Buying car insurance is not just about meeting a legal requirement; it is about building a reliable safety net for your vehicle, finances, and peace of mind. Today, many people prefer to buy car insurance online because of convenience and quick comparisons, but with multiple platforms and intermediaries offering policies, many car owners still feel confused about where they should actually buy their car insurance. While online marketplaces and agents may seem convenient, purchasing directly from an insurance provider offers several long-term advantages that are often overlooked.

1. Transparent Policy Details with No Middle Layer

When you buy directly from an

insurance provider, you receive complete and accurate information about

coverage, exclusions, add-ons, and claim conditions. There is no risk of

miscommunication or partial explanations that sometimes happen when policies

are sold through intermediaries focused on quick conversions.

Direct communication ensures you

clearly understand:

- What is covered

- What is not covered

- How claims are processed

- What documents are required

This transparency helps you avoid

unpleasant surprises during claim time and ensures you select coverage that

actually matches your driving habits and vehicle usage.

2. Faster and Smoother Claim Processing

Claim settlement is the real test of

any insurance policy. When your policy is purchased directly from the insurer,

your claim goes straight into their system without delays caused by third-party

involvement.

Direct buyers often benefit from:

- Quicker claim registration

- Faster surveyor appointments

- Real-time status updates

- Direct coordination with network garages

In stressful situations like

accidents or breakdowns, faster claim handling can make a significant

difference in both cost and convenience.

3. Better Access to Policy Customization and Add-Ons

Insurance providers offer a wide

range of add-ons that enhance protection, such as:

- Zero depreciation cover

- Engine protection

- Return to invoice

- Roadside assistance

- Consumables cover

When buying directly, you can

discuss which add-ons are suitable for your vehicle age, location, and driving

frequency. Instead of generic packages, you receive tailored recommendations

that improve your protection while keeping premiums under control.

This personalized approach is

especially useful for:

- New car owners

- Luxury car buyers

- People driving in flood-prone or high-traffic areas

4. Accurate Premium Calculation Based on Risk Profile

Premium pricing depends on several

technical factors like:

- Vehicle model and fuel type

- City of registration

- Claim history

- No Claim Bonus eligibility

Insurance providers calculate

premiums using detailed underwriting rules, ensuring that your price reflects

your actual risk profile. This avoids both overpayment and under-insurance.

Direct purchase also reduces chances

of:

- Incorrect vehicle details

- Wrong IDV selection

- Misapplied discounts

Accurate data means fewer

complications during renewals and claims.

5. Stronger Customer Support and Accountability

When you buy from an insurance

provider, you know exactly who is responsible for your policy. There is a

direct accountability structure that ensures:

- Faster grievance resolution

- Dedicated customer service teams

- Access to policy experts for clarification

You are not passed between

platforms, agents, and service centers. Instead, your insurer remains your

single point of contact throughout the policy lifecycle.

For long-term policyholders, this

consistency improves service quality and trust.

6. Long-Term Benefits and Loyalty Rewards

Many insurance providers offer

benefits to customers who stay with them over multiple years, such as:

- Higher No Claim Bonus protection

- Renewal discounts

- Priority claim handling

- Exclusive add-on offers

These advantages are easier to track

and apply when your relationship is directly with the insurer rather than

through multiple channels.

Long-term customers often enjoy

smoother renewals and fewer documentation issues because their history is

already available in the insurer’s system.

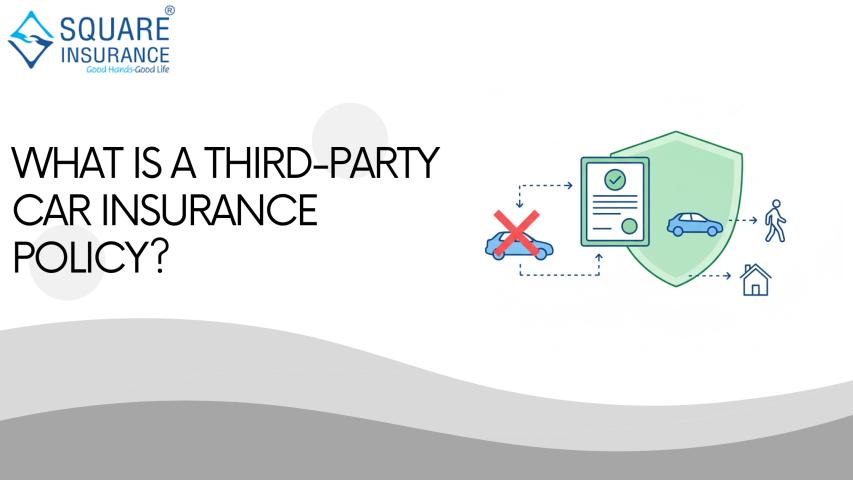

7. Compliance, Security, and Data Protection

Car insurance involves sensitive

personal and vehicle data. Buying directly from a licensed insurance provider

ensures that:

- Your data is stored securely

- Regulatory guidelines are followed

- Policy documents are legally valid and verifiable

This becomes important during:

- Ownership transfer

- Claim disputes

- Policy corrections

Direct insurer platforms maintain

standardized documentation processes that protect your legal and financial

interests.

Conclusion

While quick online comparisons and

agent recommendations may seem convenient, buying car insurance directly from a

trusted insurance provider offers stronger protection, faster claims, better

transparency, and long-term value. The right insurer does more than sell you a

policy—they become your financial partner during unexpected situations.

Platforms like Square Insurance

focus on simplifying the insurance journey while ensuring that customers

receive expert guidance, genuine coverage options, and reliable post-sale

support. When your protection truly matters, choosing the right provider makes

all the difference.

Buying smart today means fewer

worries tomorrow.

Frequently

Asked Questions

1.

Is it cheaper to buy car insurance directly from an insurance provider?

Direct purchase may not always mean

the lowest price, but it ensures accurate pricing based on your vehicle and

risk profile. It also reduces the chances of hidden costs during claims.

2.

Are claims easier if I buy directly from the insurer?

Yes. Claims are processed faster

when there is no intermediary. You deal directly with the insurer’s claims

team, which improves turnaround time and communication.

3.

Can I still compare policies if I buy directly from insurers?

Yes. You can review different plans

and coverage options offered by the insurer and select what fits your needs

instead of choosing generic bundles.

4.

Is customer service better with direct insurance providers?

Direct insurers usually have

dedicated service teams, better tracking systems, and faster escalation

processes, which improves overall customer experience.

5.

Can I change insurers later if I buy directly?

Yes. You are free to switch insurers

during renewal if you find better coverage or service elsewhere. Buying direct

does not lock you into long-term commitments.