Maruti Suzuki is one of the most trusted car brands in India. From small hatchbacks to family cars and compact SUVs, Maruti Suzuki vehicles are known for their mileage, easy maintenance, and wide service network. Even though these cars are affordable compared to many other brands, owning a car also comes with risks. Accidents, theft, and natural disasters can happen at any time. This is where Maruti Suzuki Car Insurance becomes important.

In this blog, we will explain what

Maruti Suzuki car insurance is, what it covers, and why it is necessary for

every Maruti Suzuki car owner in India. The language is kept simple so that it

is easy to read and understand.

What Is Maruti Suzuki Car

Insurance?

Maruti Suzuki Car Insurance is a car

insurance policy that provides financial protection for Maruti Suzuki vehicles.

It helps cover losses or damages caused due to accidents, theft, fire, or

natural calamities. It also covers legal liabilities if your car causes injury

or damage to a third party.

Like all car insurance policies in

India, Maruti Suzuki car insurance can be bought as a third-party policy or a

comprehensive policy. Most owners prefer comprehensive insurance because it

offers wider protection.

Why Is Maruti Suzuki Car

Insurance Important?

Even though Maruti Suzuki cars are

known for low maintenance, repair costs can still be high after an accident.

Without insurance, you may have to pay all expenses from your own pocket.

Here are some key reasons why Maruti

Suzuki Car Insurance is important:

- It protects you from unexpected repair costs

- It provides legal coverage for third-party damage

- It covers loss due to theft

- It offers peace of mind while driving

- It helps you follow motor vehicle laws

In India, having at least

third-party insurance is mandatory by law.

Types of Maruti Suzuki Car

Insurance Policies

Understanding the types of insurance

policies will help you choose the right one for your car.

Third-Party Maruti Suzuki

Car Insurance

This policy covers damage or injury

caused to a third party by your car. It also covers third-party property

damage. However, it does not cover damage to your own Maruti Suzuki car.

This policy is cheaper but offers

limited protection.

Comprehensive Maruti Suzuki

Car Insurance

Comprehensive Maruti Suzuki Car

Insurance offers complete protection. It covers third-party liabilities as well

as damage to your own car caused by accidents, fire, theft, or natural

disasters.

This type of policy is highly

recommended for car owners who want full coverage.

What Does Maruti Suzuki Car

Insurance Cover?

A standard Maruti Suzuki Car

Insurance policy usually covers:

- Damage due to accidents

- Theft of the vehicle

- Fire and explosion

- Natural disasters like flood, earthquakes, and cyclones

- Man-made events like riots or vandalism

- Third-party injury, death, or property damage

These coverages help reduce

financial stress during unexpected situations.

What Is Not Covered Under

Maruti Suzuki Car Insurance?

Knowing what is not covered is just

as important. Some common exclusions are:

- Damage caused due to drunk driving

- Driving without a valid driving license

- Normal wear and tear

- Mechanical or electrical breakdown

- Damage caused outside the policy terms

Understanding these exclusions helps

avoid claim rejection.

Add-On Covers for Maruti

Suzuki Car Insurance

Add-ons provide extra protection by

paying a small additional premium. Some useful add-ons for Maruti Suzuki cars

include

Zero Depreciation Cover

This add-on ensures full claim

amount without deducting depreciation on car parts.

Engine Protection Cover

It covers engine damage caused due

to waterlogging or oil leakage.

Roadside Assistance Cover

This offers help during breakdowns,

towing, or emergency situations.

No Claim Bonus Protection

This protects your No Claim Bonus

even if you make a claim.

Why Comprehensive Insurance

Is Better for Maruti Suzuki Owners

Many Maruti Suzuki car owners choose

comprehensive insurance because it offers better safety. Even small accidents

can lead to costly repairs. Comprehensive insurance reduces this burden.

It also allows you to add useful

covers and enjoy cashless repairs at network garages, which makes the repair

process easier.

Factors Affecting Maruti

Suzuki Car Insurance Premium

The premium amount depends on

several factors, such as:

- Model and variant of the car

- Age of the vehicle

- City of registration

- Type of insurance policy

- Add-on covers selected

- No Claim Bonus

Choosing the right balance between

coverage and premium is important.

