Owning a car in 2026 is no longer just about comfort or convenience. It is also about making smart decisions that protect your investment. Roads are busier, weather conditions are less predictable, and repair costs continue to rise. In such a situation, having the right insurance coverage is not optional — it is necessary. One option that many car owners now prefer is ICICI Lombard Standalone Own Damage Car Insurance.

This type of policy focuses only on protecting your vehicle. It is simple, practical, and designed for people who want clarity instead of complicated bundles. Let us explore why this policy has become such a sensible choice for modern car owners.

Understanding Standalone Own Damage Insurance

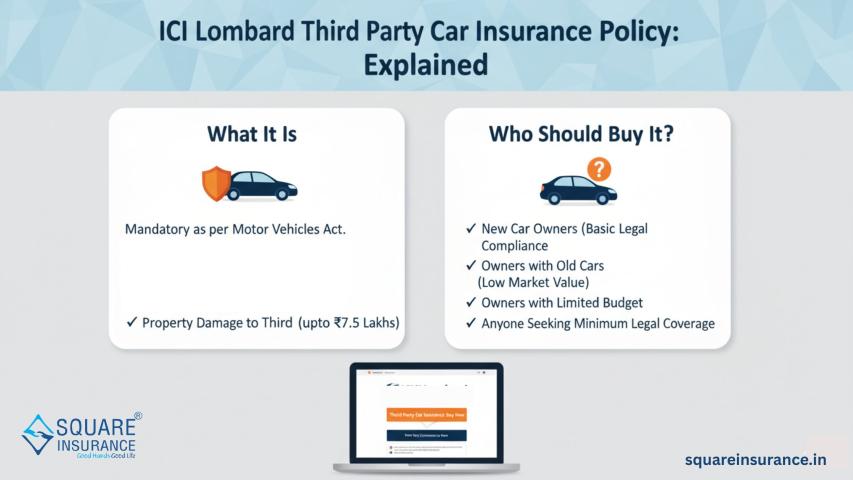

Standalone own damage car insurance covers only the damages to your own vehicle. It works separately from third-party insurance, which is legally required. While third-party insurance protects others, own damage insurance protects you and your car.

This coverage includes loss or damage caused by:

- Road accidents

- Fire or explosions

- Floods, storms, earthquakes, and other natural events

- Theft

- Vandalism or riots

- Falling objects

In simple words, whenever your car gets damaged due to an unexpected event, this policy helps you manage the repair or replacement cost.

Why This Policy Matters More in 2026

1. Rising Repair Expenses

Cars today use advanced technology. Even a small accident can damage sensors, cameras, or electronic systems. These parts are costly, and labor charges have also increased. Without insurance, repair bills can easily disturb your budget.

2. Unpredictable Climate

Flooded roads, heat damage, and sudden storms have become more common. Vehicles are more exposed to natural risks than before. Own damage insurance gives financial support during such situations.

3. Busy Traffic Conditions

More vehicles on the road mean higher chances of accidents, even for careful drivers. Insurance becomes a safety net that protects you when things go wrong.

Key Benefits of ICICI Lombard Standalone Own Damage Insurance

Focused Protection

This policy is designed to cover your vehicle without mixing unnecessary components. You only pay for what you actually require.

Flexible Add-On Options

You can improve your coverage by choosing extra protection such as:

- Zero depreciation cover

- Engine and gearbox protection

- Consumables cover

- Return to invoice option

- Roadside assistance

These add-ons allow you to customize the policy based on your driving habits and car usage.

Easy Claim Process

A smooth claim experience reduces stress during accidents. When the process is simple, you can focus on getting back on the road rather than worrying about paperwork.

Cashless Repairs

You can get your car repaired at authorized service centers without paying upfront, which is very helpful during emergencies.

Digital Convenience

Policy purchase, renewal, and claim tracking can be managed online. This saves time and avoids unnecessary visits or paperwork.

Who Should Consider This Policy?

This policy is ideal for:

- Car owners who already have third-party insurance

- People who want better protection for their vehicle

- Owners of new or high-value cars

- Drivers in accident-prone areas

- Individuals who travel frequently by car

It is also a good choice for people who prefer control over their insurance coverage.

What the Policy Covers

The standalone own damage policy generally includes:

- Damage caused by accidents

- Fire and explosion losses

- Theft of the vehicle

- Natural calamities

- Man-made incidents such as riots

- Damage while the car is parked

This wide coverage ensures that your vehicle remains protected in most real-life situations.

What Is Not Covered

Understanding exclusions is important to avoid confusion later. The policy usually does not cover:

- Regular wear and tear

- Mechanical or electrical breakdown without external damage

- Damage due to illegal driving

- Driving under the influence of alcohol or drugs

- Loss due to negligence

Knowing these details helps in using the policy responsibly.

Cost Advantage

Standalone own damage insurance is often more affordable than combined policies. Since it focuses only on vehicle damage, the premium stays balanced. This allows car owners to enjoy strong coverage without paying extra for unwanted features.

Over time, this approach helps in better financial planning.

Claim Experience Matters

Insurance is not just about buying a policy. It is about how you are treated when you actually need help. A clear and transparent claim process builds trust and confidence. When claims are settled smoothly, insurance truly serves its purpose.

A Practical Choice for Everyday Drivers

Not every driver wants complicated insurance terms. Many people simply want honest protection, fair pricing, and dependable service. This policy fits well into that expectation. It keeps things simple while offering strong financial safety.

Long-Term Value

Over the years, a car faces multiple risks. Small scratches, dents, broken parts, or major accidents — everything adds up. Having own damage insurance ensures that these costs do not disturb your long-term savings.

It also helps maintain the car’s resale value by allowing timely repairs.

Peace of Mind While Driving

When you know your car is protected, your driving experience becomes more relaxed. You focus on the journey instead of worrying about possible losses. This peace of mind is one of the most important benefits of own damage insurance.

Why It Makes Sense in Today’s Life>

Modern life is fast. People want quick solutions, easy processes, and reliable support. This insurance policy matches today’s life>

It is not about luxury — it is about smart protection.

Conclusion

ICICI Lombard Standalone Own Damage Car Insurance is a sensible choice for car owners who value clarity, protection, and financial safety. It gives focused coverage, flexible options, and reliable support in uncertain situations.

In 2026, when every decision affects your peace of mind and financial health, choosing the right insurance is a responsibility. This policy helps you fulfill that responsibility with confidence.

A car is not just a machine — it is part of your daily life. Protecting it properly is not an expense, but a wise investment.