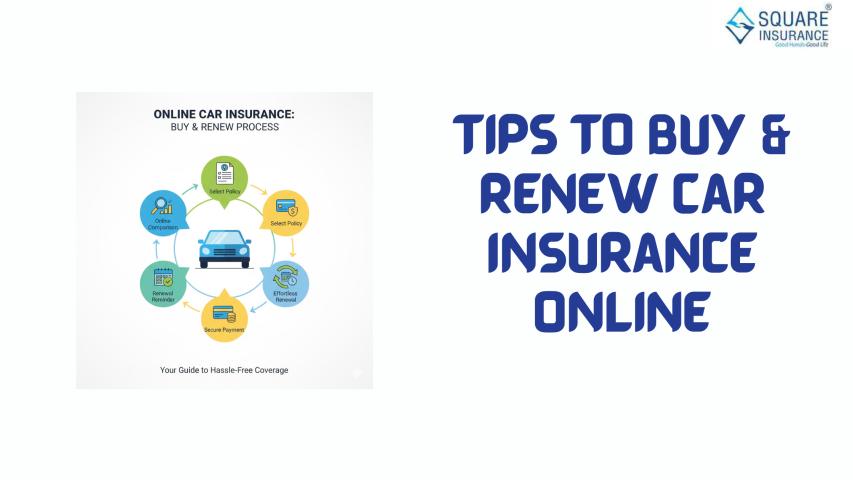

Buying car insurance is not just about finding the cheapest premium—it is

about securing the right protection at a price that fits your budget. With

increasing repair costs and evolving traffic risks, choosing a policy that

balances affordability and coverage is more important than ever. This guide

shares top tips to buy car insurance at the

best price without compromising on essential protection, helping

vehicle owners make confident and cost-effective decisions.

Understand What Coverage You Truly Need

Before comparing prices, understand your actual

insurance requirements. Ask yourself:

·

Is your car new or old?

·

Do you drive daily or occasionally?

·

Is your area prone to traffic congestion or

natural risks?

For new or high-value cars, comprehensive

insurance is usually the better choice. Older vehicles with lower market value

may not require multiple add-ons. Choosing only what you need prevents

unnecessary premium costs.

Compare Policies Based on Coverage, Not Just

Premium

A lower premium does not always mean better

value. Instead of focusing only on price, compare:

·

Coverage limits

·

Inclusions and exclusions

·

Claim settlement ease

·

Deductible amounts

Sometimes, a slightly higher premium can offer

much better financial protection, saving you more money in case of an accident

or repair.

Choose Add-Ons Wisely

Add-ons increase protection but also raise

your premium. Select only those that suit your driving conditions and vehicle

usage. Useful add-ons include:

·

Zero depreciation cover for new cars

·

Engine protection in flood-prone areas

·

Roadside assistance for frequent travelers

·

Consumables cover for workshop repair expenses

Avoid bundling unnecessary add-ons, as they

raise costs without adding meaningful benefits for your situation.

Maintain a Good No Claim Bonus Record

If you do not make any claims during your

policy period, you earn a No Claim Bonus

(NCB), which reduces your renewal premium. Over time, NCB discounts

can significantly lower insurance costs.

To protect your NCB:

·

Avoid small claims if repair costs are

manageable

·

Drive responsibly to minimize accidents

·

Consider NCB protection add-on if available

Preserving NCB is one of the most effective

ways to keep insurance affordable.

Opt for Higher Voluntary Deductibles (If

Suitable)

A deductible is the amount you pay during a

claim before insurance coverage applies. Choosing a higher voluntary

deductible:

·

Reduces your annual premium

·

Is beneficial for experienced drivers with low

claim history

However, ensure that the deductible amount is

affordable during emergencies. This strategy works best when you are confident

about your driving habits.

Renew on Time to Avoid Extra Costs

Late renewals can lead to:

·

Loss of NCB

·

Policy re-inspection charges

·

Higher premiums

Renewing before expiry keeps your policy

active and helps you retain accumulated benefits. Timely renewal is an easy way

to avoid unnecessary price increases.

Consider Your Car’s Age and Market Value

As cars age, their market value decreases.

Paying high premiums for extensive coverage on older vehicles may not always be

cost-effective.

For older cars:

·

Review whether all add-ons are still necessary

·

Adjust coverage to match current car value

·

Focus on essential protection rather than

premium features

This ensures that your insurance remains

practical and affordable.

Avoid Over-Insuring Your Vehicle

Over-insuring means selecting coverage limits

or add-ons that exceed your realistic needs. This results in higher premiums

without additional benefits.

To avoid over-insurance:

·

Choose appropriate insured declared value (IDV)

·

Select add-ons only if they provide real benefit

·

Review policy annually and adjust as needed

Insurance should match your risk profile, not

exceed it unnecessarily.

Check Claim Process Efficiency

Affordable insurance is only useful if claims

are settled smoothly. Choose policies that offer:

·

Simple claim filing steps

·

Clear documentation guidelines

·

Cashless repair options

·

Responsive customer support

A smooth claim experience prevents unexpected

expenses and saves time, making the policy more valuable overall.

Bundle Policies for Better Savings

If you have multiple insurance needs, such as

car and health insurance, bundling policies with one provider may offer

discounts. While not always available, this strategy can:

·

Reduce overall insurance expenses

·

Simplify policy management

·

Improve service coordination

It is worth considering if long-term savings

matter to you.

Buying car insurance at the best price is

about making informed choices rather than simply selecting the lowest premium.

By understanding your coverage needs, choosing add-ons carefully, maintaining

your No Claim Bonus, renewing on time, and avoiding unnecessary extras, you can

significantly reduce insurance costs while staying well protected.

Just as Square Insurance emphasizes clarity, customer trust, and value-driven

coverage, vehicle owners should focus on balancing affordability with reliable

protection. Smart insurance buying today prevents financial stress tomorrow and

ensures that your vehicle remains protected without burdening your budget.

Frequently Asked Questions

Q1. Is

it safe to buy the cheapest car insurance policy available?

Not always. Low-cost policies may have limited coverage or high deductibles,

increasing your expenses during claims.

Q2. How

can I reduce my car insurance premium?

Maintain a good NCB record, avoid unnecessary add-ons, choose suitable

deductibles, and renew on time.

Q3. Do

add-ons significantly increase premium?

Yes, but selecting only relevant add-ons provides better value without major

cost increases.

Q4. Does

car age affect insurance pricing?

Yes, older cars usually have lower premiums, but coverage should still match

repair costs and risk factors.

Q5.

Should I avoid small claims to save money?

If repair costs are low, avoiding claims helps preserve NCB, reducing future

premiums.

Q6. How

often should I review my car insurance policy?

Review your policy every year during renewal to ensure coverage and premium

still match your needs.