Buying insurance for a new bike is one of the first and most important responsibilities of a bike owner. While excitement around a new two-wheeler often takes center stage, choosing the right insurance policy plays a critical role in protecting both your vehicle and your finances. A well-informed decision at this stage can save you from unnecessary expenses and legal troubles later.

With

increasing road traffic, accident risks, and stricter enforcement of motor

laws, insurance is no longer just a formality.

New bike owners today have multiple policy options, coverage features, and

pricing structures to choose from.

Many riders prefer to buy bike insurance online due to ease of

comparison and instant policy issuance.

Understanding key buying tips ensures that your insurance policy genuinely

supports you when it matters most.

In this

article, drawing from years of hands-on experience in the insurance domain,

we’ll cover seven practical and expert-backed tips to help you buy the right

new bike insurance policy.

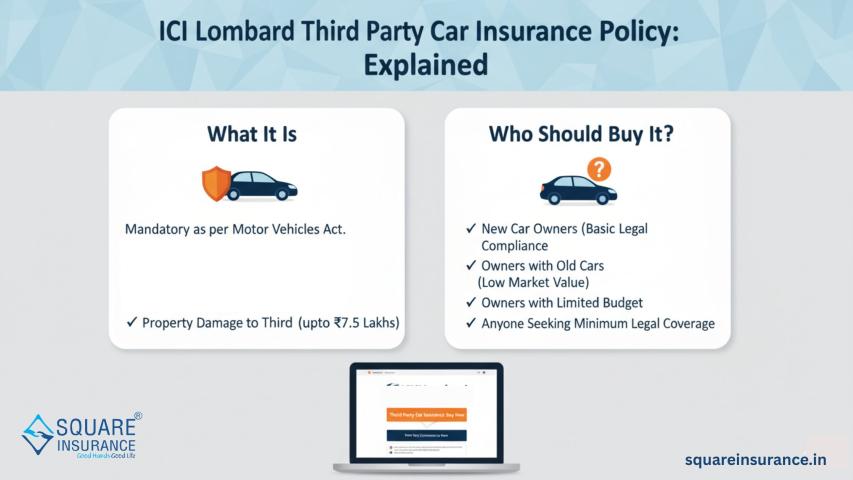

Tip 1: Understand the Types of New Bike Insurance Policies

Before

selecting a policy, it is essential to understand the available options:

- Third-Party Bike Insurance: Mandatory by law, it covers

injury, death, or property damage caused to a third party but does not

cover your own bike.

- Comprehensive Bike

Insurance:

Covers third-party liabilities along with damages to your bike due to

accidents, theft, fire, natural disasters, and more.

- Standalone Own-Damage Cover: Suitable if you already

have long-term third-party insurance and want protection only for your

bike.

For new

bikes, comprehensive insurance is generally recommended due to higher vehicle

value and repair costs.

Tip 2: Choose the Right Insured Declared Value (IDV)

IDV is

the current market value of your bike and directly impacts both premium and

claim amount. Many buyers select a lower IDV to reduce premium, but this can

lead to reduced compensation in case of total loss or theft.

When

buying insurance for a new bike:

- Avoid under-insuring your

vehicle

- Choose an IDV close to the

actual invoice value

- Balance premium

affordability with realistic coverage

A correct

IDV ensures fair claim settlement when needed.

Tip 3: Look Beyond Just the Premium Amount

One of

the most common mistakes new bike owners make is choosing a policy solely based

on the lowest premium. While affordability is important, it should not come at

the cost of inadequate coverage.

Check

for:

- Coverage inclusions and

exclusions

- Claim settlement process

- Availability of cashless

garages

- Policy terms and conditions

A

slightly higher premium often provides better financial protection and peace of

mind.

Tip 4: Select Useful Add-On Covers

Add-ons

enhance the scope of your bike insurance policy and are especially beneficial

for new bikes. Some important add-ons to consider include:

- Zero Depreciation Cover: Ensures full claim without

depreciation deduction on parts

- Engine Protection Cover: Useful for water-logging or

engine damage

- Roadside Assistance: Offers help during

breakdowns or emergencies

- Personal Accident Cover: Provides financial

protection to the rider

Choosing

relevant add-ons helps reduce out-of-pocket expenses during claims.

Tip 5: Check Policy Exclusions Carefully

Every

insurance policy comes with exclusions—situations where claims are not payable.

Ignoring these can lead to claim rejection.

