Introduction

Buying car insurance is not just about following the law—it is about

protecting yourself from financial stress caused by accidents, theft, repairs,

and legal liabilities. With rising traffic, expensive vehicle parts, and

unpredictable road conditions, choosing the right insurance policy has become a

crucial part of responsible car ownership in India.

Yet, many buyers still make rushed decisions

based only on premium price, without understanding what the policy truly

offers. This guide explains everything you should know before you buy car insurance, so you can make a smart, confident, and financially secure decision.

Why Car Insurance Is More Than a Legal

Requirement

While third-party insurance is mandatory,

relying only on minimum coverage can expose you to heavy expenses. Even a small

accident can result in costly repairs, towing charges, and loss of mobility. A

good car insurance plan provides:

·

Financial protection against accidents and theft

·

Coverage for natural disasters such as floods

and storms

·

Legal protection from third-party claims

·

Access to cashless repair facilities

·

Peace of mind during daily driving

Insurance is not an expense—it is a safeguard

for your savings.

Understand the Types of Car Insurance

Policies

Before you buy car insurance, it is important

to know the available policy options:

Third-Party Liability Insurance

This covers injury, death, or property damage

caused to others. It does not cover your own car’s damage.

Comprehensive Car Insurance

This includes third-party liability and also

covers your own vehicle against accidents, theft, fire, and natural disasters.

Standalone Own-Damage Policy

If you already have third-party insurance, you

can purchase own-damage cover separately for your vehicle.

Expert

Recommendation: For most car owners, comprehensive insurance offers

the best balance of protection and value.

What Is IDV and Why It Matters

IDV (Insured Declared Value) is the maximum

amount you will receive if your car is stolen or completely damaged beyond

repair.

·

Higher IDV = Higher premium but better

compensation

·

Lower IDV = Lower premium but reduced payout

Choosing a very low IDV to save premium can

lead to financial loss during claims. Always keep IDV close to your car’s real

market value.

Add-Ons That Can Save You Money During Claims

Add-ons are optional covers that increase your

protection and reduce expenses during repairs. Popular add-ons include:

·

Zero depreciation cover for full part

replacement cost

·

Engine protection cover for water or oil damage

·

Return to invoice cover for total loss

situations

·

Roadside assistance for breakdown emergencies

·

Consumables cover for minor repair items

Choosing the right add-ons depends on your

driving conditions, city traffic, and vehicle age.

Claim Settlement Is as Important as Premium

Many buyers focus only on premium price, but

claim experience matters more when something goes wrong. Before choosing a

policy, check:

·

Claim settlement reputation of the insurer

·

Availability of cashless garages in your city

·

Average claim processing time

·

Customer support accessibility

Smooth claims ensure faster repairs and less

financial burden during stressful times.

Policy Terms and Exclusions You Must Read

Every car insurance policy comes with

conditions and exclusions. Important points to review:

·

What types of damages are excluded

·

Whether drunk driving or expired license affects

claims

·

Deductible amount you must pay for each claim

·

Time limits for claim intimation

Understanding these terms prevents surprises

when filing claims.

Common Mistakes Buyers Make

Avoid these mistakes when you buy car insurance:

·

Selecting the cheapest policy without checking

coverage

·

Skipping important add-ons to save small premium

·

Entering incorrect vehicle or driver details

·

Forgetting to transfer insurance during used car

purchase

·

Delaying renewal and losing No Claim Bonus

Smart buying ensures long-term financial

safety, not just short-term savings.

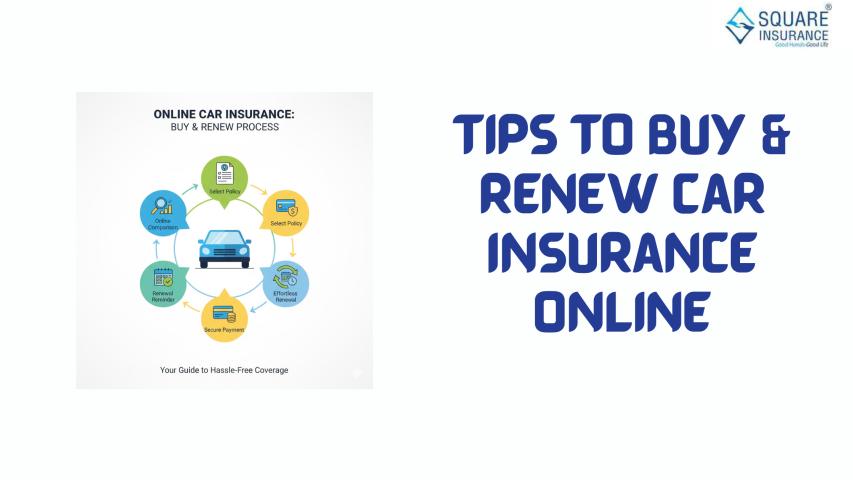

Why Buying Car Insurance Online Is Beneficial

Online platforms make insurance buying simpler

and more transparent:

·

Easy comparison of plans and features

·

Instant policy issuance without paperwork

·

Secure digital payments

·

Better control over coverage selection

·

Quick renewal reminders

Digital buying empowers customers with

information and flexibility.

How Often Should You Review Your Policy

Your insurance needs change with time. You

should review your policy when:

·

You move to a new city

·

Your car becomes older

·

You install expensive accessories

·

Your driving frequency increases

Regular review ensures your coverage remains

relevant and adequate.

Conclusion

Buying car insurance is one of the most

important financial decisions for every vehicle owner. Understanding policy

types, selecting the right IDV, choosing relevant add-ons, and checking claim

reliability are essential steps before making a purchase. A well-chosen policy

not only protects your car but also safeguards your financial stability.

At Square Insurance, we help customers understand their insurance needs, compare

suitable plans, and choose coverage that offers real protection, not just low

premiums. With the right guidance, buying car insurance becomes a confident and

stress-free experience.

Frequently Asked Questions

Q1. Is comprehensive car insurance compulsory in India?

No, only third-party insurance is legally

mandatory, but comprehensive insurance is recommended for full protection.

Q2. What happens if my policy expires?

If your policy expires, you may lose No Claim

Bonus benefits and may need vehicle inspection before renewal.

Q3. Can I change my insurer at renewal time?

Yes, you can switch insurers during renewal

without losing your No Claim Bonus if there are no claims.

Q4. Are add-ons necessary for old cars?

Some add-ons may not be cost-effective for

older cars, but engine protection and roadside assistance can still be useful.

Q5. Is online car insurance legally valid?

Yes, digital policies are fully valid and

accepted for legal and claim purposes.

Q6. Does car insurance cover personal belongings in the vehicle?

Generally, personal items are not covered unless specified under additional cover.