Introduction

Choosing the right car insurance is one of the most important decisions a car owner can make when planning to buy car insurance in India. While car insurance is mandatory, selecting the right policy goes far beyond legal compliance. A well-chosen car insurance plan protects you from financial loss, legal liabilities, and unexpected repair costs, while a poorly chosen one can leave you exposed when you need support the most.

1. Type of Car Insurance Coverage

The first and most crucial factor is

understanding the type of car insurance you need. In India, car insurance

policies generally fall into three categories:

·

Third-Party

Car Insurance: Covers third-party injury, death, or property

damage and is legally mandatory.

·

Comprehensive

Car Insurance: Offers broader protection by covering

third-party liabilities as well as damage to your own vehicle.

·

Standalone

Own-Damage Policy: Covers damage to your car when paired with

an active third-party policy.

For most car owners, comprehensive car

insurance provides the best balance of protection and peace of mind.

2. Insured Declared Value (IDV)

IDV is the current market value of your car

and represents the maximum amount the insurer will pay in case of total loss or

theft.

·

A higher IDV

results in higher premiums but better compensation.

·

A lower IDV reduces

premiums but limits claim payouts.

Choosing the right IDV is essential to ensure

fair coverage without unnecessary premium costs. Always align IDV with your

car’s actual market value after depreciation.

3. Coverage Inclusions and Exclusions

Many policyholders overlook the fine print,

leading to confusion during claims. Before choosing car insurance, carefully

review:

·

What is covered (accidents, theft, fire, natural

calamities)

·

What is excluded (wear and tear, mechanical

breakdown, illegal driving)

Understanding inclusions and exclusions

ensures you know exactly what protection your policy offers and helps prevent

claim rejections.

4. Add-On Covers That Enhance Protection

Add-ons allow you to customize your car

insurance based on your specific risks and usage. Some commonly recommended

add-ons include:

·

Zero

Depreciation Cover: Ensures full claim settlement without

depreciation deduction.

·

Engine

Protection Cover: Useful in waterlogged or flood-prone areas.

·

Roadside

Assistance: Provides emergency help during breakdowns.

·

Return

to Invoice Cover: Pays the original invoice value in case of

total loss or theft.

Choosing add-ons thoughtfully enhances

coverage without inflating costs unnecessarily.

5. Claim Settlement Experience

Claim settlement is the true test of any car

insurance policy. While ratios offer insight, real-world experience matters

more.

Before choosing a policy, evaluate:

·

Ease of claim filing

·

Speed of claim processing

·

Transparency in settlement

·

Availability of cashless repairs

A reliable claims process ensures that your

insurance supports you when it matters most.

6. Cashless Garage Network

A strong cashless garage network reduces

financial stress during repairs by allowing the insurer to settle bills

directly with the garage.

Ensure that:

·

Authorized garages are available near your

location

·

Your preferred service centers are covered

·

The network includes reputable workshops

This factor becomes especially important

during emergencies or major repairs.

7. No Claim Bonus (NCB) Benefits

NCB is a reward for safe driving and

claim-free years, offering significant discounts on premiums over time.

Key points to consider:

·

NCB can reduce premiums by up to 50%

·

It belongs to the policyholder, not the insurer

·

It can be transferred when switching insurers

Preserving your NCB through careful driving

and informed claims can lead to long-term savings.

Why Regular Review Matters

Choosing car insurance is not a one-time

decision. Your car ages, your driving habits change, and risks evolve. Reviewing

your policy annually helps you:

·

Update IDV

·

Adjust add-ons

·

Optimize premiums

·

Improve coverage relevance

Regular reviews ensure your policy continues

to serve your best interests.

Conclusion

Choosing the right car insurance requires

careful evaluation of coverage, IDV, add-ons, claim support, and long-term

value—not just premium cost. By considering these eight key factors, you can

select a policy that truly protects you financially and legally while offering

peace of mind on every drive.

Platforms like Square Insurance simplify this process by helping car owners understand coverage clearly, compare options transparently, and choose policies that align with their specific needs—making car insurance a smart and confident decision rather than a confusing one.

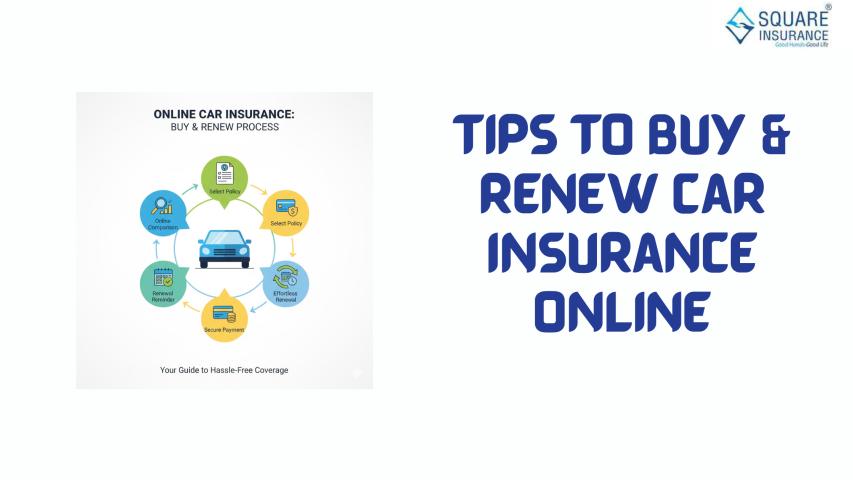

- Buy Car Insurance Online: Step-by-Step Guide

- Car Insurance Online: Benefits, Features, and Buying Tips

Frequently Asked Questions

1. Is comprehensive car insurance better than

third-party insurance?

Yes, comprehensive car insurance offers wider

protection by covering both third-party liabilities and damage to your own

vehicle.

2. How often should I review my car insurance

policy?

You should review your policy at least once a

year during renewal to ensure it matches your current needs.

3. Can I change my car insurance provider if

I’m not satisfied?

Yes, you can switch insurers during renewal

without losing your No Claim Bonus, provided there is no policy lapse.

4. Are add-ons mandatory when choosing car

insurance?

No, add-ons are optional but highly beneficial

when chosen based on your risk exposure and car usage.