How to Choose the Right

Maruti Suzuki Car Insurance Policy

Here are some simple tips to choose

the right policy:

Compare Different Policies

Always compare coverage, premium,

and benefits before choosing a policy.

Check Claim Settlement

Process

Choose an insurer with a simple and

fast claim settlement process.

Look at Network Garages

A wide network of garages ensures

easy cashless repairs.

Choose Add-Ons Carefully

Select add-ons based on your driving

habits and location.

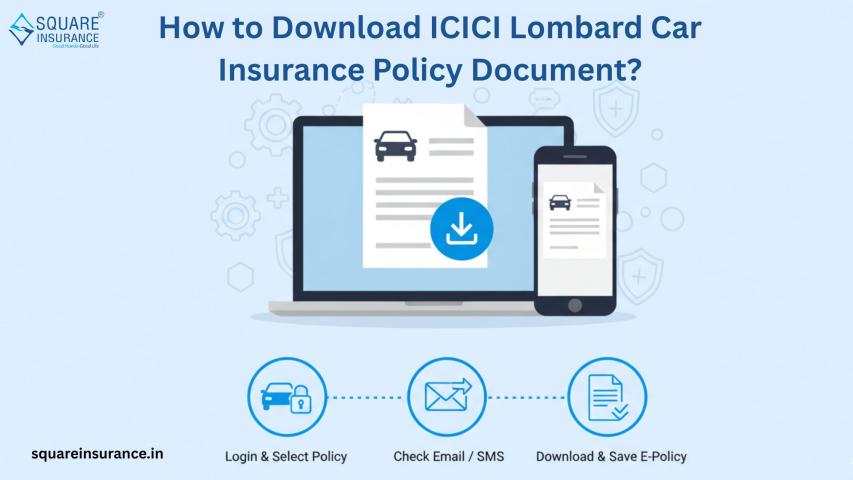

How to Renew Maruti Suzuki

Car Insurance?

Renewing your Maruti Suzuki car insurance on time is very important. If your policy expires, you may lose

coverage and No Claim Bonus.

Most insurers offer easy online

renewal. You only need to enter your policy and vehicle details and make the

payment.

Tips to Reduce Maruti

Suzuki Car Insurance Premium

Here are some simple ways to save on

premium:

- Avoid small claims to earn No Claim Bonus

- Install safety devices

- Choose only necessary add-ons

- Renew policy before expiry

- Maintain a good driving record

These tips help you reduce costs

without compromising coverage.

Conclusion

Maruti Suzuki cars are designed for

Indian roads, but risks are always present. Having the right Maruti Suzuki car insurance is not

just a legal requirement but also a smart financial decision. It protects you

from unexpected expenses and gives you confidence while driving.

By understanding the types of

policies, coverage, and add-ons, you can choose the right insurance plan for

your car. A good insurance policy ensures safety, savings, and peace of mind

for every Maruti Suzuki car owner.

Frequently Asked Questions

(FAQs)

Q1.

Are add-on covers important for Maruti Suzuki cars?

Yes,

add-on covers like zero depreciation, engine protection, and roadside

assistance provide extra safety and reduce out-of-pocket expenses, especially

during major repairs.

Q2.

Can I transfer my no-claim bonus while renewing Maruti Suzuki car insurance?

Yes,

the No Claim Bonus can be transferred during renewal or when switching

insurers, provided no claim was made in the previous policy period.

Q3.

How can Square Insurance help with Maruti Suzuki car insurance?

Squareinsurance

helps car owners compare Maruti Suzuki car insurance policies, understand

coverage details, and choose suitable add-on covers. This makes the insurance

selection process simple and clear.

Q4.

What happens if Maruti Suzuki Car Insurance is not renewed on time?

If

the policy is not renewed on time, the car owner may lose coverage and the No Claim

Bonus. Driving without valid insurance can also result in legal penalties.

Q5.

Can Maruti Suzuki Car Insurance be renewed online?

Yes,

Maruti Suzuki Car Insurance can be easily renewed online by entering vehicle

and policy details and completing the payment process.

Note

For

easy access to car insurance guidance, policy information, and

insurance-related support, you can also use our mobile application “Square Insurance POS – Apps on Google Play”.

The app is designed to help users explore insurance options and manage

insurance-related tasks in a simple and convenient way.