Common

exclusions include:

- Riding without a valid

driving license

- Driving under the influence

of alcohol or drugs

- Using the bike for

commercial purposes

- Normal wear and tear

Understanding

exclusions helps you avoid unpleasant surprises during claim settlement.

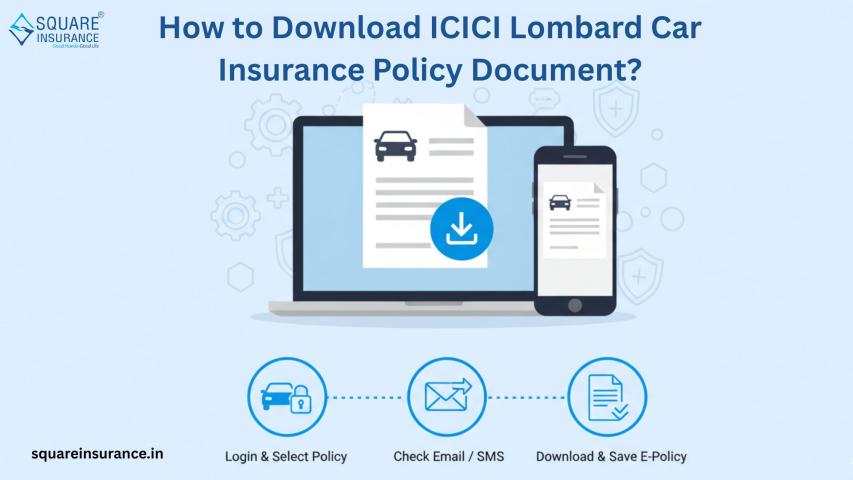

Tip 6: Buy Insurance from a Reliable and Transparent Platform

Where you

buy insurance matters as much as what you buy. A reliable platform ensures

transparency, proper guidance, and post-sale support.

While

buying insurance, look for:

- Clear policy wording

- Easy access to policy

documents

- Responsive customer support

- Simple renewal and claim

assistance

A

trustworthy platform simplifies the entire insurance journey, from purchase to

claims.

Tip 7: Avoid Delaying Insurance Purchase or Renewal

For new

bikes, insurance should be purchased immediately, preferably before

registration or delivery. Delaying insurance can expose you to legal penalties

and financial risk.

Timely

insurance ensures:

- Legal compliance from day

one

- No risk of uninsured riding

- Eligibility for No Claim

Bonus in future

- Continuous coverage without

gaps

Always

set reminders for renewals to avoid policy lapses.

Why Buying New Bike Insurance Online Makes Sense

Online

insurance buying has transformed the experience for new bike owners. It allows

you to:

- Compare multiple plans

instantly

- Customize coverage as per

your needs

- Avoid agent bias

- Receive instant policy

documents

- Save time and effort

Digital

platforms empower buyers with information, control, and convenience.

Common Mistakes New Bike Owners Should Avoid

Even

informed buyers can make mistakes. Avoid:

- Choosing third-party insurance

only for a brand-new bike

- Ignoring add-ons to save

small premium amounts

- Selecting incorrect personal

or vehicle details

- Not reading policy documents

after purchase

Avoiding

these errors ensures smooth claim experiences in the future.

Conclusion

Buying a

new bike insurance policy is not just about fulfilling a legal requirement-it

is about securing your financial future on the road. By understanding policy

types, choosing the right IDV, opting for meaningful add-ons, and avoiding

common mistakes, you can make a confident and informed decision.

A

well-chosen insurance policy protects you from unexpected expenses and provides

peace of mind every time you ride. Platforms like Square Insurance help

simplify the insurance buying process by offering clear comparisons, expert

guidance, and customer-focused solutions, making it easier for new bike owners

to choose the right coverage without confusion.

Frequently Asked Questions

1. Is insurance mandatory for a new bike in India?

Yes, at

least third-party bike insurance is mandatory by law for all new bikes.

2. Should I buy comprehensive insurance for a new

bike?

Yes,

comprehensive insurance is recommended for new bikes as it offers wider

protection.

3. Can I buy new bike insurance online before registration?

Yes,

insurance can be purchased online using dealer and vehicle details before

registration.

4. What is the best add-on for a new bike insurance policy?

Zero

depreciation and engine protection are among the most useful add-ons for new

bikes.

5. Does buying insurance online affect claim settlement?

No,

online policies are legally valid and claims are processed the same way as

offline policies.