

Policy certificate (e-Certificate of Insurance)

·

Terms and conditions

·

Coverage details and add-ons

·

Contact details for claims

Store these safely on your device and keep a

printed copy in your vehicle for emergencies.

Tips for Safe and Efficient Online Car

Insurance Purchase

1.

Use

Official and Trusted Platforms – Always buy insurance from

verified company portals or trusted aggregator websites.

2.

Check

Policy Terms Carefully – Understand exclusions, claim process,

and add-on benefits.

3.

Leverage

No Claim Bonus (NCB) – If you have a previous policy, ensure

your NCB is applied to reduce premium costs.

4.

Avoid

Fraudulent Offers – Be wary of deals that seem too good to be

true; verify authenticity before making payment.

5.

Maintain

Digital Records – Keeping all documents digitally ensures easy

retrieval during claims or renewal.

Common Mistakes to Avoid While Buying Car

Insurance Online

1.

Not

Comparing Plans—Choosing the first plan without comparison

may result in higher premiums or inadequate coverage.

2.

Ignoring

Add-On Covers—Skipping relevant add-ons can lead to financial

loss in unforeseen circumstances.

3.

Entering

Incorrect Vehicle Details – Mistakes in registration or model

info can invalidate the policy.

4.

Delaying

Renewal – Failing to renew on time may result in a lapsed

policy and loss of coverage.

5.

Overlooking

Exclusions—Not understanding policy exclusions can lead to

rejected claims.

By avoiding these mistakes, car owners can

ensure both cost efficiency and maximum protection.

Conclusion

Buying car insurance online is fast,

convenient, and secure when approached methodically. By following the steps

outlined—gathering accurate information, selecting the right type of policy,

comparing plans, adding relevant covers, making secure payments, and safely

storing policy documents—car owners can protect both their vehicles and

financial interests.

Just as Square Insurance emphasizes clarity,

reliability, and ease in insurance solutions, following these structured steps

allows car owners to buy car insurance line quickly and safely while maximizing

benefits and minimizing risks. Staying informed and cautious throughout the

process ensures a smooth experience and confidence in your coverage.

Frequently Asked Questions

Q1.

Can I buy car insurance online for a new car?

Yes, online platforms allow you to purchase insurance for new cars instantly,

often with zero depreciation options.

Q2.

How long does it take to get the policy after online payment?

Most insurers issue the e-policy immediately after payment confirmation.

Q3.

Can I renew my existing car insurance online?

Yes, you can renew existing policies digitally, and your No Claim Bonus will be

applied automatically.

Q4.

Are online payments for car insurance safe?

Yes, as long as you use verified platforms and secure payment methods like net

banking, credit/debit cards, or UPI.

Q5.

What should I do if I enter incorrect details while buying insurance online?

Contact the insurance provider immediately to correct any mistakes; inaccurate

information may affect claims.

Q6.

Are add-on covers necessary for all cars?

Not always. Add-ons like zero depreciation or roadside assistance are

recommended based on car value, usage, and personal preference.