In the digital-first age of customer experiences and data-driven decisions, traditional legacy systems alone no longer suffice for banks. One exemplary transformation witnessed in the Indian financial sector has been embarked upon by Unity Small Finance Bank. The bold journey toward hyperautomation is considered an approach in which every bit of an operation's axis is digitized and optimized through robotic process automation (RPA), AI, machine learning, and advanced analytics.

While one side of the conversation is harnessing technology, the other side speaks of culture and structure, and how hyperautomation services can redefine the customer experience, banking efficiency, and compliance.

What Is Hyperautomation in Banking?

Before moving in with the transformation of Unity Bank, it is important to understand the concept. Hyperautomation is the next evolutionary step past conventional RPA. While RPA in banking focuses on the automation of repetitive tasks such as the entry of data or reconciliation, hyperautomation, in turn, leans on a much broader technology stack:

1. Robotic Process Automation (RPA)

2. Artificial Intelligence (AI) and Machine Learning (ML)

3. Business Process Management (BPM)

4. Process Mining and Analytics

5. Intelligent Document Processing (IDP)

6. Natural Language Processing (NLP)

Together, they allow banks to build self-improving systems that can scale, learn, mix, and adapt, and so are much more powerful than siloed automation initiatives.

Why Did Unity Small Finance Bank Opt for Hyperautomation?

With financial inclusion being the mission, Unity Small Finance Bank serves a broad range of individual and small business customers across India. Like many other banks operating in the digital domain, Unity had to ensure that it remains agile and efficient without compromising on regulatory compliance or customer experience.

Some of the challenges the bank faced were:

1. The manual process of onboarding is slowing down account activation

2. Increasing costs for the compliance department as a result of regulatory changes

3. Heavy dependence on legacy systems for core banking operations

4. Slow response to customer support and service requests

5. Department-wise data is being disintegrated, resulting in poor decision-making

To deal with these bottlenecks, Unity SFB opted to seek help from established RPA providers offering end-to-end hyperautomation services that could be used to transform its operations on a large scale.

How Did Unity Bank Implement Hyperautomation in Phases?

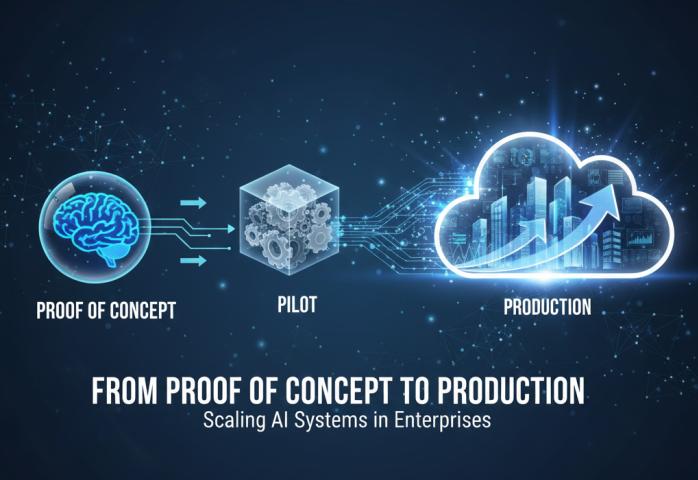

1. What Was the First Step: Process Discovery & Automation Audit?

First, the bank went through a deep process mining exercise to identify every possible area of automation. Applying advanced analytics, they categorized processes by automation potential, risk level, and ROI.

Key areas included:

- KYC and AML screening

- Account opening and verification

- Loan application processing

- Customer support workflows

- Core banking system integrations

2. How Were RPA Services Deployed?

With the identification of high-impact processes, Unity was able to let down the bots through skilled RPA services vendors, automating:

- Extraction of data from ID documents by OCR

- Automated report generation for regulators

- Rule-based alerts for suspicious transactions

- Internal ticketing and service request routing

This reduced manual effort and drastically cut down processing times.

3. How Did AI and Decision Intelligence Enhance the Workflow?

In the next step of the process, AI and machine learning were incorporated above the RPA workflows so that, instead of the bots performing just tasks, they were now able to:

- Predict loan defaulters by studying past patterns

- Detect anomalies concerning fraud across channels

- Auto-categorize customer queries based on urgency and sentiment

- Recommend financial products to customers on a one-to-one basis

Turning those intelligent enhancements into a kind of cognitive digital worker through their bots was the stepping stone to full-scale hyperautomation.

What Tangible Results Did Hyperautomation Deliver for Unity?

1. Speedier Customer Onboarding

Automated onboarding has brought down the speed for new account opening from 3 days to less than 6 hours. Bots run OCR, document verification, and background checks, making sure they execute fast and compliantly.

2. 40% Increase in Operational Efficiency

After automating the repeat tasks with bots, Unity back-office teams focused more on client engagement and strategic planning.

3. 30% Reduction in Compliance Costs

Automated audit trails, along with live monitoring and AI-based compliance investigations, reduced the time required for reporting, as well as the rate of human error.

4. Improved Customer Satisfaction

Customers now enjoy round-the-clock services from AI chatbots integrated with backend RPA workflows. These bots take care of balance inquiries to transaction questions.

5. Scalable Digital Core

The Unity now has a modular and scalable automation architecture, giving the bank the ability to quickly launch new products and processes across its expanding network.

How Is RPA in Banking Evolving Beyond Task Automation?

The Unity Bank case perfectly demonstrates how RPA in banking is moving beyond simple task automation into full-fledged business transformation. While traditional RPA still acts as a basis, today's banks must also have:

- A capacity to learn and adapt with AI and ML

- A capacity to collaborate across departments and data sources

- A capacity to dynamically plan and replan using decision engines

This is where RPA companies that offer hyperautomation truly stand out. Instead of merely offering software licenses, they create integrated solutions to transform banking so that it works differently.

How to Choose the Right RPA Company for Hyperautomation?

For a bank wanting to walk the same path, vendor choice is very important. Top RPA companies offering hyperautomation solutions provide:

- Process Discovery Tools to map inefficiencies

- RPA Custom Development for unique banking use cases

- AI & ML Integration to uplift automation from reactive to proactive

- Governance & Security Frameworks to ensure compliance with RBI and GDPR

- Scalability & Support to handle growing volumes without interruptions

The best providers are not just software engineers carrying out projects here and there; they become strategic partners in line with a bank’s digital roadmap.

What’s the Future of Autonomous Banking?

The movement of Unity Bank towards hyperautomation is not a single case story; it is the bigger trend of Autonomous Banking. In the next few years, there will be:

- End-to-end loan approval by AI agents

- Predictive risk analysis for investment products

- Smart RPA bots orchestrating branch operations in real time

- Chatbots are solving 90% of customer requests without any human intervention

- Compliance reports are being auto-generated with no manual input

With the speed of innovation fast-tracking, hyperautomation will be just the beginning.

Final Thoughts: Why Hyperautomation Is the Future of Scalable Banking

The plunge into hyperautomation by Unity Small Finance Bank stands as a yardstick for how modern transformation ought to be. By blending RPA services with intelligent technologies, they have enhanced efficacy while reinventing the customer experience, compliance, and agility.

Now, for any other institutions, this case spells out one thing: Investing in hyperautomation services today is the best way to build the intelligent, scalable bank of tomorrow. Whether you're a regional co-operative bank or an international financial colossus, partnering with the right RPA companies can create a future where automation doesn't just support banking operations, it drives them.